A Beginners Guide to Trading Futures

How and Where to Trade Futures

If you’re wondering the best way to learn futures trading, then you’re on the right track to making a solid investment choice. Day Trading Futures is relatively unknown compared to mainstream forms of trading such as trading Stocks, or Forex. Futures trading provides a number of advantages over these better known and more highly promoted forms of trading.

One of the most attractive features of trading Futures is that Futures Traders execute their trades directly on regulated stock exchanges. Other traders will access the markets via an OTC Broker. More on this later.

Futures Traders are also able to trade with lower leverage when compared to some other derivative instruments. Lower leverage means lower potential risk for both profit and loss. Higher leverage means a high potential for profit, and a high potential for loss.

When trading any derivative, it is important to note that leverage means risk, so hence great traders need to be very good at risk management.

Below you will learn exactly what Futures are and how and where to trade Futures. We’ll provide reasons why Day Trading Futures for beginners and experts alike is recommended over all other forms of trading, and provide tips to trading them.

What are Futures?

Futures, or a Futures contract is an agreement between two parties. The agreement states that the buyer or seller of the contract will then sell or buy back the contract at or before the contract’s end date. A Futures trader can choose to exit a contract early with no penalties should they choose. The value of the contract is derived from an underlying asset. For example, a trader may buy a contract on Oil, that contract is assigned the value of the current price of Oil on the Futures market.

Trading Futures gives you the ability to both buy and sell contracts. This means that it does not matter whether the market goes up or down, there exists an opportunity to profit if you are good enough to do so.

The Background of Futures

Futures contracts were originally created to trade agricultural goods. Having a written contract guaranteeing an amount of money gave historical farmers a level of security in making long term plans.

Speculators would assume the risk of entering Futures contracts in the hope that the price they would pay upon delivery will be lower than the marketing price at the future point in time.

These Futures contracts have become more common over the years as their regulated nature means they are accompanied by smaller counterparty risk.

Futures Contracts vs Forward Contracts

Both Futures and Forward contracts are derivative arrangements that describe two separate parties agreeing to buy or sell assets at an agreed price by a specific date. There are distinct differences between these two types of contracts.

A Forward contract is an over-the-counter (OTC) arrangement in which securities are traded through a broker-dealer network rather than on a centralised exchange. This means that the parties involved in forward contracts will privately negotiate its terms.

Forward contracts are riskier for both parties due to the greater chance of default or non-settlement by the client. They mostly exist as an instrument for hedgers to manage the volatility of assets.

Unlike Forward contracts, Futures contracts are standardised contracts that are traded through stock exchanges and are settled on a daily basis. Futures contracts hold comparatively little risk, as they come with uniform terms and fixed maturity dates.

The Benefits of Trading Futures

There are many good reasons why we choose to trade Futures above all other forms of trading. Our Futures trading course reviews also demonstrate the popularity of Futures trading amongst all kinds of people.

Let’s go through some of these reasons:

Fair and transparent pricing

The Futures markets allow a trader to directly connect to an exchange without the need for a traditional OTC style broker. Connecting directly to the market means that you receive the ‘true price’ rather than the broker’s interpretation of that price.

It is worth noting that the broker’s interpretation of the correct price for a market may be completely different to the stock exchange defined price of the market. In this interpretation, there is a great deal of room for price manipulation in favour of the broker and against you the trader.

In direct comparison, futures traders trade directly to their chosen stock exchange with only one price point for all traders. One global price point produces a level playing field for traders big and small.

When trading the Futures market you can be confident that the price you are given is the real current price, and not a price manipulated in favour of your Broker.

Leveraging

Futures trading allows a trader to leverage a small account. This means that a Futures trader doesn’t need to trade funds equal to the full value of the contract. An initial margin is required instead and is a fraction of the contract price. This means that the potential return as well as the potential loss is increased. While this does create more risk it provides successful traders the ability to access more buying power.

Smaller account size potential

One of the biggest complaints from stock traders that have a small amount of capital is the restrictions on trading accounts that are under $25,000. While you can trade stocks with a small account you can only day trade a certain number of times per week, or create a cash account which then involves waiting for trades to ‘settle’ which is essentially the same problem dressed a different way.

A major benefit of Futures trading is that this constraint doesn’t exist, you don’t need that much capital to day trade. All you ever need is enough funds to cover margin, so you can day trade with an account smaller than that of a stock trader. Futures also provide E-mini and E-micro markets that require a much smaller margin in order to trade and are well suited to traders with limited funds.

Funds Required To Day Trade By Product

Liquidity

The Futures markets are some of the most liquid markets available in the world. What this means is that there are a lot of people trading these markets each and every day and the volume of tradable contracts in these markets is huge. To quantify huge, the US Markets alone turn over more than 3 Trillion US Dollars every day. The Futures markets are significantly larger than the global FOREX markets.

A liquid (high volume) market allows a trader to instantly place trades and have them executed into the market. Trading products like Options with lower liquidity means that you might not get your trade ‘filled’ straight away which means that price could move away from your desired trade entry point before you have a chance to enter your trade.

Diversification

There are over 70 different markets available to Futures Traders. These include Oil, Gold, all Currency Pairs and most major global stock index markets. In trading, these are known as asset classes.

Because of the number of asset classes available to Futures Traders, there is opportunity to focus on the best market opportunities. If Oil is running, trade oil. If gold is falling, trade gold. Your market trading options are many and varied. For those who choose to trade longer term (swing traders for example) the ability to diversify your trades across different markets helps you hedge your account and limit risk.

| Product | Liquidity | Volatility | Transparency |

|---|---|---|---|

| Mid/Large Cap Stocks | YES | SOMETIMES | YES |

| Penny Stocks | NO | SOMETIMES | YES |

| Forex | YES | SOMETIMES | NO |

| Options | NO | SOMETIMES | YES |

| Futures | YES | YES | YES |

How and where to Day Trade Futures

Futures trading is becoming more and more popular among ‘mum and dad’ investors. The Futures markets are not strictly for hedge funds and wholesale investors, they are extremely accessible to the average trader. Due to the advancement of the internet, trading markets such as the Futures markets are accessible to just about anyone.

What you’ll need in order to trade Futures

There are a few tools and services that you will need in order to access the Futures markets and place trades. Here is what you will need:

A laptop or computer

You will need to have a laptop or trading computer that is capable of running software that will allow you to connect to the market and place trades. You won’t need a top of the line machine, however it should be robust enough to not lag or crash at the wrong time.

Many of our members choose to use a laptop as it provides mobility and extra flexibility for where they can trade. Others prefer to set up a desktop computer in a designated location (a trading den, if you will.)

Some traders use multiple computer screens to trade with. This typically enhances your ability to look at larger and smaller trading charts simultaneously. We find that this micro/macro perspective on the market assists greatly in detecting high probability trades.

A reliable internet connection

Because the live markets can move quickly it is important to execute your trades quickly. It is also important to have a reliable connection that won’t drop out and leave you stuck in a trade until you’re back online. Broadband or cable internet are the most preferred connections for trading.

A Trading platform

In order to connect to a market and execute trades you will need a special software called a trading platform. This software will provide you with the charts and drawing tools that will help you identify trades, as well as the functionality to place trades.

Our favourite trading platform is NinjaTrader and it is the platform that we and our members use.

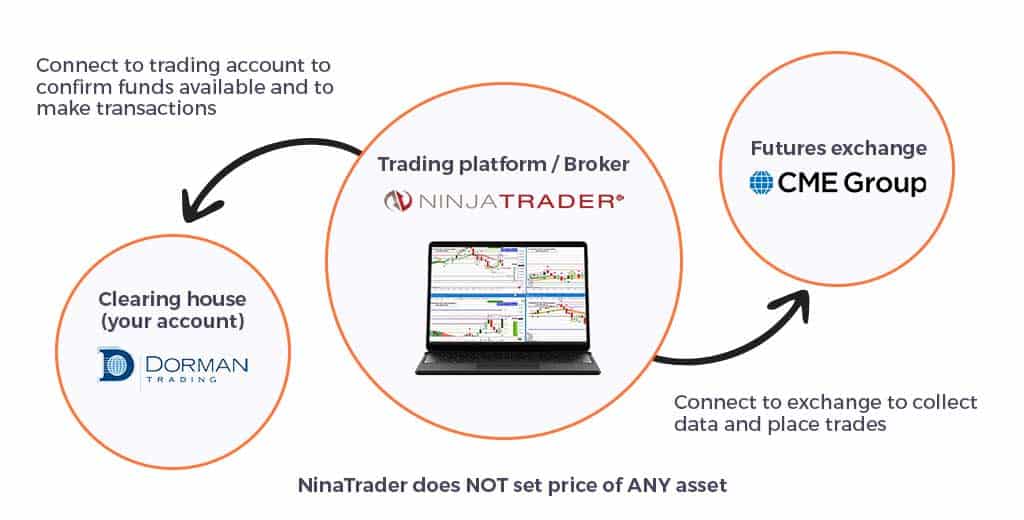

Broker vs Clearing house

You need to have a trading account in order to trade. Most people open a trading account with an OTC style broker like eToro, IG or Saxo, but we recommend you don’t. We suggest you open your trading account with a either a Clearing House, or a non-OTC broker which doesn’t control price.

Your trading account holds your funds which are accessed by the trading platform when you place trades.

We choose to use NinjaTrader as our trading platform which also acts as our Clearing House.

This allows us to trade directly to and from the stock exchange of our choice. This gives us 100% market transparency without the potential for market data interference or manipulation.

NinjaTrader connects live market data directly from the exchange, this means you see the ‘true price’. The trading platform then facilitates the execution of trades.

A live connection and data feed

A live connection to a market is needed so that a trading platform can make the request to execute a trade. The data feed will provide the information about price and allows the trading platform to build trading charts.

Tips for being profitable when trading Futures

There are many beginner traders that have tried and failed in all forms of trading and they all lacked the same thing. Here are some tips to avoid those mistakes and give yourself a better chance of being profitable in trading.

Develop or copy a proven trading strategy

Not having a trading strategy is possibly the number one reason why new traders fail. You need to have a set of rules and a plan for every trade that you place. Not having a strategy often leads to spur of the moment decisions that can be costly. Your strategy will also help you understand what a good opportunity looks like and what a bad trade might look like.

Learn from a reputable trading educator with an online Futures trading course

It is so incredibly important to invest in your education, with your time, money, and effort. While it is possible to teach yourself you will find that your learning is unstructured, unsupported, and a Frankenstein’s Monster of different techniques and strategy.

It’s best to learn to trade with an educator/ take an online Futures trading course with the International Day Trading Academy, which has a solid track record of success. You should find someone who provides a high level of support and guidance. Choose a program that you feel confident that you could learn.

Learn to Trade in a Live Trading Room

A Live Trading Room is an online coaching tool where trades are called live in the market. In our opinion, a Live Trading Room provides guidance in identifying high-probability trades. We would go so far as to say that if an educator does not run a Live Trading Room, you need to question the integrity of their strategy. You also need to ask them why they are not prepared to call trades live, in real time, so you can measure their true professionalism.

We suggest you only use an educator that also runs a Live Trading Room and will let you test that Live Trading Room before you decide to be educated by them.

Downsides to trading Futures

There are a lot of great reasons to trade Futures, however it must be noted that every form of trading carries two risks, the risk of making money and also the risk of losing it. In short, the Futures markets involve risk that needs to be managed with proper risk management techniques if you want to be successful as a Futures trader.

The bottom line

The popularity of Futures amongst its traders comes largely from being able to access a fair market that they can get in and out of quickly. The appeal also comes from being able to trade a smaller account. Futures traders can negate the restrictions that are involved in other forms of trading.

Combining Day Trading with the Futures markets gives you the opportunity to create an income on a daily basis (when the markets are open). This is popular because it can provide either a second source of income or even a full time income working fewer hours.

Online Futures Trading Course

If you are looking to learn how to day trade Futures online, make sure you properly prepare yourself. A good place to start is with one of our courses in Futures trading for beginners.

Our Futures trading course reviews and testimonials demonstrate our course’s value in teaching key insights into day trading.

It’s always best to create a simulation account where you can practice strategies that you’ve learnt. Never trade your own money until you have proven to yourself that you can be profitable. We call this go slow to go fast and we believe this is the best way to approach any learn Futures trading.