Are you watching price charts bounce between the same levels over and over, wondering when the next big move will happen? Breakout trading is one of the most popular strategies traders use to catch these explosive price movements. Whether you’re interested in stocks, futures, or forex, understanding how to identify and trade breakouts can open doors to significant profit opportunities.

In this comprehensive guide, you’ll learn exactly what breakout trading is, how to spot high-probability setups, and the practical steps to execute your first breakout trade with confidence. Let’s dive into this powerful trading approach that both beginners and professionals rely on.

What is Breakout Trading?

Breakout trading is a strategy where traders enter positions when the price moves beyond a clearly defined support or resistance level, typically accompanied by increased volume. Think of it like water building pressure behind a dam. Once the dam breaks, the water flows forcefully in one direction.

In trading terms, when price consolidates within a range, it builds energy. A breakout in trading occurs when buyers or sellers finally overwhelm the opposing side, pushing price decisively beyond established boundaries. This creates momentum that traders aim to capitalize on.

The Psychology Behind Breakouts

Understanding why breakouts occur helps you trade them more effectively. When price reaches a significant resistance level, many traders place sell orders or stop losses at these levels. Similarly, support levels accumulate buy orders. When these levels break, it triggers a cascade effect:

- Stop losses are triggered, forcing traders out of losing positions

- Breakout traders enter, adding fuel to the momentum

- Trapped traders panic, creating additional pressure in the breakout direction

- New trend followers jump in, sustaining the move

This combination creates the explosive price movements that make breakout strategies so appealing to traders looking for quick profits.

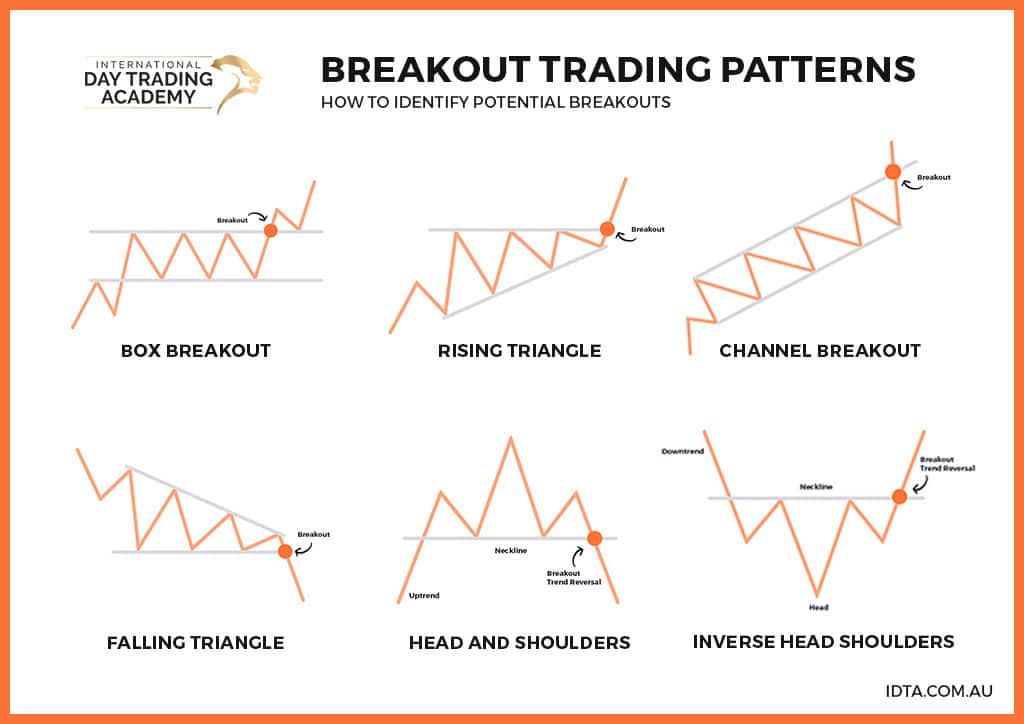

Common Breakout Patterns Every Trader Should Know

Successful breakout trading strategy implementation starts with pattern recognition. Here are the most reliable breakout patterns you’ll encounter:

1. Rectangle or Range Breakouts

This is the simplest pattern where price moves sideways between horizontal support and resistance lines. Once price breaks above resistance (bullish) or below support (bearish), traders enter in the direction of the breakout.

Key Characteristics:

- Clear horizontal support and resistance levels

- At least two touches on each level

- Consolidation period typically lasting several days to weeks

- Volume often decreases during consolidation and spikes on breakout

2. Triangle Breakouts

Triangles form when support and resistance lines converge, creating a tightening range. There are three types:

- Ascending Triangle: Flat resistance with rising support (typically bullish)

- Descending Triangle: Flat support with declining resistance (typically bearish)

- Symmetrical Triangle: Both lines converge (breakout direction less predictable)

3. Channel Breakouts

Channels have parallel trendlines showing price moving in a consistent direction. A breakout strategy for channels involves entering when price breaks through either the upper trendline (acceleration) or lower trendline (reversal).

4. Head and Shoulders Breakout

This reversal pattern consists of three peaks with the middle one being highest. The neckline connects the lows between peaks. When price breaks below the neckline, it signals a potential downtrend, creating a bearish breakout opportunity.

How to Identify Valid Breakouts (and Avoid False Signals)

Not all breakouts lead to sustained moves. Many result in “fakeouts” where price quickly reverses. Here’s how to distinguish genuine breakouts from false ones:

Volume Confirmation

Volume is your best friend in breakout trading. Legitimate breakouts almost always show significantly increased volume compared to the consolidation period. Without volume, treat the breakout with skepticism.

- Strong breakout: Volume increases by 50% or more

- Weak breakout: Volume similar or lower than average

- Confirmation: Check if volume stays elevated for multiple candles after the breakout

Timeframe Analysis

Always check multiple timeframes. A breakout on a 5-minute chart might be meaningless if the daily chart shows price still within a larger consolidation zone. For stronger conviction:

- Identify the pattern on your primary trading timeframe

- Verify the breakout direction aligns with the next higher timeframe trend

- Ensure major support/resistance levels on higher timeframes aren’t nearby

The Strength of the Level

Not all support and resistance levels are equal. Consider:

- Number of touches: More touches generally mean stronger levels

- Age of the level: Older, well-tested levels carry more significance

- Historical significance: Has this level been important in the past?

- Round numbers: Psychological levels like $100, $50 often act as stronger barriers

Step-by-Step Breakout Trading Strategy

Now let’s put theory into practice with a systematic approach to executing your breakout trading strategy:

Step 1: Identify the Pattern

Scan your charts for consolidation patterns. Look for price moving sideways for at least 10-15 candles on your chosen timeframe. The longer the consolidation, the more powerful the eventual breakout tends to be.

Step 2: Mark Your Levels

Draw clear horizontal lines at support and resistance. For triangles and channels, use trendlines to connect the highs and lows. Be precise with these levels as they determine your entry points.

Step 3: Wait for the Breakout

Patience is crucial. Don’t try to predict the breakout direction. Wait for price to definitively break through your marked level with a strong candle close beyond the boundary.

Step 4: Confirm with Volume

Check your volume indicator. You want to see a substantial spike confirming trader interest in the breakout. This is your signal that the move has conviction behind it.

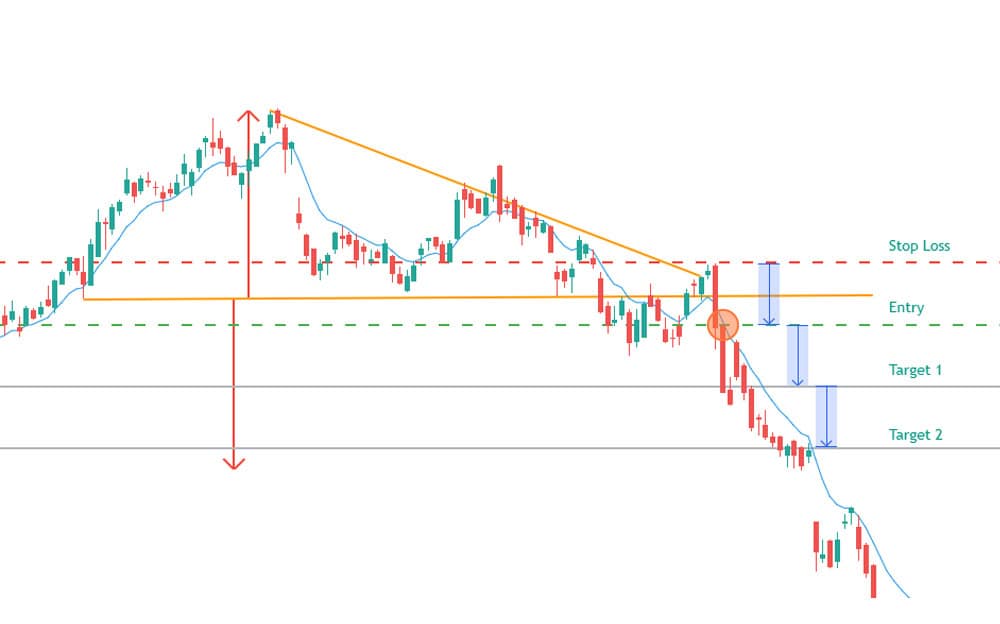

Step 5: Enter the Trade

There are two main entry approaches:

- Aggressive entry: Enter immediately on the breakout candle close

- Conservative entry: Wait for a pullback to retest the broken level (now acting as new support/resistance) before entering

Beginners should consider the conservative approach as it offers better risk-to-reward ratios and confirmation.

Step 6: Set Your Stop Loss

For bullish breakouts, place your stop loss below the consolidation range or below the breakout candle’s low. For bearish breakouts, place it above the range or above the breakout candle’s high. This protects you if the breakout fails.

Step 7: Determine Your Target

A common approach is to measure the height of the consolidation pattern and project that distance from the breakout point. For example, if a rectangle pattern is $10 tall, target $10 of movement from the breakout level.

Breakout trading is just one approach in a successful trader’s arsenal. To maximize your potential, consider learning multiple strategies that complement each other. Discover the best day trading strategy for beginners and build a diversified approach to the markets.

Like any trading strategy, mastering breakout patterns takes practice, discipline, and continuous learning…

Risk Management: Protecting Your Capital

Even the best breakout in trading setups can fail. Professional traders survive and thrive because they manage risk effectively. Here’s how to protect yourself:

Position Sizing

Never risk more than 1-2% of your trading capital on a single trade. If you have a $10,000 account, risk only $100-$200 per trade. Calculate your position size based on your stop loss distance.

Formula: Position Size = (Account Risk) / (Entry Price – Stop Loss Price)

The False Breakout Problem

False breakouts (fakeouts) are common, especially in choppy markets. Minimize their impact by:

- Requiring strong volume confirmation before entry

- Waiting for candle closes beyond the level rather than intrabar breakouts

- Using multiple timeframe analysis to confirm trend direction

- Avoiding trading during low volatility periods or news events

- Being extra cautious with breakouts near market open or close

Scaling Out of Positions

Consider taking partial profits as price moves in your favor. For example, exit half your position at 1:1 risk-reward, then let the remainder run to your full target. This locks in profits while maintaining upside potential.

Best Markets and Timeframes for Breakout Trading

While breakout patterns appear in all markets, some environments are more conducive to successful breakout trading than others.

Ideal Market Conditions

Trending markets with periods of consolidation work best. During strong trends, consolidations act as continuation patterns, making breakout direction more predictable. Choppy, directionless markets produce more false breakouts.

Top Markets for Breakouts

- Futures markets: High liquidity and leverage make futures ideal for breakout strategies, especially indices like ES (S&P 500) and NQ (Nasdaq)

- Forex pairs: Major pairs like EUR/USD, GBP/USD offer clear breakout patterns and 24-hour trading

- Large-cap stocks: High volume stocks provide cleaner patterns and better execution

- Cryptocurrencies: Volatile but offer dramatic breakout moves (requires careful risk management)

Recommended Timeframes

- Day traders: 5-minute, 15-minute, and 1-hour charts

- Swing traders: 4-hour and daily charts

- Position traders: Daily and weekly charts

Beginners often find the 15-minute to 1-hour timeframes offer a good balance between opportunity frequency and signal quality.

Common Mistakes to Avoid in Breakout Trading

Learn from the mistakes others make so you don’t have to experience them yourself:

1. Chasing Breakouts

Entering after price has already moved significantly away from the breakout level. This puts you at risk of a pullback and offers poor risk-to-reward. Solution: Wait for retests or look for the next setup.

2. Ignoring Volume

Treating all breakouts equally regardless of volume. Low-volume breakouts frequently fail. Solution: Make volume confirmation a non-negotiable part of your breakout strategy.

3. Trading Every Breakout

Quality over quantity. Not every consolidation leads to a tradeable breakout. Solution: Be selective and only take setups that meet all your criteria.

4. Poor Stop Placement

Placing stops too tight (getting stopped out prematurely) or too wide (risking too much capital). Solution: Base stops on technical structure, not arbitrary percentages.

5. Neglecting the Bigger Picture

Focusing only on your trading timeframe without checking higher timeframes. Solution: Always verify your breakout direction aligns with larger trends and doesn’t face immediate resistance on higher timeframes.

6. Emotional Decision Making

One of the biggest challenges in breakout trading isn’t technical; it’s psychological. The fear of missing out (FOMO) can cause you to chase breakouts that have already moved too far. Similarly, the fear of losses might make you exit winning trades too early or hesitate on valid setups.

Success in breakout trading requires mastering your emotions as much as mastering chart patterns. Understanding trading psychology helps you stick to your rules, avoid impulsive decisions, and maintain discipline even after losses. The best traders know that controlling their mindset is just as important as identifying the right breakout.

Frequently Asked Questions About Breakout Trading

What is breakout trading?

Breakout trading is a strategy where traders enter positions when price moves beyond a defined support or resistance level with increased volume. The breakout signals potential for continued movement in the breakout direction. Traders capitalize on the momentum created when price breaks free from consolidation patterns.

How do I identify a valid breakout?

Valid breakouts typically show three key characteristics: increased trading volume (50% or more above average), strong price momentum that closes decisively beyond the level, and confirmation through multiple timeframes. The price should stay above (for bullish breakouts) or below (for bearish breakouts) the breakout level without immediately reversing. Additionally, look for the breakout to occur from a well-established consolidation pattern with clear support and resistance levels.

What is the best timeframe for breakout trading?

While breakout strategies work across all timeframes, beginners often find success with 15-minute to 1-hour charts for intraday trading, or daily charts for swing trading. The best timeframe depends on your trading style, available time, and goals. Day traders might focus on shorter timeframes for multiple opportunities per day, while part-time traders may prefer daily charts that don’t require constant monitoring. Always confirm breakouts on your primary timeframe with at least one higher timeframe to increase probability of success.

How can I avoid false breakouts?

To minimize false breakouts, require strong volume confirmation before entering trades, wait for candle closes beyond the breakout level rather than entering on intrabar moves, use multiple timeframe analysis to verify trend direction, and avoid trading during extremely low volatility periods or major news releases. Additionally, consider waiting for price to retest the broken level before entering, which offers better confirmation and risk-to-reward ratios. Be especially cautious with breakouts occurring near market open or close when liquidity is lower.

What is a good risk-reward ratio for breakout trades?

Professional traders typically target a minimum risk-reward ratio of 1:2 or better for breakout trading. This means if you risk $100, you should aim to make at least $200. Many successful breakout traders target 1:3 ratios, especially when trading with the major trend. Calculate your potential reward by measuring the height of the consolidation pattern and projecting that distance from the breakout point. Always ensure your stop loss placement allows for reasonable price fluctuation while still maintaining favorable risk-reward metrics.

Take Your First Step in Breakout Trading

Breakout trading offers beginners a systematic, rules-based approach to capturing significant price movements. By focusing on clear patterns, waiting for confirmation, and managing risk properly, you can develop a reliable strategy that works across markets and timeframes.

Remember these key takeaways as you begin your breakout trading journey:

- Always wait for volume confirmation before entering trades

- Use multiple timeframes to verify breakout direction and strength

- Risk only 1-2% of your capital per trade

- Be patient and selective with your setups

- Practice identifying patterns before risking real money

Like any trading strategy, mastering breakout patterns takes practice, discipline, and continuous learning. Start by paper trading or using a demo account to build confidence without financial risk. Track your trades, review what works and what doesn’t, and refine your approach over time.

Transform Your Breakout Trading Skills

You’ve learned the fundamentals of breakout trading, but reading about strategies is just the beginning. Real mastery comes from structured learning, live practice, and expert guidance. IDTA’s comprehensive futures trading courses provide everything you need to go from beginner to confident trader.

Our courses combine breakout strategies with risk management, market analysis, and real-time trading sessions. Join a community of traders who’ve already made the leap toward trading better together.

Cameron has over 10 years experience in teaching people how to day trade the futures markets. He has feature alongside the CME Group, and NinjaTrader, and has been published in multiple magazines, including leading trading magazine Your Trading Edge magazine.