Understanding the basics of how to trade is crucial for anyone looking to enter the market. Learning can seem overwhelming, but with the right approach, anyone can learn the skills needed to navigate the markets.

This step-by-step guide is designed to walk new traders through the fundamentals. From choosing markets to trade, developing strategies, trading psychology, and managing risk. Whether its day trading, swing trading, or long-term investing, understanding the core principles of how to trade is the first step.

What is Trading?

In simple terms, trading is the act of buying and selling financial instruments. This can include stocks, futures, or currencies—with the goal of making a profit. Unlike long-term investing, focused on gradual wealth, trading is more short-term in nature. Traders look to take advantage of price movements, whether over minutes, hours, or days.

There are many styles of trading. These range from day trading, where trades happen in the same day, to swing trading, which may take several days. Regardless of style, successful trading requires strategy, discipline, and risk management. It’s not about guessing—it’s about making informed decisions based on data, and probabilities.

Why Trade?

People want to know how to trade for freedom, flexibility, and financial potential. Unlike traditional careers, trading can offer the ability to work from anywhere. You can set your own schedule, and grow your income based on skill—not seniority or hours worked. For many, it’s not just about the money—it’s about the lifestyle that trading can create.

That said, trading isn’t a shortcut to easy money. It’s a professional skill that takes time and effort to develop. In this section, we’ll explore what makes trading appealing, financial expectations, and the capital you need to get started.

The Trader’s Lifestyle

One of the biggest attractions of trading is the freedom it offers in both time and location. Unlike traditional 9 to 5 jobs, trading allows you to choose when and where you work. Whether you’re trading from home, a café, or while travelling. All you need is a computer, trading platform, and a reliable internet connection. This makes trading especially appealing to those who value work-life balance.

You can fit trading around school drop-offs, personal hobbies, or even another job while you’re getting started. For many, this control over their schedule is just as valuable as the potential income. It’s not just about making money — it’s about building a trader’s lifestyle aligned with your personal goals.

Potential Income Scalability

One of the key advantages of trading is its scalability. As your skill, experience, and confidence grow, so does your ability to scale up. Not by working more hours, but by increasing position sizes or account size. This means your earning potential isn’t tied to your time input, unlike many traditional careers.

That said, growth in trading should be approached cautiously and strategically. Success doesn’t come overnight, and attempting to scale too quickly can increase risk. It’s important to develop a consistency before expanding your trading size or capital.

To get a clearer picture, we’ve explored how much you can make day trading in detail.

Low Barrier to Entry For Beginner Traders

One of the reasons many people explore trading is because it’s so accessible. You don’t need a formal degree, expensive equipment, or a business loan to get started. Most brokers offer low minimum deposits, and demo accounts for practice. They often provide trading platforms that work from a basic laptop.

That said, just because it’s easy to start doesn’t mean it’s easy to master. The low barrier can sometimes attract people who rush in without a plan or proper education. Often this leads to losses. But with the right mindset, risk management, and support, it’s an affordable way to build a skill that can scale over time.

Skill-Based Income

Trading rewards skill, not seniority or hours worked. Unlike traditional jobs where income is tied to time or rank, day traders earn based on the quality of their decisions. As your strategy, discipline, and risk management improve, so can your results. This makes trading a unique opportunity. Consistent effort and learning directly impact your income — a true merit-based path.

Pro Trader Ingela, trading on location.

How to Trade Different Markets

Before placing your first trade, you should understand the markets available to you. Each market — from futures to forex, stocks to commodities — operates a little differently. They each come with their own pros, cons, and trading styles. Some are better suited for short-term strategies, while others may align more with swing or position trading.

In the sections below, we’ll break down the most common markets. You’ll learn which aligns best with your goals, risk tolerance, and preferred approach.

Markets available

With so many financial instruments to choose from, traders have more flexibility than ever in shaping their strategy. Whether you prefer fast-paced futures, familiar stocks, or global forex, each market has its own unique features. The key is finding a product that fits your capital, time commitment, and risk appetite. Below, we’ll explore the most popular markets and what makes each of them worth considering.

Futures Markets

Futures are standardised contracts to buy or sell an asset at a predetermined price and date, and are a popular choice for many day traders. If you’re looking into trading futures in Australia, you need to know how these contracts work and the leverage they offer.

If you’re new, learning what is a futures contract can help you understand the risks and rewards. Futures offer high liquidity and long trading hours, suited to active traders who want flexibility and variety.

The biggest advantage that Futures have over every other market is that it is traded directly to the exchange. What this means is that there is greater transparency and a fairer playing field for you, the retail trader.

Trading Stocks

Trading stocks involves buying and selling shares of publicly listed companies. Stocks offer traders opportunities to profit from price movements, dividends, and long-term growth.

Stock trading is easy to access, but it helps to know how markets, companies, and the economy affect prices. Day traders have lots of stocks to choose from, but not all are equally active or volatile.

Unlike futures, stocks have different margin rules and trading hours. If you’re deciding between markets, check out our guide on futures vs stock trading to see which might suit your style and goals better.

Options Trading

Options trading gives you the right—but not the obligation—to buy or sell an underlying asset at a set price before a specific date. This can help traders manage risk or speculate on market movements with defined potential losses limited to the premium paid.

Options offer unique strategies, such as spreads and hedging, that are not available with futures contracts. However, options can be more complex due to factors like time decay and implied volatility. For those weighing their choices, understanding the differences is crucial. To learn more, explore our detailed comparison on options vs futures to find out which market aligns best with your trading goals.

Contracts For Difference (CFDs)

Contracts for Difference (CFDs) allow traders to speculate on price movements. Traders can buy or sell various assets without owning the underlying security. CFDs offer flexibility with lower capital requirements and access to a wide range of markets.

Markets available include stocks, indices, and commodities. CFDs often involve higher fees and potential risks due to overnight financing costs. CFDs provide less regulation compared to futures.

If you’re trying to decide which market suits you best, understanding the key differences is important. Check out our comprehensive guide on CFD vs futures to help you make an informed choice for your trading strategy.

Currencies (Forex)

Forex trading involves buying and selling currency pairs on the global foreign exchange. It’s the largest and most liquid financial market, operating 24 hours a day. Forex currency trading offers opportunities to profit from changes in exchange rates. Forex offers high leverage to amplify potential gains—and risks. Because the market is so vast, it provides trading options for both beginners and pros.

Market Indices

Stock indices, also known as stock indexes, represent the performance of a group of stocks from a particular exchange or sector. Popular examples include the S&P 500, NASDAQ, and the ASX 200. Trading indices allows you to speculate on the broader market rather than individual companies. This makes it a useful tool for gauging economic trends or hedging portfolio risk.

Index trading often appeals to those seeking diversification with fewer trades. It’s commonly done through futures, CFDs, or ETFs. It’s a way to gain exposure to the overall market momentum with a single position.

For more information about Indices, check out What Are Indices? | Guide to Trading Indices Online

Commodities

Commodity trading involves buying and selling materials like gold, oil, and agricultural products. These assets are often traded through futures contracts, making them a key part of the global trading ecosystem.

Many are drawn to commodity trading for its volatility and potential profit opportunities. This is especially true during times of economic uncertainty or inflation. Commodities are influenced by global events, weather, and supply chain dynamics. Due to this, they can offer unique trading setups not found in traditional stock markets.

How to trade different time frames

Every trader needs to choose a time frame that fits their goals, personality, and lifestyle. Each option—long-term investing, swing trading, day trading, or scalping—has its own pros and cons.

Knowing how to trade different time frames helps you find a style that suits you. Whether you like holding trades for months or making quick moves in minutes, each method needs a different mindset and skill set.

| Trading Style | Time Frame | Typical Holding Period |

|---|---|---|

| Position Trading | Long-term | Months to Years |

| Swing Trading | Mid / Short-term | Days to Weeks |

| Day Trading | Short-term | Minutes to Hours |

| Scalp Trading | Extremely Short-term | Seconds to Minutes |

Long-term Investing

Long-term investing means holding trades for months or years. The goal is to benefit from big market moves and long-term growth. It’s usually less stressful than short-term trading. You don’t have to react to daily price changes.

This style relies more on fundamental analysis. That means looking at a company’s or asset’s long-term value, not just chart patterns.

It takes patience and a long-term commitment of capital. But it can be a strong way to build wealth slowly. It also comes with lower fees and less time spent managing trades.

Swing Trading

Swing trading falls between long-term investing and day trading. Trades are usually held for a few days to a few weeks. The goal is to catch short- to medium-term price moves. Traders often use technical analysis and momentum to guide their decisions.

A good swing trading strategy enters a trade early in a move and exits before it turns. Tools like trendlines, moving averages, and chart patterns help spot these setups.

Swing trading suits people who want to stay active in the market without watching charts all day.

Day Trading

Day trading means buying and selling within the same day. Traders try to profit from small price moves.

It’s fast-paced and needs focus, discipline, and a solid plan. If you’re day trading in Australia, you can access global markets like futures, forex, and indices. You’re not limited to local trades.

Most day traders use technical analysis and real-time data. They follow strict risk rules to act quickly and stay safe.

Day trading can be tough, but it offers flexibility and a chance for daily gains with the right approach.

Scalping

Scalping is a fast trading style. It focuses on small price moves that happen in seconds or minutes. Scalpers make many trades in one session. They aim to earn profits from volume, not big trades. This strategy needs quick thinking, perfect timing, and a strong setup.

Scalping trading works best with fast internet and direct market access. Traders must stay focused and disciplined.

Each win may be small, but steady results and good risk control can make scalping effective.

How to Trade Using Technical analysis

Technical analysis is key to many short-term trading strategies. Instead of studying news or company data, traders focus on price charts and patterns.

They look for setups that have worked in the past. The goal is to find high-probability trades based on price behavior.

This applies to stocks, futures, and currencies. Tools like price action, candlestick patterns, and chart setups help traders enter and exit with more confidence.

Price Action

Price action shows how a market’s price moves over time. Many professional traders use it as a core part of their strategy.

Instead of relying on indicators or algorithms, price action trading focuses on how price reacts at key areas—like support, resistance, and trend lines.

Traders read candlesticks and chart patterns to guess where price might go next. It’s especially useful for day traders and scalpers who need fast, clear signals.

Learning price action helps you understand market psychology and make more confident trading decisions.

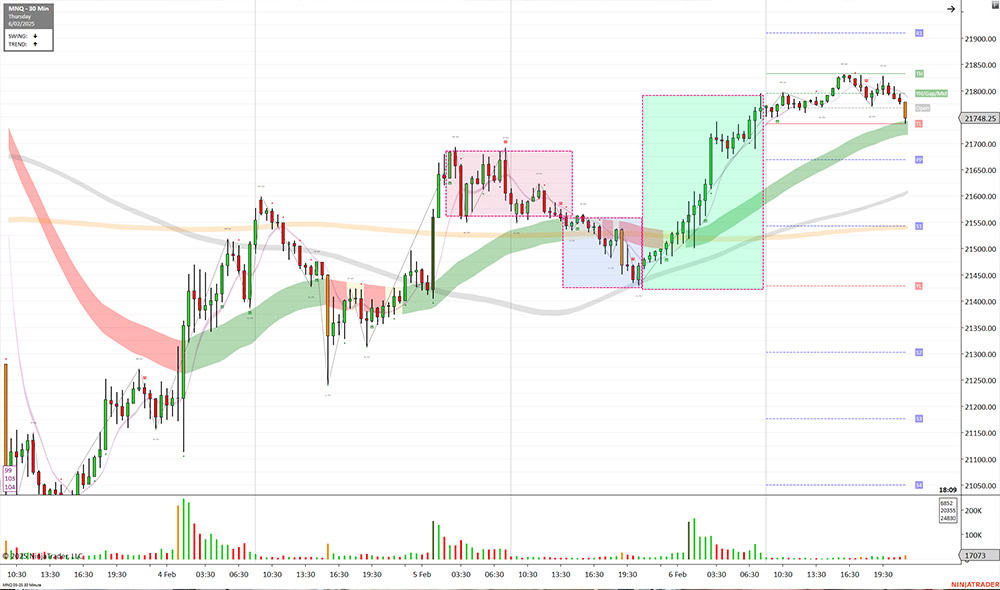

Trading Charts

Trading charts help traders see how prices move over time. They show key data like the opening, high, low, and closing prices.

You can view this information in different formats—line charts, bar charts, or the popular candlestick charts. These visuals make it easier to spot trends, find patterns, and make smart trading decisions based on what’s happened before.

Whether you’re using simple trendlines or complex indicators, reading charts effectively is a key skill in technical analysis. The right chart setup can give you a clearer edge when timing your entries and exits.

Candlestick Patterns

Candlestick patterns are a common tool traders use to read market sentiment and spot possible price moves. Each candle shows the open, high, low, and close for a set time period, with its shape and color hinting at whether buyers or sellers were stronger.

Patterns like doji, hammer, engulfing, and shooting star can signal reversals or trends continuing. Learning to how to read candlestick charts helps traders react faster and make smarter decisions. For beginners in technical analysis, this is an important skill to build confidence and timing in the markets.

Chart Patterns

Chart patterns are shapes made by price movements on a chart. Traders use them to guess where the market might go next. Patterns like head and shoulders, triangles, and double tops or bottoms can point to possible breakouts or trend reversals.

They’re a key part of technical analysis and help traders make better decisions about when to enter or exit a trade. Learning to spot trading chart patterns can boost your confidence and improve your overall strategy.

How to Trade Different Strategies

Every trader is unique, and the markets offer many trading strategies to match different goals, and time commitments. Learning how to trade different strategies is important to find the one that fits you best. Whether that means following trends, riding momentum, or spotting reversals.

Each approach comes with its own set of tools, risk profiles, and decision-making processes. The goal isn’t to master them all, but to explore, test, and refine a strategy that aligns with your trading style and objectives. In the sections below, we’ll break down some of the most popular strategies used by traders around the world.

Trend Trading

Trend trading is one of the most popular and widely used strategies in the markets. At its core, it involves identifying the general direction a market is moving. Is it moving upward, downward, or sideways? The trader will then enter trades that align with that trend. The basic idea is simple: if the price is consistently making higher highs and higher lows, it may be in an uptrend. If it’s making lower highs and lower lows, it’s likely in a downtrend.

Trend traders aim to “ride the wave” as long as the market keeps moving in one direction. This method works across markets like stocks, futures, forex, and commodities, and on timeframes from minutes to months. Common tools include moving averages, trendlines, and the Average Directional Index (ADX) to spot and confirm trends.

One big benefit of trend trading is the potential for strong risk-reward when trends last. But markets don’t always trend—during sideways or choppy periods, trend signals can be false. That’s why many traders use extra confirmation tools like volume or higher time frame checks to improve accuracy.

Success in trend trading requires discipline and patience. Instead of trying to guess market tops or bottoms, trend traders focus on current market behavior and adjust as needed. Done well, this approach helps traders follow momentum and capture big moves.

Channel Trading

Channel trading is based on the idea that prices often move within clear ranges called “channels.” These channels form when an asset’s price bounces between two parallel lines—resistance at the top and support at the bottom. Traders use these lines to decide when to enter or exit trades, aiming to buy near support and sell near resistance.

Channels can slope up, down, or stay flat. An upward channel shows a bullish trend, while a downward channel points to bearishness. A flat channel usually means the market is consolidating. Traders draw these lines manually or use tools like Bollinger Bands or regression channels.

The goal is to profit from price moves inside the channel. When price nears the bottom, traders watch for signs it will bounce up before buying. Near the top, they look for weakness to sell or short.

A key benefit is clarity—clear channels give straightforward trade signals. But traders must watch for breakouts, where price moves outside the channel, signaling a new trend and the need to adjust strategy.

Combining channel patterns with tools like volume, oscillators, or candlesticks helps improve timing and avoid false signals. As always, solid risk management is essential.

Momentum

Momentum trading focuses on assets moving strongly in one direction, expecting that move to continue short term. Instead of trying to catch tops or bottoms, momentum traders enter once the trend is clear and ride it until signs show it’s weakening.

Traders watch for rising price speed, volume spikes, and use indicators like RSI, MACD, or rate of change (ROC) to spot when momentum builds and fades.

A good momentum trading strategy includes clear rules for entering and exiting trades, often using breakouts or pullbacks. Risk management is crucial since momentum can shift fast. Tight stop-losses and discipline help prevent big losses.

This style suits fast markets like futures, forex, and volatile stocks. With careful analysis and planning, momentum trading can offer strong opportunities for traders who act quickly and control their risk well.

Reversals

Reversal trading aims to spot when a market trend is about to change direction. This can be either from up to down (bearish reversal) or from down to up (bullish reversal). Unlike trend or momentum traders who follow the current price movement, reversal traders look for signs that the trend is ending and a new one is starting.

To trade reversals well, you need to understand technical analysis. Traders watch for signals like candlestick patterns (dojis, hammers, engulfing), key support and resistance levels, and divergences between price and indicators like RSI or MACD. These signs can show that buying or selling pressure is fading.

Reversals can be sudden and come with more volatility, so timing is key. Many traders wait for confirmation—such as a break of a key price level or a moving average crossover—before entering. Setting stop-losses carefully is crucial, as entering too early or misreading signals can cause losses if the trend keeps going instead of reversing.

Reversal trading can be highly rewarding, especially when entering at the early stage of a new trend. However, it demands patience, discipline, and a strong risk management plan to avoid the common pitfall of “trying to catch a falling knife.”

Short trading

Short trading involves making profits from falling markets. Instead of buying low and selling high like in traditional trades, short trading means selling high first and then buying back at a lower price. Though it may seem backward, short trading is a common and effective strategy in markets like futures, forex, and stocks.

To short trade, a trader usually borrows an asset and sells it at the current price. Later, they buy it back when the price drops, keeping the difference as profit. This lets traders benefit from market declines, making short trading an important part of a balanced trading approach.

It should be noted that futures trading works a little differently and no borrowing actually takes place.

Effective short trading requires a strong grasp of technical analysis and precise execution. Markets often fall faster than they rise, so timing and risk control are critical. Traders rely on chart patterns, resistance levels, and indicators to identify ideal entry points.

While short trading offers opportunity, it also comes with unique risks. The biggest risk is the potential for unlimited losses if a market rises unexpectedly. For this reason, having a clear exit plan, tight stop-losses, and a disciplined mindset are essential when trading from the short side.

How to Trade and Manage Risk

Risk is part of every trade, but how you manage it determines your long-term success. Mastering trading risk management means protecting your capital while allowing room for growth. It’s not about avoiding losses entirely—it’s about making sure no single trade can ruin your account.

Effective risk management includes:

- Using leverage responsibly

- Setting consistent stop-losses

- Maintaining a strong risk-reward ratio.

These principles help you stay in the game, even when the markets turn against you. By managing risk well, you create the consistency needed to build lasting results.

Position Sizing

Only risk a small portion of your trading capital per trade. Many experienced traders risk 1–2% or less. This helps ensure no single loss can significantly dent your account.

Risk to Reward Ratio

The risk-reward ratio is a key concept in trading that compares how much you’re willing to risk on a trade versus how much you expect to gain. For example, if you risk $100 to potentially earn $300, your risk-reward ratio is 1:3.

A good risk-reward ratio helps you stay profitable over time—even if not every trade wins. Many traders aim for at least a 1:2 or 1:3 ratio, meaning their potential reward is two to three times greater than their risk. Applying this approach ensures that even with a lower win rate, your profitable trades can outweigh your losses.

Using a Stop Loss

A stop loss is a predefined price level at which a trader exits a losing trade to prevent further losses. It’s one of the most important tools in managing risk and protecting capital.

In stop loss trading, the goal is not to avoid losing altogether, but to control how much you lose on any single trade. By setting a stop loss based on your risk tolerance, you create a safety net that prevents emotional decision-making. Traders who use stop losses consistently are better positioned for long-term success.

How to Trade Leverage

Leveraged trading, sometimes known as trading on margin is a way of amplifying you buying power as a trader. This means that a trader can access higher value assets without needing the full amount of funds required.

When trading leveraged products, having the right risk management tools in place is essential to protect your account from outsized losses. Because leverage can amplify both gains and losses, smart traders use a combination of protections to control their downside.

Common Mistakes

Many new traders fall into common traps that can quickly erode their capital. Overtrading, poor risk management, and letting emotions drive decisions are just a few examples. Understanding why most traders lose money is key to avoiding these pitfalls. Learning from these mistakes early, can improve your chances of becoming a consistent trader.

How to Trade With the Right Mindset

Successful trading goes beyond mastering charts and strategies, it starts with the right mindset. Trading psychology plays a crucial role in shaping your decisions. It helps you manage emotions like fear and greed that can cloud judgment. Developing mental discipline and emotional control is essential for consistency and rational choices. Understanding and managing your mindset is as important as any technical skill when it comes to long-term success.

Understanding Fear in Trading

Fear is one of the most common emotions that can negatively impact traders. It can cause hesitation, missed opportunities or premature exits from potentially profitable trades. Fear of loss can also push traders to avoid taking necessary risks or to exit trades too early, which limits gains. Learning to recognize and manage fear is a vital part of trading psychology. By building confidence through education, and experience, traders can reduce fear’s influence. This helps make clearer, more disciplined decisions.

The Role of Greed in Trading

Greed can be just as dangerous as fear when it comes to trading. It often drives traders to take excessive risks or hold onto positions for too long, chasing bigger profits. This can lead to significant losses and emotional stress. One common example is FOMO trading—the fear of missing out on a big move—that pushes traders to enter the market impulsively without a clear plan. Managing greed requires discipline and sticking to your trading strategy. Doing so helps you avoid decisions based on emotions rather than logic.

Resources and Tools

Successful trading relies not just on knowledge, but also the right resources and tools. They help traders plan, track, and execute trades with greater precision and discipline.

Tools that play a role in improving your chances of success:

- A solid trading plan

- Maintaining a detailed trading journal

- Choosing the right trading platform

- Using effective indicators

Additionally, a live trading room can provide real-time insights and community support. This helps you learn faster and stay motivated on your trading journey.

Trading Plan

A well-crafted trading plan is the foundation of consistent success. It outlines your goals, risk tolerance, entry and exit rules, and money management strategies. A trading plan keeps your decisions clear and disciplined. Using a trading plan can help you build a structured approach tailored to your style and objectives. With a solid plan in place, you reduce emotional decision-making and improve your ability to stick to proven strategies over time.

Id you don’t have a trading plan, you can download a free trading plan template.

Trading Journal

Keeping a detailed trading journal is one of the most valuable habits a trader can develop. A journal helps you track every trade you make, including entry and exit points, position size, strategy used, and the outcome. Over time, this record provides insight into what’s working and where improvements are needed.

Reviewing your journal allows you to identify patterns, manage emotion, and refine your approach. For those looking to improve, maintaining a trading journal is a cornerstone of successful trading.

Trading Platform

Choosing the right trading platform helps you execute your trades efficiently and effectively. A good platform offers reliable real-time data, fast execution, and user-friendly charting tools. We use NinjaTrader, which is popular for its powerful features tailored to futures markets.

NinjaTrader supports advanced order types, customizable indicators, and automated strategies. This makes it an excellent choice for both beginners and experienced traders. Having the right platform helps you stay on top of the markets and make informed trading decisions.

Trading indicators

Trading indicators help analyse market data to identify potential entry or exit points. They can range from simple moving averages to complex signals to support decision-making. While no indicator guarantees success, using the right combination can improve your trading.

Using effective day trading indicators is crucial to enhancing your strategy.

Live Trading Rooms

Our live trading room is one of the few licensed and regulated environments in the world dedicated to futures trading. What sets us apart is that we trade real money—live and in front of our students—offering a transparent, hands-on learning experience. This allows traders to see real-time decision making, risk management, and strategy execution in action. Participating in a live trading room helps bridge the gap between theory and practice. There you’ll build confidence and skill as you watch experienced traders navigate the markets.

How to Start Trading

Starting out can feel overwhelming, but breaking it down into smaller steps makes it much more achievable. The key for how to start trading is to build a solid foundation through education, practice, and mentorship before risking real capital. Whether you learn through courses, work with a mentor, or read books, gaining knowledge and skills is essential.

Once you have a good grasp of the basics, practicing with a demo account allows you to apply what you’ve learned in a risk-free environment. This helps you develop confidence and refine your strategies. When you feel ready, transitioning to real money trading with a clear plan and strong risk management will set you up for long-term success. In the following sections, we’ll explore each step to how to start share trading.

How to Start Trading With a Trading Courses

One of the best ways to start learning how to trade is by enrolling in structured day trading courses for beginners. These courses teach you the key concepts, strategies, and tools you need to start trading. They often include video lessons, quizzes, and practical exercises that help build a strong foundation. A really good trading educator will facilitate practical training.

Taking a reputable course can save time and frustration by teaching proven methods, helping you avoid common mistakes. A good trading program will cover risk management, trading psychology, and market analysis. You will receive a well-rounded education to kickstart your trading journey.

Trading Mentors

Working with a trading coach can accelerate your learning and help you avoid costly mistakes. A mentor provides guidance tailored to your goals, experience level, and trading style. Unlike self-paced courses, a coach can give real-time feedback, answer your questions, and keep you accountable.

Having an experienced trader by your side helps build confidence and discipline. These are critical for long-term success. If you’re serious about improving your skills, partnering with a trading mentor can be one of the smartest moves you make.

How to Start Trading Using Trading Books

Reading trading books can be a valuable way to build your foundational knowledge. Many cover everything from technical analysis, trading psychology, to risk management and strategy.

Books allow you to learn at your own pace and revisit important ideas as needed. Reading alone isn’t enough, but combining it with practise and other learning methods can help build strong trading skills. Whether you’re a beginner or more advanced, there’s always something new to gain from a good trading book.

Practicing with a Demo Account

Using a demo account is one of the best ways to practice trading without risking real money. Demo accounts simulate live market conditions. With a demo account you can test strategies, learn your trading platform, and build confidence in your skill.

A risk-free environment helps you understand the markets and your strategies’ performance before trading live. It’s an essential step for beginners and even experienced traders trying out new approaches. Regular practice on a demo account can improve your skills and reduce costly mistakes when you transition to trading real money.

Transition to Trading Real Money

Moving from a demo account to trading with real money is a crucial step in your trading journey. It requires a shift in mindset, as real money brings real emotions like fear and excitement that can impact your decisions.

Start small by trading with a manageable amount of capital and stick closely to your trading plan and risk management rules. Gradually increase your position size as you gain confidence and consistency. Remember, the goal is to build steady profits over time, not to rush for quick wins. A disciplined and patient approach will help you navigate the challenges of live trading and set you up for long-term success.

Before diving in, it’s essential to be aware of the risks involved. Trading products like Futures, or CFDs often involve leverage, letting you control a larger position with a smaller deposit. While leverage can amplify gains, it can also magnify losses which can potentially exceed your initial investment. This makes risk management absolutely vital. Always use stop-loss orders, only risk what you can afford to lose, and never trade based on emotion.

Taking the time to understand these risks and practicing solid risk management strategies can make the difference between long-term success and costly mistakes as you transition from practice to live trading.

Wrapping up How to Trade

Learning to trade can be rewarding, but requires preparation, discipline, and continuous learning. Whether you’re just starting or looking to improve, knowing the basics of markets, strategies, risk, and psychology is essential. There’s no one-size-fits-all approach — successful trading comes from developing a style that suits your goals.

As you move forward, use the resources available, practice, and seek guidance when needed. With patience and persistence, you can build the skills necessary to trade confidently. Keep learning, stay disciplined, and trade smart!

If you’re interested in learning, register for our free trading class now.

Cameron has over 10 years experience in teaching people how to day trade the futures markets. He has feature alongside the CME Group, and NinjaTrader, and has been published in multiple magazines, including leading trading magazine Your Trading Edge magazine.