Most traders lose money; sounds odd coming from someone who educates people on how to trade, doesn’t it? Well, the fact of the matter is that most traders fail in their first 12 months of trading.

In this article, we’ll take a look at 12 of the most common mistakes, that cause most traders to lose money; and show you how to avoid them.

What Percentage of Day Traders Lose Money?

The vast majority of day traders lose money – statistically speaking. There is no comprehensive set of data available to be able to say what percentage of Day Traders lose money. Some might say 90% of Day Traders fail, others say it’s 80%, these numbers are often unsourced.

What we can say is that a high percentage of day traders lose money. According to a research paper by Brad M. Barber (University of California) more that 75% of all day traders quit within two years. Now that you know that most traders lose money, let’s see why that is, and how you can avoid these traps.

Why Do Most Traders Lose Money?

There are a few reasons why most traders lose money, many of them quite common. So why do most traders fail? Let’s look at some of the main reasons:

1. Informed But Not Educated

This is a very common mistake, and a lot of the other mistakes on this list, stem from this one. When trying to understand how most Traders lose money, first consider; do they actually know what they’re doing?

Many people have tried to take up trading on the back of watching some YouTube videos, or reading an article or 2. So it’s not to say they are completely ignorant, they are informed. The problem is that they’re not properly educated.

It’s not enough to gain a basic understanding of how to trade and expect to trade real money. A free trading class might be a good place to start when you want to learn to trade; but there’s more to it.

If you want to be a successful Day Trader, you need to train yourself properly. Consider taking a course on day trading for beginners. Build your core understanding of the markets, and how to find good trades. Such a course will also help you with the remaining mistakes on this list.

2. Lacking Discipline

Discipline is important in trading, because it’s the foundation of success. Without discipline, you’ll find it hard to stick with a plan, and you’ll likely make more mistakes than you are comfortable with.

If you want to be successful as a Day Trader, you need to develop a set routine for trading. Make sure that your trading days are structured, and that you stick to them as closely as possible. This will help keep your emotions in check, and allow you to focus on the task at hand.

Making too many trades is another common mistake and a reason why most Traders fail. When trying to make money in the markets, it’s important to trade only when you have strong convictions about the trade. If you’re not sure about the trade, wait until you are!

3. Impatient

Many of those new to trading want to get stuck right in. They lack the patience needed in order to trade the markets well. It’s important to fully educate yourself in how to trade. It’s also important that your practice how to trade on a simulated account where no real money is at risk.

It can be useful to practice in live day trading rooms where an existing strategy can be followed and practised.

I like to think of trading as being similar to driving a car. When you get your license you need to learn the road rules, this can be like learning the rules of a trading strategy. Before you’re able to go out and drive by yourself, you need to put in the hours of practice driving a car. Rather than a licensed driver in the passenger seat you could consider a day trading mentoring program or some form of coaching.

4. Trading With Emotion

What most people don’t understand is that trading is 80% mindset, 20% skill. One of the biggest reasons why most traders fail is that they allow their emotions to get in the way of their decision making. It’s not that trading is hard to understand, or a difficult concept to grasp for them, it’s their mindset.

For example, if you’re thinking about exiting a trade as the market is going against you, chances are your emotions will override your logic and you’ll end up exiting. You might do this despite what your trading strategy tells you, and you may sell at a loss where there could have been eventual profit. This is why it’s important to keep a cool head when trading.

Trading is 80% mindset, 20% skill.

5. Over-Confidence

Another common mistake is overconfidence in your trading skills. You might feel that you know more about the market than you actually do. This can be dangerous because it can lead to you taking unnecessary risks. You might be so sure of being correct in your analysis.

6. Over-Complication

Some traders get caught up in the details of their trades, and this can lead to them making mistakes. A trade should be simple enough for you to understand and execute, but not so simple that you’re unable to make a profit.

7. Trading Too Much

One of the most common mistakes that Traders make is trading too much. This can be because they don’t have a solid system or strategy, or they’re just trying to make money quickly. If you’re trading too much, it’s likely that you’ll lose money.

The best way to avoid this is to have a trading plan and stick to it. Also, make sure that you’re only trading with assets that you understand fully. If you’re not comfortable with an asset, then avoid trading it.

Check out this article if you want to learn how to create a trading plan.

8. Impulsive

Impulsive trading is trading on emotion rather than logic. You might be swayed by news events or other factors that you can’t control. If you’re trading impulsively, it’s likely that you’ll make mistakes. The best way to avoid this is to use a Trading Strategy and follow it religiously.

9. No Trading Strategy

Most Traders lose money by making the mistake of not having a trading strategy. If you’re not prepared to trade, then you’re likely going to lose money. You need to have a plan and stick to it, even if the market is moving in your favour.

Your strategy will help you identify good trades from bad, and will help you know when to get in and out of your trades.

Trading without a strategy will lead you to making decisions on a whim, and will provide you with no direction.

10. Not Measuring Performance

If you’re not measuring your performance you’re not truly understanding what works and what doesn’t. Often I see traders tell me that a certain type of trade works best for them. But then when they look at the data they can see that there are different trade setups performing better.

The best way to track your performance is to record all of your trades in a trading journal. You can get a copy of our trading journal template here.

11. No Risk Management

One of the most important things that you can do when trading is to have a risk management system in place. This means that you know how to limit your losses and protect yourself from possible losses. It’s also important to be aware of the risks involved in trading and understand how to hedge your bets.

Why we only trade the Futures markets

12. Trading The Wrong Market

Not all markets are equal, and for some traders, their only mistake is trading the wrong market.

There are a number of things to consider when choosing a market to trade. Some examples would be:

1. Liquidity

2. Accessibility

3. Ability to short sell

4. Market data source

5. Transparency

6. A level playing field

7. Diversity

8. Highly regulated

1. Liquidity: The liquidity of a market refers to the number of buyers and sellers. A market with a high liquidity will have a lot of buyers and sellers, which will make it easier for you to trade. A trader is able to get in and out of the market quickly.

2. Accessibility: You also need to consider the accessibility of the market. Day Trading some markets, like Stocks and Options takes a lot of starting capital. In order to Day Trade these markets you must adhere to the Pattern Day Trading (PDT) Rule. This rule states that you must maintain an account of at least USD 25,000 in order to trade on a daily basis.

3. Ability to short sell: Some markets provide simpler access than others when it comes to short selling. Short selling is the ability to take advantage of a falling market in order to profit. Trading stocks for example does not provide this function. Stock traders need an asset to rise in value in order to profit. This is very limiting, especially in a bear market.

4. Market data source: The Futures markets provide a direct connection to the exchange. Data received by Futures traders is the same for all traders, large and small. The price given is called the ‘true price’ and is not altered by an OTC broker as it is with other types of trading.

If you can imagine, a broker will choose to provide price that is beneficial to the broker and not the trader. This can be one of the reasons that a Day Trader fails.

5. Transparency: The Futures markets are centralised and market data is universally the same to all traders. This means that not only is price true, but the volume being traded is absolutely accurate. No data can be altered by any entity to be misleading.

6. A level playing field: It’s important that there is a level playing field when it comes to trading. Without a level playing field, market makers, hedge funds, and brokers can all manipulate the markets (and often do).

This means that there is an unfair advantage, a Day Trader loses money because they are fighting against the big guys in some situations.

7. Diversity: Diversity in the market is important. Trader’s and investors that want to hedge against risk will choose to diversify their holdings. This means that if price moves against the Trader in one sector, it can be hedged by gains in another.

8. Highly regulated: Markets like Forex, and others that use OTC brokers have very low levels of regulation. In order to trade these markets you MUST have a middle man (OTC broker) in order to access the markets.

The broker will set the price, and may choose to trade against you rather than place the trade on the market. It’s surprising completely legal for them to do, it’s called ‘taking the other side’.

These are some of the most popular for retail traders, as you can imagine, this could most certainly be why most Day Traders lose money.

Most Traders Lose Money – Handling Losses

Losses are inevitable in trading, even the best traders see losing trades, losing day, or even a losing week when trading. The traders that fail, and the ones that can’t accept this fact.

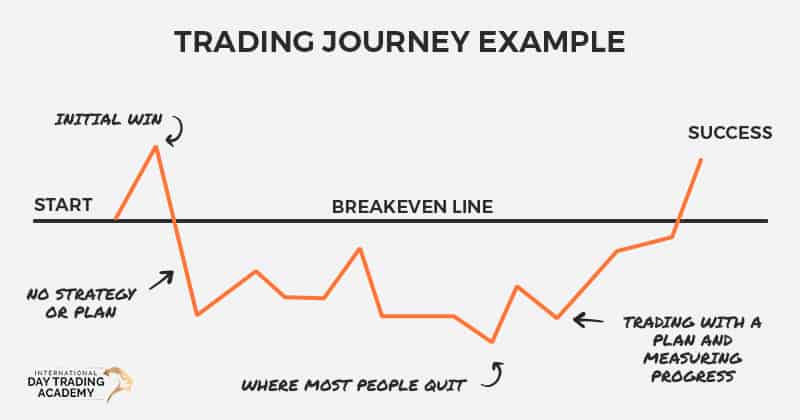

New traders who make the previously mentioned mistakes are slow to see return on their investment. Most commonly a trader will get frustrated and quit before achieving consistent profit. Not because they will never be able to be consistently profitable, they just don’t know how.

It’s important to except the losses that you make. If the loss was because you did the wrong thing, learn from the mistake. If the loss comes after following your plan exactly, oh well, that happens too, move on.

Traders that can’t handle losses often end up making larger and more costly mistakes by trying to avoid an inevitable loss.

Can You Make Money Day Trading?

All things considered, can you make money day trading? Of course, you can, the profession wouldn’t exist if that weren’t true. In saying that, it’s a very risky proposition.

Unless you have a very good understanding of the markets and are able to follow sound trading strategies, you’re likely to lose money.

As we’ve already seen, much of the reason why most traders lose money is they’re simply not doing it correctly. If you’re not prepared to learn and put in the hard work, day trading is not for you. The best way to learn day trading is through an academy that teaches all pillars of trading.

If you’re looking for a quick buck, or you think you can take short cuts, you’ll find yourself as one of those traders losing money.

Start Your Trading Journey The Right Way

Treat your trading like a business. Like any good business you need to understand your market, and your product (your trading).

Most traders lose money by wanting to take short cuts in getting started, or in taking the cheapest option. If you do this you end up giving much more time and money to the market and have nothing to show for it.

People who are successfully Day Trading in Australia do so with the correct tools and mindset. It is a work in progress and nobody is an overnight success.

The trader’s lifestyle is truly unique in the opportunities that it provides, but you still need to treat trading as a business.

A great place to start would be to speak with a ASIC regulated educator, you can get in touch with us via info@idta.com.au if you have any questions, or want to get started today.

![What is Scalping Trading [is it Illegal in Australia?]](https://idta.com.au/wp-content/uploads/2023/05/scalping-trading-is-it-legal-in-australia-500x383.jpg)

![What Are Indices [A Guide To Indices Trading]](https://idta.com.au/wp-content/uploads/2023/04/what-are-indices-a-guide-to-trading-indices-500x383.jpg)