Risk management in intraday trading is a huge part of a successful trading strategy. You could be the world’s best trader when it comes to technical analysis, but sometimes the market doesn’t move the way you want it to. What happens when risk is an afterthought in this scenario?

The simple fact is that there is no trader on this planet that picks winning trades 100% of the time. The best traders understand this, and have a set of contingency plans in place to address this. Risk management in intraday trading can be the difference between being a great trader or being a failed trader.

What is a Risk Management System in Trading?

For the beginner trader it may seem that making money trading is simple, all you need is a strategy and some technical skills. This is a good start, but a crucial component of being a successful trader is employing an effective trading risk management system.

What I’ve noticed in my years of teaching is that there’s a reluctance to learn risk management in intraday trading. There seems to be a want to focus on the technical aspects and the risk management skills fall by the wayside.

I will say that this does not surprise me. People want to learn the skill that helps you find the trades that could make you money. People don’t want to think about the potential of losing money.

Trading is a high-performance activity and you should treat it like a business. People who look to perform at their highest are risk managers.

Let’s have a look at some of the intraday trading risk management techniques for beginner

Accepting Losses is Part of Trading Risk Management

A supermarket, or any shop that sells a physical product, has a special type of risk. This risk is called a carrying cost, this is the money tied up in purchasing and holding stock on shelves. The risk remains until that item sells. Because stock needs to be on shelf at all times, this risk always exists.

The supermarket has the risk of losing that carrying cost if an item is not sold before its expiry date.

You already know what the supermarket will do when there is stock on hand that is nearing its expiry. They run the risk of having to throw away stock that does not sell before the use by date. Knowing this, they reduce the price of the product to attempt to make the sale. They do this knowing that they are either cutting profit, or more likely taking a loss on the sale.

Why are they happy to take a loss? Well, taking a small loss on the sale of an item is far better than making no money off of the item. Any item that never sells will be a 100% loss on the cost price. If they are able to sell the product for even 50% of the cost price, they have bettered their return by 50%.

So how do we relate that idea to trading risk management?

The same thing will happen to a trader if they hold a position (open trade). As long as the trade is open the trader has a risk of running a loss.

📖 Read More: Most Traders Lose Money; 12 Common Mistakes To Avoid

A trader should seek to take an acceptable loss in a similar way. A classic mistake beginner traders make is holding onto a position in the hopes that it will turn around. What they should do is take the loss.

Holding onto that open position is like a supermarket not selling their product in time. You heighten your risk if you do not accept the loss.

With trading, not any trade that becomes unprofitable should be immediately exited. You should allow some wiggle room for price to correct itself. Every trade you take will have both a volatility and expected time duration. Use these expectations to determine if a trade is worth keeping or if it needs to be closed.

A good trader will have an acceptable loss in mind before they place a trade. Most likely they will also set this on their trading platform when placing the trade. This price level is a “Stop Loss”.

Types of Risk Management in Day Trading

Day trading, with its fast-paced nature and frequent trading decisions, involves inherent risks. Effective risk management strategies are essential to protect your capital as you seek sustainable trading success.

Here are some key types of risk management in day trading you should consider if wanting to embark on your day trading journey:

- Position Sizing: This risk management technique involves determining the size of each trade relative to your account balance. It helps control the amount of capital at risk on each trade. A common approach is to risk no more than 1-2% of your total trading capital on a single trade.

- Stop Loss Orders: A stop loss order is a predefined price level at which you will exit a losing trade. Placing a stop loss helps limit potential losses and ensures you don’t let a losing position run out of control. Setting stop loss orders is a crucial part of risk management in day trading.

- Take Profit Orders: In addition to stop loss orders, take profit orders specify a price at which you will exit a winning trade. These orders lock in profits and prevent you from getting greedy and holding on to a profitable position for too long.

- Diversification: Diversifying your trading portfolio by trading multiple assets or instruments can help spread risk. A single losing trade won’t have as significant an impact on your overall capital if you have a diversified portfolio. This is especially true for stock and option traders, it has less effect on futures traders who have more flexibility in different market conditions.

- Risk/Reward Ratio: Calculating and adhering to a favourable risk/reward ratio is vital. A common rule of thumb is to aim for a risk/reward ratio of at least 1:1, meaning you are willing to risk $1 to potentially make $1. This ensures that winning trades are of a minimum equal risk to reward. Most professional traders will tell you the best risk reward ratio for day trading is 1:2 risk to reward. Aim for 1:2 if the trade setup allows for it, or as near to it as your strategy dictates. By having lower risk vs your reward, you can offset potential losses.

Advantages of Risk Management in Day Trading

Effective risk management in day trading offers numerous advantages:

- Capital Preservation: The primary goal of risk management is to protect your trading capital. By limiting losses and managing risk, you can preserve your capital for future trading opportunities.

- Emotional Control: Risk management strategies help you maintain emotional discipline. Knowing that you have predefined exit points reduces the temptation to make impulsive decisions based on emotions. Trading is gambling once emotion takes over.

- Consistency: Implementing consistent risk management practices allows you to approach each trade with a structured plan. This consistency can lead to more predictable and stable trading results.

- Long-Term Sustainability: Effective risk management is essential if you want long-term success in day trading. It helps you limit the damage a series of losing trades can pose, rather than have them wipe out your account. This gives you the opportunity to learn from mistakes and improve your trading strategy over time.

- Improved Decision-Making: By having a risk management plan in place, you can make more rational and objective decisions during volatile market conditions, reducing the likelihood of impulsive errors.

What Is Hedging in Risk Management?

Hedging is a risk management strategy employed by traders and investors to protect themselves against adverse price movements in an asset. While it is more commonly associated with longer-term investments, it can also be used in day trading to mitigate risk.

Here’s how hedging works in risk management:

- Long and Short Positions: In day trading, a trader can open two opposing positions – long and short – on the same asset. For example, if you hold a long position on a stock, you can open a short trading position in the same stock or a related one. This way, if the market moves against your long position, your short position can offset some of the losses.

- Futures and Options: Another way to hedge in day trading is by using futures or options derivatives contracts. An example of this is you can buy put options to protect your long stock positions. If the stock’s price falls, the put options will increase in value, offsetting some of the losses in your stock holdings.

- Diversification: Diversifying your trading portfolio across different assets can also be a form of hedging. When one asset performs poorly, others may perform better, reducing the overall impact of any potential losses.

Hedging can be a useful tool in day trading to manage risk, but it should be approached with caution. It adds complexity to your trading strategy and may have associated costs, such as option premiums. Therefore, it’s essential to understand the mechanics of hedging thoroughly before implementing it in your day trading activities.

Using a Stop Loss in Intraday Trading Risk Management

As mentioned, a stop loss is entered into your trading platform when executing a trade. A stop loss does exactly that, it stops further losses. This is achieved by the stop price being reached which triggers and automatically exits you from the trade.

Setting a stop loss is not about picking an arbitrary point, there is more to it if you want to set an effective stop loss. You want to pick a point in price that is far away enough from the current price so that you don’t exit the trade too soon. You also don’t want to set the stop too far away and risk more than you need to.

If you’ve done your technical analysis you should already know where support and resistance levels are. Take our Essential Futures Trading course if you want to learn about technical analysis.

Traders will often place their stop loss right below a support level when taking a trade long. This is because the support price is a known price that is difficult to break. Doing this allows the trade to make a reversal off the support which would see price go up toward being profitable.

A break of support would indicate price moving even further and creating a much larger loss. At this point the trade is unlikely to be profitable, so you should cut your losses and exit.

If you set the stop too close to support you could trigger the stop before you needed to. It’s a heart-breaker to see a trade hit your stop loss and then rocket up higher. You should place the stop below support, not too close, not too far. This ensures that if price does break below support, you’ll limit your loss. You’ll also avoid being stopped out if price is only testing the support level.

If you are able to limit your losses using a stop loss you will be able to keep losses small. The benefit of this is that your winners should be bigger than your losers.

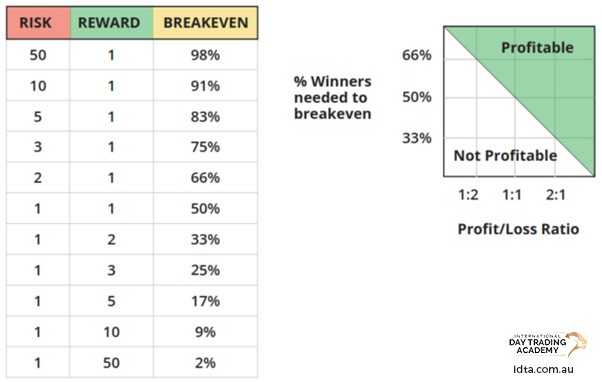

This means that you can have a lower percentage of winners compared to losers to be profitable. If your losses are around the same size, or god forbid larger than your wins, you need to pick winning trades much more often than not.

Leveraged Trading Risk Management

Trading with leverage can amplify gains — but it also magnifies losses just as quickly. That’s why managing risk becomes even more critical when using borrowed capital. Without a solid risk management plan, it’s easy to blow up a small account with just a few poorly managed trades.

To use leverage effectively, traders must carefully control position sizing, set precise stop-losses, and avoid overexposure. Leveraged trading rewards discipline, not aggression.

Day Trading Risk Management & Using Take Profits

A good trader plans each trade before they place it. They will consider their entry point, stop loss, and their take profit (profit target).

A take profit is like a stop loss in that it is a predetermined price that will force an automatic exit of the trade. Rather than exiting the trade to avoid further loss, a take profit will allow a trader to lock in their profits and exit. Traders refer to a take profit as their profit target or trade target.

It may sound counterintuitive at first to exit a trade while it is making a profit, but there is good reason. Whatever market you’re looking at, there will be levels of resistance. Resistance is a point in price that is historically difficult to break.

Because the markets move in patterns, support and resistance levels are easy to spot once you know how to read a a candlestick chart.

If you fail to set a take profit you run the risk of hitting a resistance level and seeing price move against you. When you do this, you are giving your profits back to the market. It is always best to set your profit target and let your profits run until you reach the target. If you do this you will have a better chance of maximising your profits.

Risk to reward ratio

A risk reward ratio for day trading is the difference between the amount of risk in a trade (where you place your stop) and the potential profit (your take profit). If you have a risk to reward ratio of 1:1 you would need to be correct 50% of the time to break even (assuming all trades are of the same size). You want to have a higher reward compared to risk for each of your trades. The higher the reward compared to risk the less accurate you need to be in order to still be profitable.

In the table below you can see, the higher the reward compared to risk, the less often you need to have a winning trade. Of course, you need to be realistic and find a balance. You’re extremely unlikely to hit your target if it is 50 times larger than the level of risk. You will be stopped out almost every time.

So, what is the sweet spot for your risk to reward ratio?

It depends a little on what your strategy is, and what your risk tolerance is. But, your reward should be greater than your risk in each of your trades. Many traders say that anywhere between 1:1 and 1:2 is where you should be looking to place your risk to reward, the closer to 1:2 the better. Base your risk to reward on your own risk appetite, your trading plan, and the trade setup.

Creating your risk profile

You should always understand what your risk profile is before you start trading. Your risk profile will dictate the amount of risk you are willing to take on when trading. Once you decide on your risk profile you must always ensure that you trade within that profile.

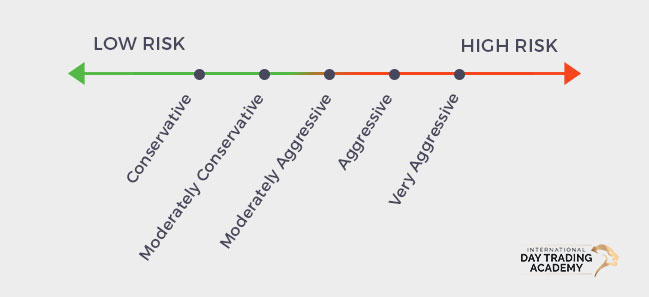

People are different, some are risk takers, others are very conservative. A risk taker will be someone who is happy to accept more risk to make a higher return. A conservative trader will accept a lower level of risk for a lower return.

Someone who has a conservative approach to trading will seek to slowly grow and compound their account. A risk taker will seek the highest return possible and is happy to see their account size see large swings in profit and loss.

For those who are starting out, or those that are trading a small account, it is always best to take a conservative approach to limit losses.

It’s important to understand that seeking high returns will involve a higher risk than a more conservative approach. If you are someone who wants to grow an account very quickly you will need to be willing to accept that risk. If you’re unwilling to accept that risk, be conservative in growing your account.

A trader, or investor will find themselves somewhere along the graph below. Note that the more aggressive the approach the higher the required risk. If you are someone who wants high returns, you will find yourself on the right hand of the scale. You will need to accept any risk that comes with that approach. Someone who is more interested in capital protection (limiting losses) would gravitate to conservative strategies.

Setting your risk profile

You already know yourself whether you are the type to take risks, or be more conservative when it comes to money. This accounts for the emotional decision which makes up a large part of your decision. You should consider 2 things when deciding on your risk profile:

Time Horizon: First you need to understand your financial goals and ensure that whatever approach you take to your trading or investing will be achievable. If you are someone who is looking to trade long-term with a horizon of 3-5 years you won’t need to be as aggressive as someone who is looking to make a quick return over say 6-9 months. If you have a short time horizon you may need to consider being more aggressive in order to achieve your goals.

Funds Available: Before you even think about what your risk profile is you should already know how much you intend to invest. The funds that you wish to trade should always be dictated by the amount of funds that you can stand to lose without creating financial stress. That might sound a bit bleak, but it will remove excess fear, or early exit due to needing to access those funds.

📖 Read More: How Much Money Do You Need to Day Trade?

If your funds available are low you cannot take on the same risk as someone who has a much larger account. You should always consider the percentage of your account that you are openly trading at any point in time. Again, you should look to keep this under 2% per trade if you want to limit your risk.

To create your Risk Profile, you need to consider these 3 things:

- Your personality as either a risk taker or non-risk taker

- Your goals for your time-frame and desired return

- Your funds that will be utilised in your trading/investing

How much should you risk per trade?

Of course, how much of your funds to risk depends on what your risk appetite is. Industry standards suggest that it’s best to keep it under 2% per trade. Any time you risk more than 2% of your account balance on a single trade you’re assuming a lot of risk, even for a risk taker.

You should decide on what you feel is an acceptable amount of risk for your trades. That is, always have a number in mind that you feel ok with losing if the trade goes against you.

Keep in mind also that traders with small accounts should make sure that they limit their position sizes enough in order to stay within the margin requirements of the trade.

Day Trading Risk Management for Beginner Traders: The Bottom Line

Although your overall risk management will differ depending on what your risk appetite is, there are some black and white rules that you should follow.

Always have an understanding of your goals and the levels of risk you are happy to take to achieve those goals. If your goals are high growth, you will need to be willing to accept higher risk to achieve that goal.

No matter what your risk appetite is, you will have a trading plan that will dictate your risk to reward ratios, stop loss, and take profits. If your trading plan dictates your decision making you improve your consistency and balance your risk.

Interested in learning more about how to balance risk and reward in day trading as a beginner? Sign up for our Free Trading Class and learn the tools you need to successfully trade the markets.