Trend trading is a popular approach in financial markets. It involves identifying and following market trends to make profitable trades.

This strategy is favored by traders who seek to capitalize on market momentum. It requires a keen eye for trading trend patterns and stock trend patterns.

Understanding what is trend trading is crucial for success. It involves using trend trading indicators to confirm market directions.

Trend following is a related strategy. It focuses on riding the wave of market trends for maximum gains.

Both strategies require discipline and patience, and are applicable across all markets.

In this article, we will explore trend trading and trend following strategies. We will cover how to identify patterns, use indicators, and implement effective strategies.

What is Trend Trading?

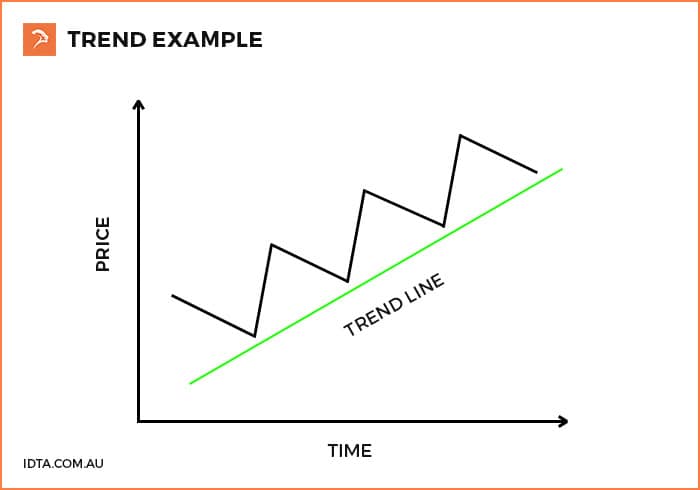

Trend trading is a method focusing on market movements (price action). Traders identify and follow trends to make profit.

This strategy relies on recognizing the market’s prevailing direction. Traders buy in an uptrend and sell in a downtrend.

To succeed, traders must understand trend dynamics. They use technical analysis to identify trends early.

Key elements of trend trading include:

- Identifying trends using indicators

- Entering and exiting trades based on trends

- Adjusting strategies based on market conditions

Effective trend trading requires continuous market monitoring. Traders must be vigilant about changes in trends.

The aim is to maximize gains by catching the entirety of market moves. With disciplined execution and sound analysis, trend trading can be profitable. However, it’s important to remember that no strategy is infallible, and continuous learning is essential.

Understanding Trend Following

Trend following capitalises on existing trends for consistent gains.

Traders utilize trend following to benefit from extensive price shifts. They avoid predicting market directions.

The strategy relies heavily on technical tools. It’s systematic, often involving long-term positions.

Essential aspects of trend following include:

- Identifying long-lasting trends

- Using indicators to confirm trend strength

- Setting stop-loss orders for risk control

This method requires discipline and patience. It’s particularly effective in strong trending markets.

While trend following doesn’t chase instant profits, it aims for substantial long-term gains. It’s suited for those who prefer methodical and less speculative approaches to trading. Mastering this strategy involves learning to trust the process and making adjustments based on evolving market conditions.

Types of Market Trends

There are three primary types of market trends: uptrends, downtrends, and sideways trends. Each type presents different trading opportunities and challenges.

An uptrend indicates rising prices, characterised by higher highs and higher lows. Conversely, a downtrend shows declining prices with lower highs and lower lows. Sideways trends, or horizontal patterns, occur when prices move within a range, showing little directional change.

Types of market trends include:

- Uptrends

- Downtrends

- Sideways trends

Recognising these trends helps traders decide when to enter or exit trades. Properly identifying them can significantly impact trading results. Each trend type requires a distinct approach and strategy to maximize potential profits and minimize risks. Knowing how to react in different market conditions is a crucial skill for any trader.

Trading Trend Patterns: How to Identify and Use Them

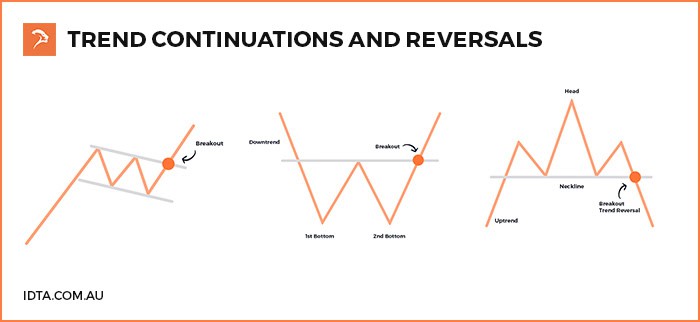

Trend trading patterns play a vital role in helping traders find entry and exit points. They provide clues about potential future price movements by analysing historical data.

Recognising trading trend patterns involves understanding stock trend patterns like head and shoulders, double tops and bottoms, or flags/pennants. Each pattern suggests different potential outcomes based on past market behavior. They either suggest that the trend will continue, or it will reverse and potentially create a new trend.

To identify these patterns, traders often use charts and technical analysis tools. Keeping track of price movements over time can reveal these recurring formations, aiding decision-making.

Key patterns to identify include:

- Head and Shoulders

- Double Tops and Bottoms

- Flags and Pennants

Using identified patterns effectively involves considering the context in which they appear. Traders should combine pattern analysis with other trend trading strategies and trading indicators to confirm signals. This multi-faceted approach increases the likelihood of successful trades by providing a more comprehensive market view.

Key Trend Trading Indicators

Trend trading indicators serve as essential tools for analyzing market trends. Traders rely on them to confirm price directions and make informed decisions.

Indicators help identify when a trend begins, gains strength, or loses momentum. They offer visual representation through charts, enabling quick insights.

Common trend trading indicators include moving averages, MACD, and RSI. Each serves a distinct function in understanding market patterns.

Moving averages smooth out price data, showing overall direction. MACD highlights changes in trend strength and momentum.

RSI indicates potential overbought or oversold conditions, aiding risk management. Familiarity with these indicators can boost trend trading success.

- Moving Averages

- MACD

- RSI

- On-Balance Volume (OBV)

- Bollinger Bands

IDTA has its own trend indicator designed on many market variables, that displays a clear visual of which direction the market is moving.

Image: IDTA Custom-build trading indicator

Choosing the right combination of indicators is crucial. Each market condition may require a different mix for effective analysis. Trend traders can enhance strategies by practicing and refining indicator use.

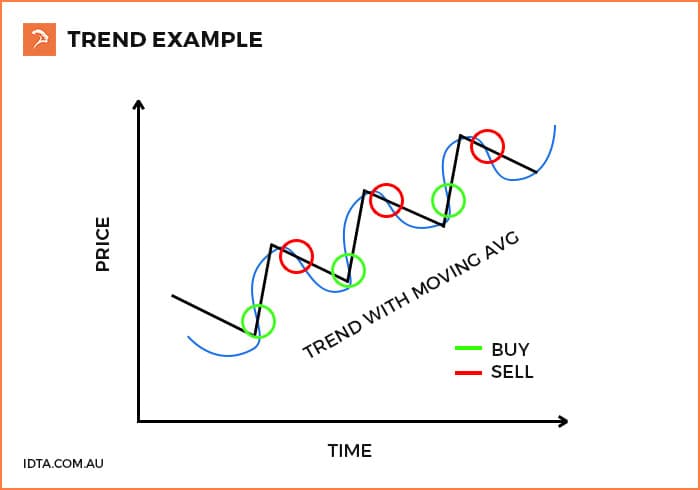

Moving Averages

Moving averages represent average price values over a set period. They help traders identify stock trend patterns and smooth out price fluctuations.

By visualizing trends over time, they offer insights into potential entry and exit points. Common types include the Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Key features of moving averages:

- Smooth price data

- Indicate trend direction

- Assist in spotting trend reversals

MACD (Moving Average Convergence Divergence)

MACD is a trend-following indicator displaying the relationship between two moving averages. It highlights trend strength and momentum changes.

Traders use MACD to spot bullish or bearish divergences, indicating potential shifts. Its histogram reveals momentum insights, aiding timing decisions.

Core elements of MACD:

- Signal line crossovers

- Histogram analysis

- Trend divergence identification

RSI (Relative Strength Index)

The RSI indicator measures the speed and change of price movements. It ranges from 0 to 100, indicating overbought or oversold conditions.

Traders use RSI to identify potential trend reversals or to confirm ongoing trends. It can signal market tops and bottoms effectively when used correctly.

- Overbought/oversold levels

- Divergence signals

- Momentum identification

Other Useful Indicators (OBV, Bollinger Bands, Parabolic SAR)

On-Balance Volume (OBV) links volume with price changes, offering insight into trend strength. It helps spot stock trend patterns based on volume shifts.

Bollinger Bands create price envelopes to capture volatility, suggesting possible entry or exit signals. They adapt to market conditions by adjusting their width.

Parabolic SAR highlights potential reversal points by tracking price or time variations.

- On-Balance Volume (OBV)

- Bollinger Bands

- Parabolic SAR

Popular Trend Trading Strategies

Trend trading strategies aim to harness the power of market trends. They provide a framework for traders to identify entry and exit points.

Different strategies suit different market conditions. While some focus on price breakouts, others capitalize on price retracements.

Successful trend traders often combine multiple strategies. This adaptation enhances performance across varying market scenarios.

- Consider market volatility.

- Understand your risk tolerance.

- Ensure strategy compatibility with your trading style.

Some strategies maintain positions for long durations, while others focus on shorter timeframes. This versatility is beneficial for diverse market types.

When it comes to how to trade effectively, keeping strategies simple and straightforward often yields better results. Complexity can lead to confusion and reduced effectiveness.

- Simplicity over complexity.

- Consistency and discipline.

- Regular strategy reviews.

Breakout Trading

Breakout trading identifies stock trend patterns where prices move beyond support or resistance levels. This indicates a new trend initiation.

Traders aim to enter at these pivotal points, capturing significant price movements. Breakouts suggest heightened market interest.

- Support/resistance levels

- Volume confirmation

- Entry timing

Retracement Trading

Retracement trading involves entering positions during temporary price reversals in a larger trend. It’s about capitalizing on corrections.

Traders seek opportunities when prices pull back within a larger trend, forecasting a continuation. This strategy relies on confirmation.

- Identify trend direction

- Spot retracement levels

- Confirm continuation signals

Range Trading

Range trading applies when price movements fluctuate between defined support and resistance levels. It involves trading the “range” or channel.

This strategy profits from predicting reversals at these levels. Range traders seek stability in non-trending markets.

- Identify range-bound markets

- Use oscillators for confirmation

- Focus on reversal points

News-Based Trend Trading

News-based trend trading relies on market responses to news events. Traders anticipate direction shifts triggered by significant announcements.

Such news includes economic data releases or corporate news. Timing is critical, as reactions often happen quickly.

- Monitor news sources

- Prepare for volatility

- Quick reaction and decision-making

Trend Following Strategy: Rules and Best Practices

Trend following strategies seek to capitalize on existing market trends. These strategies emphasize patience and discipline.

Such an approach often involves holding positions over extended periods. It targets profit from sustained price movements.

- Align trades with the overall trend

- Use stop-loss orders to manage risk

Successful trend followers avoid predicting market movements. Instead, they adapt to market conditions, allowing trends to guide decisions.

- Regularly review and adjust risk management plans

- Leverage technical indicators for trend confirmation

While trend following can be profitable, it requires a strong psychological mindset. Traders must remain unbiased and adaptable.

This strategy also demands an understanding of market dynamics. Continuous learning and experience in trading trend patterns enhance outcomes.

Risk Management in Trend Trading

Effective trading risk management is critical in trend trading. It helps mitigate potential losses and safeguard investments.

Key components of risk management involve setting stop-loss and take-profit levels. These measures provide clear exit points during trades.

Additionally, position sizing plays a vital role. By limiting the amount at risk per trade, traders can protect their capital.

- Defining acceptable loss limits per trade

- Utilizing trailing stops to lock in profits

- Diversifying trading portfolios to spread risk

Traders should continuously monitor and adjust their risk strategies. Market conditions and volatility can change quickly.

Regular assessment allows traders to stay ahead. They can respond effectively to any unforeseen market shifts.

Common Mistakes and How to Avoid Them

Mistakes in trend trading can lead to significant losses. Recognizing and avoiding these errors is essential for success.

One common mistake is overtrading. Trading too frequently can erode profits and increase risk. This is a common theme in our trading mentoring amongst new traders.

Additionally, failing to adhere to a trading plan can be costly. Consistency and discipline are crucial in executing successful trades.

- Avoid emotional decisions and stay focused on the strategy

- Refrain from chasing price movements impulsively

- Regularly review and update trading strategies

Traders should stay informed and continuously improve their skills. Education and practice can prevent costly errors.

Back-testing and Optimizing Trend Trading Strategies

Back-testing is a crucial step for evaluating trend trading strategies. By testing strategies against historical data, traders can assess potential outcomes.

Optimization involves refining strategies for better performance. This requires adjusting parameters to improve results while avoiding overfitting.

- Using diverse data sets to ensure strategy robustness

- Evaluating risk-adjusted returns

- Regularly reviewing and adapting strategies for changing market conditions

A well-optimized strategy can significantly enhance trading success. Continuous refinement and adaptation are key.

Is Trend Trading Right for You?

Determining if trend trading suits you depends on several factors. Consider your risk tolerance and time commitment.

- Are you comfortable with medium to long-term positions?

- Can you handle periods of market volatility?

- Are you patient and disciplined in following strategies?

Reflecting on these questions can help decide if trend trading aligns with your investment goals and trading style.

Conclusion and Key Takeaways

Trend trading offers numerous opportunities for profit through market movements. Understanding trends and employing strategies can maximize your success.

- Identify trends accurately with reliable indicators.

- Implement solid strategies and maintain discipline.

- Manage risks to protect your investments.

Trend trading is not without challenges. It requires a keen eye and continuous learning. Yet, with diligence, traders can unlock its potential for enhancing their trading journey.

If you’d like to learn more about trend trading, consider taking our beginner trading course.

Cameron has over 10 years experience in teaching people how to day trade the futures markets. He has feature alongside the CME Group, and NinjaTrader, and has been published in multiple magazines, including leading trading magazine Your Trading Edge magazine.