In a falling market, short trading allows a trader to still find opportunities to make money, if they are astute and nimble. In this article, we’ll explore some short trading strategies that can help you capitalize on opportunities.

What is Short Trading?

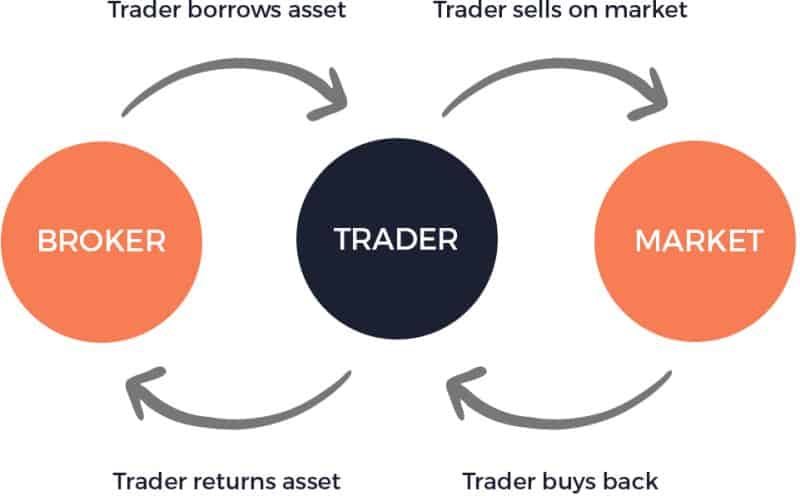

Short trading is when a trader borrows shares or other asset from a broker and sells them. This is done with the expectation of being able to buy them back at a lower price later. The trader then has to deliver the asset back to the broker once bought back.

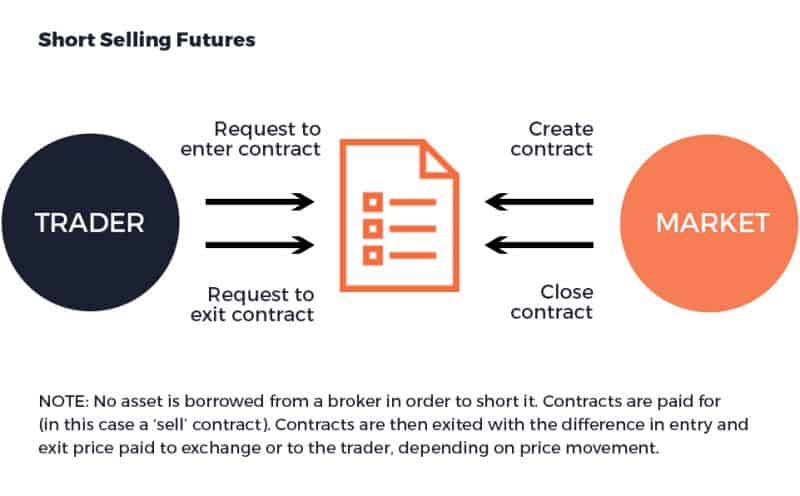

In Futures trading, short trading is simply the purchase of a “sell contract”. The contract is an agreement to pay the difference between entry price and exit price. If price goes up, the trader receives a loss, if the price goes down, they make a profit.

Short selling is one of a few bear market trading strategies, it allows investors to profit from falls in price.

Long vs Short Trading

As well as short trading, traders are able to take long trades. Long and short trading are at the opposite ends of the spectrum. Where short selling profits from a decline in price, long trades profit from a rise in price.

When it comes to long vs short trading, there is no one better than the other. The best strategy is actually to trade both long and short to maximise opportunities. Being able to trade the market in both directions allows a trader to find more opportunities, and to trade more market types.

In using a long and short trading strategy means you have opportunity when the market goes down and well as up.

What is a Bear Market?

A bear market is one in which sentiment is negative and price is falling. Alternatively, a market in which price is rising is called a bull market.

Strictly speaking a bear market is when price falls by 20% or more from the 52 week high, or from recent highs. A bear market is generally marked by investor pessimism. This can cause prices to continue falling, adding to further negative sentiment.

Note that the price drop is a sustained one, typically 2 months or more. Bearish markets tend to mirror overall economic downturns or negativity. A downtrend lasting for fewer than 2 months can be considered a correction.

Bearish markets are associated with stock indices such as S&P500, NASDAQ, etc, but commodity, and currency markets can also be bearish.

Day Traders aren’t concerned whether it’s a bear, or bull market. We can go short or go long in both environments. We’re more focused on picking the turns in the market and finding the micro trend up or down.

Bear Market Trading Strategies

Besides short selling, there are bear market strategies where you can seek to profit from a falling market.

A bear market trader might view the market as an opportunity to build a portfolio of “value stocks” at a good price.

This strategy is “buying the dip” it’s used to enter at value prices, or to dollar-cost average existing positions

Trading dividend stocks is another bear market strategy. A dividend stock is one that pays a certain percentage to investors at scheduled dates. The dividend paid by the company may assist in hedging the drop in the price of the stock.

With day trading Futures, things are a little simpler.

Rather than worrying about open positions, hedging, buying dips, a short seller purchases sell contracts. If correct, and price falls, they profit.

How to Execute a Short Trade

The very first thing you need to do is consider both fundamental and technical analysis on the asset you want to trade. It’s important to identify a good trade and to have a solid thesis as to why it’s a good trade.

In performing technical analysis you will first need to know how to read candlestick charts. Candlestick charts are used to display price movement of a given market or asset. These charts begin to produce patterns over time, based on historical data. These chart patterns help predict where price will move.

Now that you have identified the short trading opportunity, these are the steps in executing.

For Stocks, Commodities, Forex etc:

- Borrow the stock/asset from your broker

- Immediately ‘sell’ the asset on the market

- Monitor and manage risk for your open trade

- If price drops you can buy it back cheaper than you borrowed it for

This results in profiting from the difference between the price you borrowed at, and the price you bought the asset back at. If you were wrong you would eventually have to return the asset to the broker by buying back at a higher price.

For Futures:

- Buy 1 or more sell contracts on your chosen market/asset

- Monitor and manage risk for your open trade

- If price drops you can exit and receive funds to the value of the contract at its current price

If you’re wrong in your prediction you will exit the trade and will be receiving funds to the reduced value of the contract.

What are the Rewards of Short Trading?

In a bearish market, short selling is one of the only ways of profiting from the market. Where there is a downward trend across markets it is difficult to find long trades.

In a bearish market the trend is strong, so when price falls, it does so quickly. This means that if the bear market trader chooses the right direction, they could see a larger return on a smaller investment.

Another way to use short selling is to hedge against long positions. For example, you may be holding socks that are falling in price, shorting provides the opportunity to balance the losses. If you think that price will continue down, you could seek to make money on the short. You do this to balance the loss on your long position.

What are the Risks of Short Trading?

So far I’ve made being a short trader sound pretty good, but there are downsides. Short trading is an excellent way to increase the opportunities available in the markets, but it’s not without it’s risk.

Short selling technically has “unlimited risk” because there is no gauge to how high price can go. Contrasted with long trading where risk is limited to the asset reaching 0 value. This is why it’s important to use a stop loss in your trading to limit your risk.

With derivatives such as Futures and Options, there’s risk of losing more that 100% of your account. Your broker might exit you from the trade when you don’t have enough margin to remain in a trade.

In the context of short selling individual stocks, the risks can apply to the companies themselves. If there is enough short selling of a stock it can send a company into bankruptcy.

Managing Risk in Short Trading

As mentioned earlier in this article, short selling has unlimited risk. It’s therefore important to make sure that you manually control your risk in any short trade.

The way in which you control your risk is to use a stop loss. A stop loss is a pre-defined price that you set in your trading platform that exits if reached. You set the limit to how much you can lose, once the price is reached, your platform exits you from the trade.

You should also set a reasonable take profit. This is similar to a stop loss, but is your profit target for the trade. As with a stop loss, when this price is reached, you exit the trade.

You should be using a risk management system in trading, whether long or short.

Is Short Selling Legal in Australia

Yes, short selling is legal in Australia. Both institutional traders and retail traders (individuals) have access to short short selling.

Naked short selling is not legal. This is where the short trader places a trade without a lending agreement with a 3rd party. In order for short selling to be legal in Australia, the stock must be borrow before entering the order.

This again doesn’t apply for derivatives like Futures because the underlying asset is never held. Futures traders purely buy and sell contracts that derive value from an underlying asset.

Activist short selling is also not legal in Australia. This is the process of shorting a financial product, then releasing disseminating information publicly.

As long as your short trade is aboveboard, it’s absolutely legal to short sell in Australia.

Bottom Line

Being a short trader can be a profitable way to trade in a declining market, but it is not without risk. You can’t short sell because prices everywhere look like they’re falling. You need to know what you’re doing.

All the principles and required skills apply to short trading. You will need to know how to go about finding high-probability trades. You’ll also need to have strong risk management skills and a grasp of trading psychology.

If you’re interested in learning more about short trading, check out our day trading for beginners course.