Introduction to Commodity Trading

Commodity trading is an interesting and potentially lucrative venture. It involves the buying and selling of raw materials or products known as commodities.

Commodities can range from metals like gold and silver, to agricultural products, such as wheat and corn and more. Commodities also cover energy resources like oil and natural gas and much more.

The commodity market allows traders to speculate on the price movements of these commodities with the aim of making profits.

In this guide to commodity trading, we’ll explore the fundamentals, and why it is an attractive investment option. You’ll also learn how to get started with commodity trading.

What are Commodities?

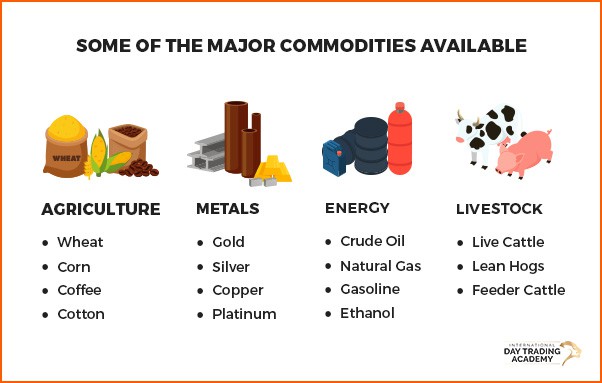

Commodities are tangible goods that have value and can be exchanged for other goods or money. They are typically categorized into four main types: energy, metals, agriculture, and livestock.

Energy commodities include oil, natural gas, and electricity. Metal commodities consist of gold, silver, copper, and platinum, among others. Agricultural commodities include wheat, corn, coffee, cotton, and more. Livestock commodities encompass live cattle, lean hogs, and feeder cattle.

Commodities are an essential part of our daily lives, and form the building blocks of our global economy. They are used in various industries, such as manufacturing, construction, and agriculture.

Population growth, economic development, and geopolitical events all affect the demand for commodities. As a result, commodity prices can be highly volatile, presenting opportunities for traders to profit from price fluctuations.

Why Trade Commodities?

Commodity trading offers several advantages for both individuals and institutions.

One of the primary reasons to trade commodities is diversification. Investing in commodities can help spread risk by adding a different asset class to a portfolio. The assumption is that commodities may perform differently than traditional stocks and bonds. This diversification can help reduce the overall volatility of an investment portfolio.

Another advantage of trading commodities is the potential for substantial profits. The commodity market is volatile, which can result in significant price movements within short periods. Traders able predict these price fluctuations can generate substantial profits.

Understanding the Commodity Market

The commodity market is a complex and interconnected global marketplace. Where traders and investors from around the world buy and sell commodities. It consists of two main types of traders: hedgers and speculators.

Hedgers are participants who use the commodity market to manage or offset their price risk. For example, a farmer might use the commodity market to lock in a price for their crops before they are harvested. This is done to protect against potential price declines.

Speculators, on the other hand, are traders who aim to profit from price fluctuations. Speculators purely trade price and aren’t interested in physical delivery of the commodity.

Commodities are traded on various exchanges around the world. The largest being Chicago Mercantile Exchange (CME), and the New York Mercantile Exchange (NYMEX).

These exchanges provide a regulated platform for trading commodities. This ensures transparency and fair trading practices.

In addition to exchanges, there are also over-the-counter (OTC) markets with access to commodities trading. This is done between two parties without the involvement of an exchange. OTC markets are far less regulated than exchange traded commodities.

To trade commodities, it’s essential to understand the factors that influence their prices. Supply and demand, global economic conditions, geopolitical events, are just a few factors that can impact commodity prices. Traders need to stay informed about these factors to make informed trading decisions.

Commodity Trading Basics

Before diving into commodity trading, it is crucial to grasp the basics of how the market operates. One of the primary instruments for trading commodities is futures contracts.

A futures contract is an agreement between two parties to buy or sell a specific quantity of a commodity at a predetermined price and date in the future. These contracts are standardised and traded on exchanges.

Futures trading allows traders to speculate on future price of a commodity without owning the physical asset. For example, if a trader believes the price of oil will increase in the future, they can buy a futures contract for oil at the current price. If the price of oil rises as predicted, the trader can sell the contract at a higher price, thereby making a profit. If the price of oil falls, the trader will see a loss.

Another important concept in commodity trading is leverage. Leverage allows traders to hold larger positions in the market with a relatively small amount of capital. This amplifies both potential profits and losses. Traders should manage leverage and set appropriate risk management strategies to protect capital.

How to Get Started with Commodity Trading

Getting started with commodity trading requires a systematic approach and careful consideration. Here are the steps to embark on your commodity trading journey:

Educate Yourself:

Learn the basics of commodity trading, including market dynamics, trading strategies, and risk management. There are many resources available to help you gain the necessary knowledge.

Choose a Commodity to Trade:

Select a commodity that aligns with your interests and trading goals. Consider factors such as liquidity, volatility, and market fundamentals when making your choice.

Select a Trading Platform:

Choose a reliable a trading platform that offers commodity markets. Ensure that the platform provides real-time market data, and advanced charting tools.

Open a Trading Account:

Once you have selected a trading platform, open a trading account with a reputable broker. Provide the necessary identification documents and fund your account with an initial deposit.

Develop a Trading Plan:

With your trading goals, risk tolerance, and trading strategies in mind, create a trading plan that reflects these. A well-defined trading plan can help you stay disciplined and make informed trading decisions.

Start Trading with a Demo Account:

Most platforms offer demo accounts that allow you to practice trading without risking real money. Use a demo account to familiarise yourself with the platform and test trading strategies.

Begin Trading with Real Money:

Once you feel confident in your trading abilities, start trading with real money. Start with a small account, increase position size as you reach consistent profitability.

Commodity trading involves risks, and it’s essential to approach it with caution and discipline. Educate yourself, adapt to market conditions, and refine your trading strategies. This will help to improve your chances of success.

Commodity Trading Strategies

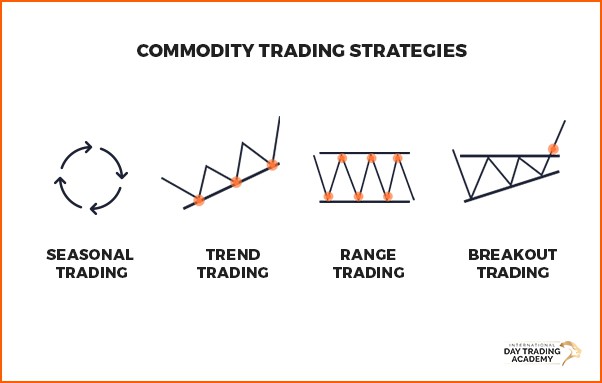

Commodity traders use various strategies to maximize their profits and minimise their risks. Here are a few popular commodity trading strategies:

Trend Following:

This strategy involves identifying and capitalizing on trends in commodity prices. Traders following this strategy aim to buy commodities in an uptrend and sell commodities in a downtrend.

Seasonal Trading:

Seasonal trading takes advantage of recurring patterns in commodity prices. Certain commodities, such as agricultural products, exhibit seasonal price fluctuations. This is due to factors like planting and harvesting seasons.

Range Trading:

Range trading involves identifying price levels at which a commodity tends to trade within a range. Traders who using this strategy buy commodities near the lower end of the range and sell near the upper end.

Breakout Trading:

Breakout trading involves identifying key support and resistance levels and entering trades when the price breaks out of a range. Traders who use this strategy aim to capture significant price movements.

It is important to note that no strategy guarantees success in commodity trading. Traders should adapt their strategies to changing market conditions. Traders should evaluate their performance frequently.

Risks and Challenges in Commodity Trading

Commodity trading, like any other form of investment, carries inherent risks and challenges. Here are some of the key risks and challenges to be aware of:

Price Volatility:

Commodities are known for their volatility, which can result significant price fluctuations. Traders need to be prepared for price swings and have risk management strategies in place to protect their capital.

Supply and Demand Factors:

Commodity prices are influenced by various supply and demand factors. Traders need to stay informed about these factors and their potential effects on prices.

Leverage and Margin Risks:

The use of leverage in trading commodities amplifies both potential profits and losses. Traders need to use the appropriate amount of leverage according to their plan. Traders should always set appropriate stop-loss orders to limit losses.

By knowing these risks and using proper risk management, traders can trade the commodity market more effectively.

Commodity Trading Regulations and Organizations

Commodity trading is subject to regulations imposed by various regulatory bodies and organizations. These regulations aim to ensure fair and transparent trading practices.

One prominent regulatory body is the Commodity Futures Trading Commission (CFTC) in the United States. The CFTC regulates commodity futures, investigates fraudulent activities, and ensures market integrity.

There are also several organizations that facilitate and promote commodity trading. For example, the London Metal Exchange (LME) is a key organization for trading base metals. The Chicago Board of Trade (CBOT) is an exchange for trading agricultural commodities. These organizations provide a regulated platform for trading commodities. They establish rules and standards for market participants.

Tips for Successful Commodity Trading

To increase your chances of trading commodities effectively, consider the following tips:

Educate Yourself:

Educate yourself about the commodity market, trading strategies, and risk management techniques. Stay updated with the latest news and developments that can impact commodity prices.

Start Small:

Begin with a small account after practising on a demo account. This approach allows you to manage risks effectively and learn from your trading decisions.

Set Realistic Goals:

Set goals and develop a trading plan that aligns with your risk tolerance and financial objectives. Avoid setting unrealistic expectations and be patient with your trading journey.

Use Stop-loss Orders:

Implementing stop-loss orders allows a trader to limit potential losses. Determine the maximum amount you are willing to lose on a trade and set stop-loss orders accordingly.

Practice Risk Management:

Incorporate risk management techniques into your trading plan. This includes diversifying your portfolio, setting risk limits, and utilising appropriate position sizing.

Keep Emotions in Check:

Emotions can prevent a trader from making logical. Follow your trading plan, and maintain discipline in your trading to avoid making emotional decisions.

Learn from Mistakes:

Trading is a learning process that continues even as you become proficient. Analyse your trading decisions, both successful and unsuccessful, and learn from them. Continuously refine your trading strategies based on your trading successes and mistakes. A good way to do this is to keep a trading journal and reflect on regularly.

Commodities Trading Bottom Line

Commodity trading offers an exciting opportunity for investors to take part in the global marketplace. It provides a potential to generate profits by speculating on the price movements of various commodities.

By learning a trading strategy, and managing risk, traders can trade commodities more effectively.

It is important to remember that commodity trading involves risks, and traders should approach it with caution. Always show discipline, and embark on continuous learning. With the right knowledge and approach, commodity trading can be a rewarding and profitable venture.

If you’re interested in learning how to day trade futures, you might consider taking one of our trading courses for beginners.