Forex currency trading is a highly popular form of day trading in Australia and throughout the world. In this article I want to introduce you to the concept of trading currencies, and an alternative to Forex trading, that I believe is far superior.

What is Forex Trading and How Does it Work?

Forex currency trading is the physical buying and selling of foreign currencies on the foreign exchange market. When a currency is traded (e.g. US Dollar) it is paired against another foreign currency to make a ‘currency pair’.

The value of a currency pair, that is, the price for the pair is known as the ‘rate’. The rate is the value of the first currency (base currency) in the pair compared to the second (quote currency).

For example, the Australian Dollar vs US Dollar as a currency pair is AUD/USD. As an example, the quoted price would look like AUD/USD = 0.67

In this example, you can see that the base currency (AUD) is equal to 0.67 of the quote currency (USD). This simply means that 1 Australian dollar is worth 0.67 US Dollars.

If a trader was to buy the AUD/USD currency pair they are buying the base currency (AUD) at the value of the quote currency which in this case is USD.

There are 6 currencies that make up the basket of major pairs. These include Australian Dollar, US Dollar, British Pound, Canadian Dollar, Euro, Japanese Yen, and Swiss Franc. These are the most common pairs for Forex currency trading

What Are the Benefits of Forex Currency Trading?

There are many benefits to Forex currency trading, and there is good reason for its popularity. It also has some serious pitfalls which you’ll learn later in this article.

A lot of the popularity of Forex currency trading comes from the high earning potential. Small movements within the Forex markets can provide a comparatively large gain. Often Forex products are also leveraged allowing traders to use a fraction of the funds required for a trade.

This is highly attractive for traders who are seeking high growth in their trading.

The Forex markets are also some of the most liquid markets in the world and can be traded 24 hours a day.

The Forex markets offer a lot of volatility to take advantage of and the liquidity allows for Forex Day Trading, as traders can enter and exit trades quickly.

What Are the Risks of Forex Currency Trading?

Forex currency trading is a highly risky venture. There is a risk of losing your entire investment, and there is also the risk of getting carried away and buying too many currencies at once.

Exchange Rates Are Highly Volatile

Exchange rates are very volatile. They tend to move around a lot even within very short periods of time. There are significant investment risks as currency fluctuations may move against you, causing you to lose money.

Less Regulation

Exchange rates are very volatile. They tend to move around a lot even within very short periods of time. There are significant investment risks as currency fluctuations may move against you, causing you to lose money.

Forex Currency Trading Scams and Fraud

Due to the popularity of Forex currency trading, and the high volatility, it’s a gold mine for scams. The promise of fast, easy money is the strongest tool that a scammer has.

Forex and Cryptocurrencies are amongst the most popular products chosen by fraudulent entities and scammers.

Offers and advertisements that sound too good to be true probably are. Access the Australian Securities and Investment Commission’s (ASIC) banned or disqualified register if you believe that someone may be conducting foreign currency trading fraud.

Forex Currency Trading Educators

Even the most legitimate of Forex currency trading educators walk the line of miss-representing the risks involved with trading Forex. Focusing very little time discussing risk, and over-selling the benefits.

Worse still are the less legitimate educators that present Forex currency trading to be an engine to make a lot of money quickly.

Do your due diligence on any trading educator or trading mentor to ensure they offer a balanced opinion on trading.

Is Forex Trading Profitable?

Forex currency trading can be profitable, it’s something that many people have done successfully. That’s not so say that it’s not difficult to do and that there aren’t many others who have failed.

In order to be one of the successful traders you will need to have a solid trading strategy. This will include a method to find good trades as well as risk management techniques to manage those trades.

It is also a good idea to have a fundamental understanding of the economy and the factors that affect currency prices.

Forex Day Trading

Forex day trading is popular with traders who are trading with a small account. The Forex markets are more accessible and easier to day trade than some of the others which suit smaller traders.

The liquidity and volatility available allow traders who are Forex Day Trading to make quick trades and therefore spend less time with funds at risk in the markets.

You should note that Forex Day Trading is a very risky form of trading, it’s advised to only trade what you can afford to lose, and have a strong understanding of risk management.

What is Forex Day Trading?

A Better Way To Trade Currencies

While Forex currency trading is highly popular, we believe there is a much better way to trade currencies.

Trading currency pairs via Day Trading Futures provides the same access to the asset i.e. currencies, but has many benefits to Forex currency trading.

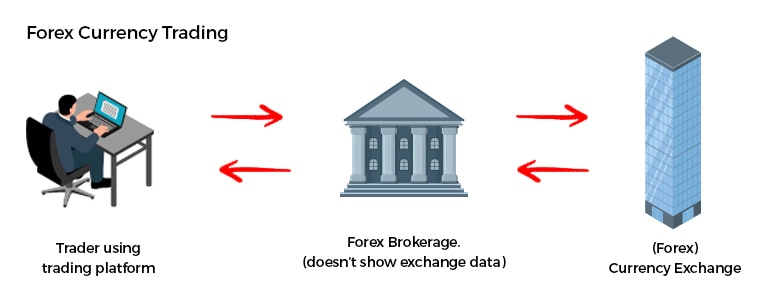

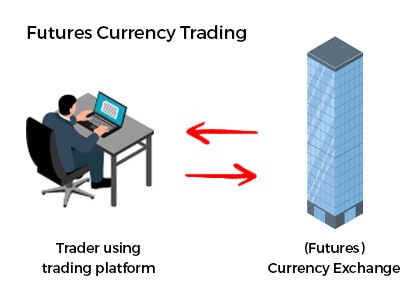

Importantly, Futures trading is not an Over The Counter (OTC) product. This means that unlike Forex currency trading, Futures Currency markets are not traded via OTC brokers. Futures are traded directly through an exchange.

What’s the difference?

An OTC broker receives data about price from an exchange and then provides their own price to the trader. This will be the exchange price plus what they decide the spread should be. There are no regulations surrounding how spread is added.

Trading through an OTC broker means that the trader places trust in the information that is provided to them by the broker.

Trading currencies via the Futures markets allow traders to get the true price directly from the exchange. The broker in this situation merely checks if the trader has enough funds, and handles order executions.

Everything that the trader sees is the same as everyone else connected to that market sees, regardless of the broker provider.

Many of the same risks exist in Futures Currency trading as do with Forex currency trading, including leverage, volatility, and exchange rate fluctuations.

However, the benefits are that the Futures markets are far more transparent and fair for traders of all sizes. Institutional traders and banks have no benefits that individuals don’t.

Not only that, the Futures markets also offer traders the most diversity when it comes to what assets can be traded. Futures traders can access Stock Market indices like S&P500, Commodities like Gold, Currencies, Cattle, Grain, and many more.

Forex Currency Trading Bottom Line

Forex currency trading is a complex and risky investment, as is currency trading via the Futures markets. However, with the right trading strategy including risk management techniques, it can be profitable.

By now you should have an understanding of the benefits of trading currency Futures vs Forex currency trading. The act of trading is very similar, but there are some real benefits when it comes to transparency and a level playing field.

If you’re interested in learning more about Futures Trading you should check out our Free Trading Web Class.

![Forex Currency Trading Alternative [A Better Way To Trade Currencies] 1 forex currency trading alternative - a better way to trade currencies - blog feature image](https://idta.com.au/wp-content/uploads/2023/01/forex-currency-trading-alternative-a-better-way-to-trade-currencies-feature-image.jpg)

![What is Scalping Trading [is it Illegal in Australia?]](https://idta.com.au/wp-content/uploads/2023/05/scalping-trading-is-it-legal-in-australia-500x383.jpg)

![What Are Indices [A Guide To Indices Trading]](https://idta.com.au/wp-content/uploads/2023/04/what-are-indices-a-guide-to-trading-indices-500x383.jpg)