I love being a lifestyle trader, it provides me with unique flexibilities rarely found elsewhere. In this article you will learn what the day trader lifestyle is and what a trader does.

What is a Lifestyle Trader?

A lifestyle trader is someone who seeks to trade for around 2 hours per day. This leaves time for lifestyle activities that are more desirable than working. This type of lifestyle trading is called day trading.

Unlike working a typical job that involves long hours, travelling to work, bosses, co-workers… lifestyle trading provides a more flexible business opportunity. Being a lifestyle trader doesn’t need to be a full-time gig either. Many day traders and lifestyle traders work a full-time job and use trading to seek a secondary income.

A lifestyle trader has a unique control over where and when they choose to trade, and for how long. That all sounds amazing, but there are risks involved with day trading. You need to trade the right way, more on that later. First, let’s take a look at what day trading is.

What is Day Trading and Lifestyle Trading?

Day trading is the entering and exiting of trades within the same trading session. The goal is to take advantage of small price movements in the markets.

The key difference between day traders and longer-term traders is that day traders don’t hold trades over-night. This removes “over-night risk” which include fluctuations in overnight markets and the need for larger margin requirements.

Margin is the collateral the exchange requires to permit a trader to be able to participate in the market. The margins increase as much as 10 times the intraday margin, for overnight positions. These margins are called maintenance margins.

What Day Trading Isn’t

Day trading isn’t a means of getting rich quick, nor is it a low effort way of drawing an income. Those who seek to get rich quick are the same that get poor quick.

Day trading or lifestyle trading is not a source of high returns gained from small amounts invested. There are of course educators and companies on the internet that will tell you they have some secret knowledge that leads to massive gains… There is no ‘secret sauce’, there are ways of giving yourself an edge, but there are no insider secrets.

Day trading or lifestyle trading is also not a guarantee; far from it actually. Most lifestyle traders fail, many of them because of the reasons mentioned above. If you want to be successful you need to put in the effort. You need to learn the theory.

You then need to practice your lifestyle trading on a simulated account, and have the patience to execute. You must be in control of your emotions, and have a risk management system.

If your intentions are to take up trading for a living, you need to understand these things.

Day Trader Lifestyle

The day trader lifestyle, as you now know, takes up little time, but what is trading for a living actually like?

The benefits of being a lifestyle trader are that you can be your own boss. You have the capability to plan your working hours. This means that you are able to trade at a time that is convenient and fits around your day-to-day life. Trading on a laptop also means you can do it anywhere, anytime. You will need an internet connection and a trading platform.

One of the benefits of being a lifestyle trader is that you can work from almost anywhere. Part of the trader’s lifestyle is the ability to trade from home which provides extra comfort that most jobs don’t. You can wear whatever you want, something far more comfortable.

If you’re day trading from home you can completely remove the need to travel anywhere. I won’t tell you about how awful driving, or catching public transport to work is, you already know. The traffic, the noisy passengers, the time it takes!

One of my favourite things about the trader lifestyle is walking to a room in my house and already be ‘in the office’.

Be your own boss is such a tacky cliché, unfortunately I don’t know a better term for it. Either way, the day trader lifestyle does allow you to be your own boss. You control when, where, and how you work. This is good because it makes you self-accountable, and you run your trading business how you want.

Lifestyle traders also don’t need to worry about co-workers. It’s nice to be in complete control of your own performance. You don’t have to worry about lazy team members weighing you down. There’s no office politics or personality clashes. You don’t need to listen to Brian from accounting whistle the tune to Gilligan’s Island every day… Every day, Brian!

That all sounds good, but what does a trader actually do?

What Does a Lifestyle Trader do?

A lifestyle trader is someone who seeks to profit from the movements in the financial markets. A typical day for a trader may involve waking up, checking financial news, and making a decision on what to trade.

If you are a Futures trader, you check news and make sure there is nothing that will affect your trading for the day. You don’t need to decide what to trade, most futures traders will focus on one market.

Most day traders have a checklist of what to do before they begin trading live in the market. This will vary from trader to trader, but you will need to make sure you’re ready to go.

When the lifestyle trader is ready to start the trading session, they need to be hyper focused. Although day trading can take a couple of hours (often fewer) you do need to remain focused the entire time.

A lifestyle trader will have a trading plan which consists of day trading strategies and general rules that dictate decision making. A day trading strategy will consist of trading patterns, or day trading indicators. These patterns and indicators provide clues on where price is more likely to move.

To be a lifestyle trader you need to have a trading plan. You also need to have a solid strategy for finding good trades (and how to manage open trades).

Peta from the IDTA enrolments team trading from her caravan.

Day Trading From Home

If you’re going to be lifestyle trading from home there are a few things that you will need.

1. Choosing your market

First of all you will need to identify the type of trading that you want to do. If you want to day trade stocks or options for example, you will need to have an account of at least $25,000. This is because of the pattern day trading rule that states that you can only place 3 day trades per week. The rule applies only if your account is smaller than $25,000.

This rule doesn’t exist in the Futures markets. The entry point can be much lower if you’re day trading with little money.

2. Learning how to find good trades

If you’re day trading from home, you’re more often than not, on your own. You will need to learn to trade well before you jump in the deep end.

Because the markets move in common and repeatable ways, they create chart patterns. These patterns appear on a trading chart consisting of “candlesticks”. So, you’ll need to know how to read candlestick charts.

It’s important to understand these patterns so that you can predict where price will move. These patterns will also help you understand where to exit your trade, whether it be in profit or as a loss.

3. Risk management techniques

A large part of trading is the ability to manage risk. You need to know how to place trades with a calculated risk. When you are in an open trade you need to know how to limit your risk. This is something that is often overlooked, but trading is not just finding trades, it’s how you manage them.

4. Trading platform and the skills to use it

To trade from home you need a way of connecting to the market you want to trade. You’ll need a means of placing requests (orders) on that market. This is what your trading platform is for. Most brokers will provide a free trading platform if you use their brokerage service. You can also use a third-party broker, we use NinjaTrader as it allows us to access the exchange directly. Over the counter (OTC) brokers don’t provide this.

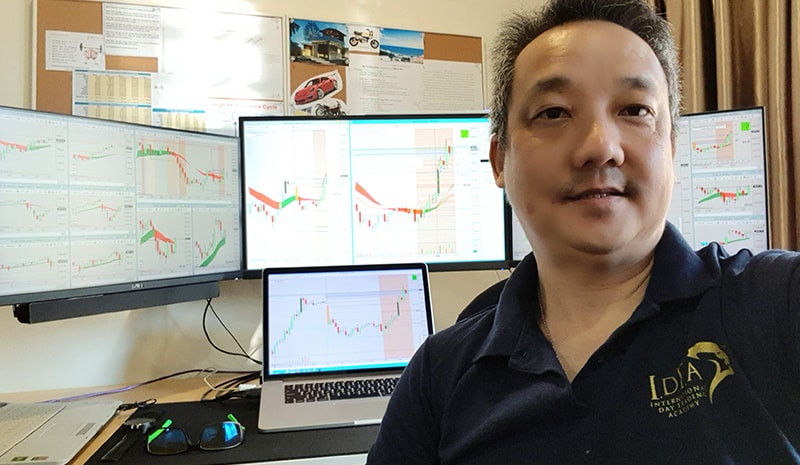

IDTA Student day trading from home from their home office

5. A broker or market connection

As I said, you need a way of connecting to an exchange to execute buy and sell orders. Most often this is done through OTC brokers who hold your funds and send your orders to the market. Futures traders are different, they can access the markets directly. Futures traders can do this via a trading platform and data feed. This means that rather than a broker setting price, you get the price directly from the market.

6. A Trading plan

To be a successful lifestyle trader you need to have a plan. Your trading plan will provide a set of rules for you to follow so you can maintain your trading edge in the market. Some of these rules will relate to the maximum amount of trades you can place in a day, your profit target for the day, and general trading goals.

7. A Trading Journal

When you’re day trading from home, there is no one above you holding you accountable, as a boss would. This means that you need to ensure that you are holding yourself accountable. The best way to do this is with a trading journal. This is either a document like a spreadsheet, or a software that records your trades. Here you can measure performance and also log your emotions and decision making.

8. Practice (until consistent)

Before you start trading live and risking real money, you want to know what you’re doing. A bit like learning to drive, you learn the theory, then practice before you can go out on your own. To practice your trading, you will need a simulation account. Simulation accounts are also sometimes called a paper trading account. This account trades pretend money; you gain the experience without risking real money.

9. A distraction free environment

If you share a house with a lot of people, or it’s a noisy environment, it’s going to make trading from home very difficult. You need to find a quiet space where you can concentrate for the entirety of your trading session. Try to make your desk clutter free, and turn off anything that may be distracting (T.V, social media etc).

Day Trading and Travelling

Other than more family, or free time for yourself, lifestyle trading offers other advantages.

Lifestyle trading is very portable. This is because it only requires a laptop, internet connection, and trading platform. It’s possible for you to take your trading with you while traveling around the world. Some of our members have, or continue to do this as part of their lifestyle.

It’s worth noting, if your full-time job is day trading, you don’t have the luxury of paid vacations. So, while you enjoy your vacation, it’s important to focus when it’s time to trade.

When travelling and lifestyle trading. consider the quality of your internet connection, and whether you’re in control of it.

Ingela Traynor – Trading coach for the International Day Trading Academy, travelling and trading in Bali

The Cons of The Lifestyle Trader

Trading Futures isn’t for everyone, there are certain personality types that just don’t mesh with trading. There are some real drawbacks for day trading (depending on your point of view). Some of the cons to being a lifestyle trader are:

Solitude: Day trading is a one man/woman business, often done alone, in a quiet room. If you find it difficult to work alone, or you enjoy working with others, trading can feel lonely. Trading’s really only fitting if you can manage those 2 or so hours per day of solitude.

Inconsistent income You can’t guarantee a certain level of income in the same way that a traditional job allows you to. In fact, you can’t guarantee a profitable day, or week. You need to be able to accept, and be in a position where this won’t hurt you financially.

The Risks of The Lifestyle Trader

Trading for a living can be a great way to live life on your own terms. But it’s not without risks. Make sure you know what you’re getting into before making the switch.

Some risks associated with lifestyle trading include the following:

- Trading can be addictive. If you’re not careful, you can find yourself trading more and more. If this happens, it’s important to take a step back and reassess your situation. This type of trading is gambling.

- Day trading can be risky because there are no guarantees in the market. This means that you could make a lot of money one day, and lose a lot the next. It’s important to be prepared for this, and have a plan for how to handle it if it happens.

- Day trading can be risky because you’re not always in control of your own destiny. The market can go up or down, and there’s nothing you can do about it. This means that if you put all your eggs in one basket, you could lose your entire account (we teach you how to avoid that). It all comes down to trading risk management, and it’s very important.

- Day trading is a very emotion driven exercise for some people. These emotions drive emotional decisions rather than logical ones and create mistakes. The most common is fear, every trader feels it from time to time. Trading without fear is hard to do, but you can teach yourself to limit fear. This allows fewer emotional decisions in your trading.

Bottom Line

There are so many great things about lifestyle trading for a living, it truly offers a unique opportunity. But there are also drawbacks, as with everything in life there is a balance of good and bad.

At the International Day Trading Academy, we focus not only on teaching you how to trade, but also how to limit the risks. A major part of our teaching is about risk management and trading psychology. We teach so much more than a strategy for finding trades. This helps us mould skillful traders that have the tools to be more consistent.

Our entry level course teaches day trading for beginners, risk management, and trading psychology. These are the 3 pillars required if you want to be a lifestyle trader.

This is called having the trader’s edge. You won’t control the markets, but you will have better control of your decisions. This is something that all the top lifestyle traders have, it’s something that takes effort, but I feel has many rewards.

![How To Be a Lifestyle Trader [What to Know] 1 lifestyle trader day trading-while travelling using laptop](https://idta.com.au/wp-content/uploads/2022/03/lifestyle-trader-day-trading-while-travelling-using-laptop.jpg)

![How To Be a Lifestyle Trader [What to Know] 5 Free day trading web class](https://idta.com.au/wp-content/uploads/2020/08/free-day-trading-web-class.png)

![Trading Futures in Australia [How to Get Started]](https://idta.com.au/wp-content/uploads/2022/03/trading-futures-in-australia-how-to-get-strated-500x383.jpg)