Stop loss trading is crucial in the fast-paced world of trading. This is because success demands the ability to manage risk effectively. A stop loss order is an essential tool in a trader’s arsenal.

If you’ve ever wondered what a stop loss is, how it works, and how to utilize it in your trading strategy, you’ve come to the right place.

In this comprehensive guide, we will delve into the intricacies of stop losses, explore their functionality, and provide practical tips for incorporating them into your trading routine. Let’s begin by understanding the basics of how to use a stop loss.

What is Stop Loss Trading?

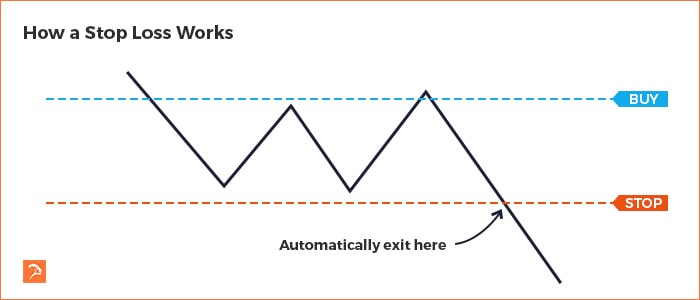

Stop loss trading is a risk management tool that allows traders to set a predetermined exit point for a trade. It is an order placed with a broker to automatically sell a security when it reaches a specified price. The primary purpose of a stop loss is to limit potential losses by closing a position before the price drops too far.

How do Stop Losses Work?

When setting up a stop loss, you specify the price level at which you want the order to be triggered. Once the market price reaches or goes below (in the case of long positions) your specified stop loss price, a market order is executed to close the position.

Stop losses can be placed for both long and short positions, ensuring that losses are controlled in either direction.

It is important to note that stop losses are not foolproof and can be subject to slippage. Slippage occurs when the execution price of the order differs from the expected price due to market volatility, rapid price movements, or gaps in liquidity. Therefore, it’s crucial to consider the market conditions and set appropriate stop loss levels accordingly.

Stop Order vs Limit Order

Stop orders and limit orders are two commonly used order types that traders employ to enter or exit positions. While both can be used in conjunction with stop loss orders, they serve different purposes:

a. Stop Order:

A stop order is triggered when the market price reaches or surpasses a specific level. It then becomes a market order and is executed at the prevailing market price. Stop orders are typically used to initiate a trade or to exit a position once a certain price is reached, helping traders capture potential gains or limit losses.

b. Limit Order:

A limit order, on the other hand, sets a specific price at which the trade should be executed. It allows traders to buy or sell a security at a price more favourable than the current market price. Limit orders are useful when traders want to enter or exit a position at a specific target price, irrespective of the prevailing market conditions.

Stop Loss Trading Strategies:

Percentage-Based Stop Loss:

This strategy involves setting a stop loss at a specific percentage below the entry price. For example, a trader might choose to set a stop loss at 2% below their entry price. This approach accounts for market volatility and adjusts the stop loss level accordingly.

Support and Resistance Levels:

Another popular technique is to place a stop loss order just below a significant support level for long positions or above a resistance level for short positions. This approach relies on technical analysis to identify key price levels where the market is likely to reverse.

Trailing Stop Loss:

A trailing stop loss is a dynamic approach that adjusts the stop price as the market moves in the trader’s favour. It allows traders to lock in profits while giving the position room to grow.

With each favourable price movement, the stop price is adjusted to maintain a specific distance from the current market price.

Volatility-Based Stop Loss:

Volatility-based stop losses take into account the inherent volatility of the security. By setting a stop loss at a level that aligns with the security’s average true range (ATR) or other volatility indicators, traders can adjust their risk exposure based on market conditions.

Practical Tips for Stop Loss Trading:

Set Realistic Stop Loss Levels:

Determine your risk tolerance and set stop loss levels that align with your trading strategy. Avoid setting them too tight, which may lead to premature exits, or too loose, which can expose you to excessive losses.

Consider Volatility and Timeframes:

Adapt your stop loss levels to the volatility of the asset you are trading. Higher volatility may require wider stop loss levels, while lower volatility may allow for tighter stops. Additionally, adjust your stop loss based on the timeframe of your trade.

Regularly Monitor and Adjust:

Stay vigilant and monitor your trades regularly. As the market conditions change, you may need to adjust your stop loss levels to protect profits or limit losses.

Stop Loss Trading: Conclusion

In the unpredictable world of trading, the effective use of stop losses is vital for protecting capital and managing risk. By understanding what a stop loss is, how it works, and the various strategies for stop loss trading, you can make informed decisions to safeguard your investments.

Additionally, recognizing the distinctions between stop orders and limit orders will enable you to leverage the most appropriate order type for your trading goals.

Remember, successful trading involves a combination of solid risk management, discipline, and a thorough understanding of the tools at your disposal.

With a well-executed stop loss strategy, you can navigate the markets with confidence and increase your chances of long-term success as a trader.

So, go ahead and incorporate stop losses into your trading toolkit, and embark on your journey toward more profitable and risk-controlled trading experiences!

To learn trading strategies such as stop losses and other risk management techniques, check out our free trading course.