Day trading for a living can be very profitable and rewarding. However, it is not easy and many people who try end up losing money. Those who are successful have found the “trader’s edge”. Below are some tips for those who want to learn day trading for a living.

Day trade for a living

Day Trading is buying or selling an asset and exiting the trade within a single trading day. An asset can be a stock, commodity, currency, etc.

People who day trade for a living are usually only trading for around 90 minutes per day. Someone who trades for only 30-90 minutes per day is often referred to as a “Lifestyle Trader“. A Day trader will trade the markets up and down seeking a profit. If they think that the price of an asset, will go up, they buy. If they think that price will go down, they will sell. When you sell an asset, you are “shorting the market“.

Think of Day Trading as trading risk for profit. With Day Trading you have the risk of price falling in value, and the risk of price rising in value. You make a profit or loss based on the difference in price from your entry to your exit.

When do full-time day traders trade?

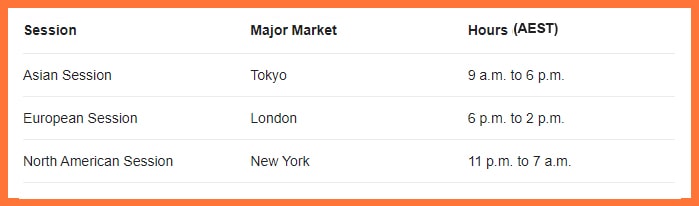

Day trading for a living is actually very flexible when it comes to time. There are many markets that you can trade at different times of the day. Because there are markets open all around the world it means there are a lot of options for when you can trade.

If you are just starting out with day trading you should try to trade during low volume periods. In the morning, late in the day, and after-market hours. During these times the prices are more stable and less volatile.

Types of day traders

There are two ways of categorising people who day trade for a living. You can group them by the amount of time they spend in a trade, and by the market or product they trade.

Time spent in a trade

Traders use a trading chart to measure their trading. The most common chart is a candlestick chart. A candlestick chart can be set to look at a variety of time-frames. A single candle can signify short periods of time, like 1 minute, 3 minute, 5 minute. They can also be set to represent hours, days, weeks, months, years. Day traders tend to focus on minute charts, the most common are 1, 2, or 3 minute candles.

A scalper is a day trader that will look to trade one, or a few candles. A scalper will only be in a trade for seconds or minutes. They will look to take advantage of smaller fast movements.

A position day trader will look to take advantage of a larger movement. Because of this, they will need to stay in the trade a little longer, anywhere between a few minutes to an hour. A position trader will look to have a profit target in mind and stay in the trade until that price is reached. If the trade fails to follow their technical analysis and is likely to not be profitable, they will exit as well.

People who day trade for a living tend not to be in an open trade for more than a couple of hours at most.

Market or product traded

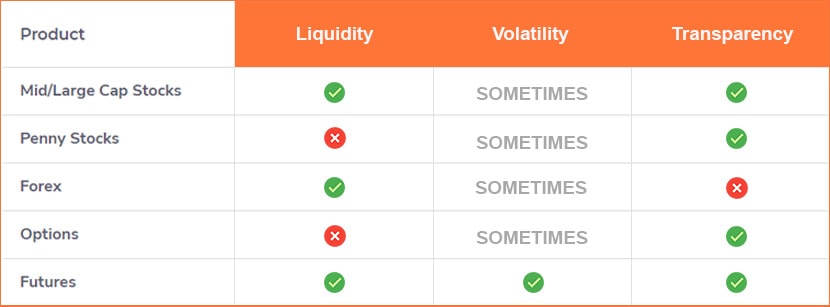

Trading comes in more than just the form of buying and selling stocks, there are many ways you can trade. When talking about product, I don’t mean the asset (stocks, commodities, etc). I’m talking about the type of trading, and there are a few.

Here is a list of some of the types of trading products:

- Standard buying and selling of stocks. Traded on a stock index and involves holding the stock itself.

- Trading Options on stocks. Options are a derivative contract that have a value based on stock price. There are other pricing factors, like time.

- Trading CFDs. CFDs (Contract For Difference) are another derivative. Using CFDs you can trade stocks, commodities like oil and gold, and currencies. Check out CFDs vs Futures for more info.

- Trading Forex. In Forex a trader will buy/sell a currency pair based on whether they believe price will rise or fall. Note forex currency trading can also be done on the futures markets.

- Trading Futures. Futures are yet another derivative. A futures contract derives its value from an underlying asset. This could be a stock index (like S&P500), Commodities, Currency, etc.

The Futures markets are the most diverse when it comes to the assets you can trade. Trillions of dollars are traded on the Futures markets each day.

What is the difference between day trading for a living and other types of trading?

Day traders don’t sit around and wait for the market to move. They jump in and out of the markets in quick spurts looking to take advantage of fast-moving markets. This is one of the benefits of day trading for a living, you don’t need to spend a long time in the market.

Other traders, like swing traders, or long-term investors look for more sustained movements. A swing trader will look to hold an open trade for days, or even months to take advantage of a larger move. Long-term investors hold a position for months or years seeking growth over time.

A Typical Day in the Life of a Full-time Day Trader

Let’s look at a typical day for someone who day trades for a living, that is, no other employment commitments. Day traders usually have a specific market and time that they like to trade. A full-time day trader will also spend some time preparing for their session. A professional day trader will likely trade the first or last 2 hours of a session. This leaves a lot of free time for other things.

Preparing for a session

A day trader will likely prepare for their trading session by reading news. This will help identify anything that may affect market movement.

Day traders that trade stocks or options will likely spend time screening stocks. Screening is a method of looking for good stock opportunities. They will use a stock scanner for specific characteristics that fit their strategy. For those trading products like Futures this exercise is not necessary.

A Futures trader will have one market that they trade and don’t need to find assets to trade.

| Type of Trading | Needs a Scanner |

|---|---|

| Stocks | Yes |

| Options | Yes |

| CFDs | Yes |

| Forex | No |

| Futures | No |

Trading a session

As mentioned earlier, someone who day trades for a living doesn’t spend much time in the market. The time that is spent in the market is hyper focused.

Day trading requires concentration for the full 60-to-90-minute session. You should note that a session may be much shorter if a trader reaches their goal for the session.

To keep your concentration, have a quiet workspace without interruptions. Have a clean desk space, some trading mantras or your trading plan are ok to have at your desk.

If you’re making a living off of day trading, you need to treat it like a business.

Wrapping up the trading session

If you want to trade for a living you should take your trading seriously. You should want to improve where ever possible. You can do this in your post session review. Each trading session a trader will review all the trades placed. They will then add them to their trading journal.

It’s important to document the types of trades made, and whether they were winners or losers. Beyond that, it’s important to note things like, mindset, mistakes, areas for improvement.

Committing these things to a journal will help identify mistakes. A trading journal will allow you to see what is working and what is not. It may not seem important, but if you want to day trade full-time, it is.

The pros and cons of trading for a living

Day trading is a career that can be very profitable for some, where others may lose money. If your system is successful, and you are willing to work, it can provide you with a very lucrative income.

Is day trading for a living right for you? Well, it’s right for some people, and wrong for others. Day trading for a living, as with any job, has its pros and cons.

Pros of trading for a living

- You’ll make your own hours

- Flexibility of hours

- It doesn’t take up a lot of time each day

- Markets are highly accessible with many sessions to choose from

- You can spend more time at home

- You can work from anywhere if you have a laptop, platform, and internet connection

- No commute to work

- No boss

- Short term exposure compared to holding positions longer term

- You are in charge of your risk

Cons of trading for a living

- There’s a high risk of losing your money

- You must be very patient and disciplined

- If you’ve not learned through an academy, you have to be willing to do everything on your own

- You need to be willing to work at it and never give up

- You must be willing to learn from your mistakes

Check out our infographic Trading Full-time vs Running a Small Business

What It Takes to Succeed as a full-time day trader

Not everyone that takes up day trading are successful in doing so. While learning the skill is achievable for most, many struggle with the mindset. If you do want to day trade as a living you need to master the mindset.

There are many factors that make a successful day trader.

- You need to be willing to take risks and live with the consequences

- You need to have a trading strategy that works

- You need to trade with limited emotion

- You need to recognise when you are trading with emotion

- You must be willing to learn from your mistakes

- You must be willing to work at it

- You must be willing to be patient

- You must be willing to put in the time

- You must have discipline

Day traders need to be more organized and disciplined than other traders. Traders who are successful in day trading use a strategy that they follow and stick to it for the long term.

Day trading for a living requires good risk management skills to ensure you don’t lose more than you make.

Someone who successfully day trades for a living will ensure that their losses are smaller than their wins. If you are able to make your losses smaller than your wins you have more room to be wrong sometimes. This also comes down to risk management. A good trader exits trades when the trade indicates it won’t be profitable.

It’s also important to have a trading plan based off of a strategy (the rules that define a good trade). If you have a good trading plan and have the discipline to follow it, then you have a very solid foundation.

Is day trading a good idea?

The answer to this question depends on you.

If you are looking for a flexible, portable business and are willing to put in time and effort, then day trading for a living is a viable career.

If you are looking for the ability to earn a bunch of money, fast, without any hassle, then no.

Day trading for a living can be a great fit for some, but not for others.

When considering whether it is right for you, do your research. You need to understand what’s involved. Be honest with yourself and ask “can I put in the effort to learn and practice this?”.

The risks when day trading for a living

Like any other investment, trading has its risks.

The biggest risk is losing your capital. Before you take on day trading for a living you need to have a strong understanding of a trading strategy. This strategy should not only allow you to find good trades, it should help you manage risk. A trading strategy and risk management system in trading are what give a trader the “trader’s edge”.

Think of day trading for a living being a little like running a casino. Of course, gambling is very risky, and the gambler loses more often than not. Obviously, you don’t want to be the gambler in this situation.

Those that are unsuccessful at trading conduct themselves as the gambler. Those that find success trade as though, they are the “house” that is, they’re running the casino. While the house runs the risk of losing, they have the odds stacked in their favour. If probability falls in your favour, you usually win more often than not. This is what it is like to have the trader’s edge.

The correct strategy and risk management, provides the potential for a profitable day trading business.

The tools needed to trade for a living

There are several tools needed to trade, certainly if you want to trade well. The tools required differ in some cases depending on what you are trading. Below are some examples of the tools that you will need.

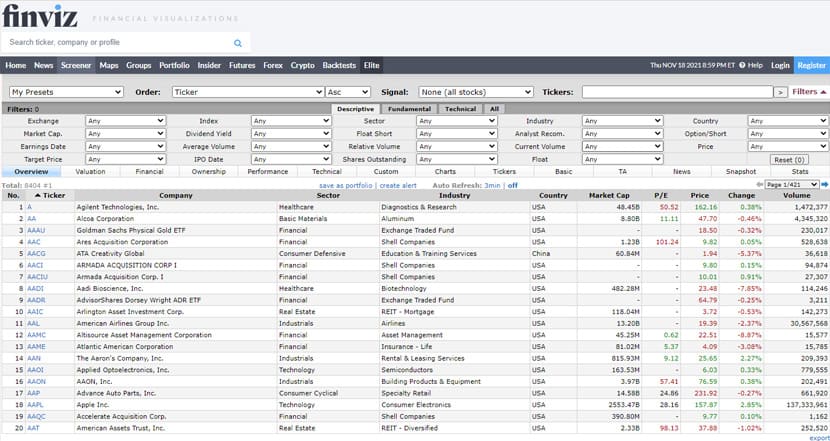

Stock Scanner

Of course, a scanner is only needed if you are trading stocks or options. A stock scanner is an excellent tool used to find trading opportunities. You can input criteria that match your trading strategy. You can look for things like, volume, momentum, you can also find scanners that look for patterns. If you want to trade stocks of options for a living, this is an invaluable tool.

Example of stock scanner, image from Finviz.com

News Source

If news can influence the product or market you trade, it’s useful to be aware of news when preparing to trade. This context can help you with your decision making.

Broker / Trading Account

For almost all types of day trading already discussed you will need a broker. A broker sets price, and sends your orders to the market. The broker will also hold your funds in a trading account.

For Futures traders this isn’t necessary.

You can connect your trading platform to an exchange (market) directly. This means that a broker doesn’t set price, you get the true price from the market. If your platform doesn’t provide the ability to hold funds you will also need to have a clearing house. A clearing house holds your funds and releases them when needed.

Trading Platform

Most brokerage firms offer a free trading platform if you use their services. They do this because they will be able to make money off of commissions and other fees. There are also paid platforms either as a one off or subscription. In most cases these platforms aren’t responsible for brokerage services. These platforms will only perform charting and trade execution.

Trading Journal

As mentioned earlier in this article, it is important to have a trading journal. You can trade without a journal, and maybe even be successful at it. But a trading journal is a must if you want to day trade for a living. A trading journal lets you refine your trading and become a better trader.

How much does it cost to day trade for a living?

This depends on many factors. The market and product you trade is a big factor. Here are some other related costs with learning to day trade and also day trading for a living.

Day Trading Education

This is not what you want to skimp on. The reason being is that if you have a poor education when it comes to trading, you’re likely to lose money.

Consider this; you can pay an educator to learn, or you can learn your own very expensive lesson from the market.

The benefit of in-depth learning is that you have a skill moving forward that has the potential to make you money. If you give your money to the market, you will have nothing to show for it.

Many people try to skip the learning phase and they fail miserably.

Funds To Trade

This again depends on what you’re trading. If you want to be able to day trade products like stocks, or options you will need an account of $25,000.

The Pattern Day Trader (PDT) rule states you can’t day trade with an account under $25,000.

If you trade Forex, CFDs, or Futures you can trade with a much smaller account as the PDT rule doesn’t apply.

Here is how much capital you need to day trade for a living

- Stocks: $25,000

- Options: $25,000

- CFDs: $2,000

- Forex: $500

- Futures: $500

If you do choose to trade a small account you increase your risk per trade, so starting at $500 can be difficult. Some traders choose to start with around $2,000 to $3,000 in a trading account.

Trading Platform (if applicable)

If you’re trading with a broker they may provide you with a free platform, others may need to pay. You need to weigh up the pros and cons of each option. Keep in mind that although a broker may provide a free platform, they will make money from you in other ways.

We use NinjaTrader as they are one of the most awarded platforms for Futures trading. NinjaTrader is a paid platform, we feel being able to connect directly to a market outweighs the cost.

NinjaTrader platform connects directly to the exchange (CME Group)

Can you make a living day trading?

Can you make a living day trading is a very common question that we get. The short answer is yes, but you need to be realistic. The reality is that the vast majority of day traders fail. Those that fail often have the wrong expectations for day trading as a living.

The most important place to start is to consider your goals. When do you expect to be trading a live account? You’ll need to learn a strategy and practice it on a simulated account.

If your goal is to day trade for a living you must treat your trading as a business rather than a hobby.

Those who are in a rush tend to fail.

Remember that when you ask yourself “can i make a living day trading?” If you can’t be patient and don’t take things seriously, the answer will be ‘no’.

How much money can I make day trading?

If you’re day trading for a living the amount you can make depends on a few things. Of course, it will depend on your profit loss percentage. It will also depend on whether you are able to make your winning trades larger than your losing trades.

The larger the account the more room for profit without over risking your account. This means that the dollar amount of your return would be larger than if you had a smaller account.

The answer the question ‘how much money can I make day trading?’ question is that there isn’t a limit to the earning potential. BUT you need to limit your risk and seek a reasonable return. There is also a real risk of losing money. It all comes down to how well you follow your plan and manage your risk.

Tips for beginner traders

Learn a trading strategy that you believe works and learn it inside out. You can do this by practicing the strategy after completing your theory. You can practice this on a simulated trading or “Paper trading” account. This will let you practice your trading without risking any real money.

Don’t start trading with a huge amount of money. Even when you have practiced and you are confident in your trading, start small. Trading a live account is very different to trading a simulation account. Trading live ads all the emotion that you need to control. You might have proved you can trade a strategy but you now need to prove yourself again in a live account.

Risk only a small amount of money until you are happy with your consistency.

Make sure you have a goal for each trading session. This can be a dollar value, or the number of trades you can place, etc.

Don’t keep on trading if you reach your target. If you reach your target and keep trading you risk giving all your profits back.

If you’re having a bad day, or you don’t feel you will be able to concentrate for the session, don’t trade. It’s ok to skip a session and pick things up again in the next session.

Don’t be greedy. Take your time in building your account.

How to make a living day trading – What you need:

If you want to know how to trade for a living, you’re going to need to know what it takes. Below is an outline of what you need so that you actually can day trade for a living.

An education

It’s possible to teach yourself to Day Trade. But self-learning is unstructured, and unsupported. You can also end up with a Frankenstein’s Monster of different techniques and strategy.

When looking at day trading courses, something worth looking for is an educator that have a track record for their strategy. Or you can look for an educator that runs a live trading room. We allow non-members into our trading rooms once per week or on request. This allows us to be transparent in what we do and you can see whether you think the strategy works.

It’s a good idea to learn an existing strategy from a reputable educator.

A trading support channel

A trading support channel is an important part of your trading education. This is because it allows you to have access to an educator throughout your trading journey.

If you’re considering learning to trade look for an educator that provides support. There are many educators out there providing online content with little support. At IDTA we have built a strong support channel and community.

If you want to day trade for a living, it might be a good idea to find a day trade mentor while you’re starting out.

All IDTA content is available forever and support channels are always open for you to use.

Practice your trading

Even if you’re confident in the theory of your trading strategy, it’s important to practice. It’s like learning to drive, you need to have all the skills before you can drive by yourself.

At IDTA we use trading indicators, simulated accounts, and a Live Trading Room. These 3 things combined allow you to practice your trading with guidance.

With a simulated account you can do this without risking any real money in the market. Those who jump into trading after learning a strategy often fail. Having a means of practicing will greatly improve your trading.

A good trading strategy

A trading strategy is a key part of your success as a trader but that doesn’t mean it’s the only part. It’s all about finding the right strategy for your trading style. With so many strategies available it can be hard to tell what is right for you and your trading style.

Here are a few questions to ask yourself when looking for a strategy:

- Does this strategy match the amount of risk I am willing to take?

- Does this strategy have a proven track record?

- Does this strategy fit my lifestyle

- Does this strategy work on the market I want to trade?

- Can I follow this strategy?

If you want to learn more about the International Day Trading Academy’s own trading strategy you can join us for our next free day trading classes online