Support and resistance are key concepts in trading. They help traders understand price movements. These terms refer to specific price levels on a chart. Support is where a downtrend might pause. Resistance is where an uptrend might halt.

Understanding these levels is crucial for traders. It helps them make informed decisions.

Support and resistance are not exact numbers. They are zones where prices tend to reverse. Traders use these levels to set entry and exit points. This can improve trading outcomes.

Various indicators can help identify these levels. Moving averages and trendlines are common tools.

Support and resistance are used in many markets. Stocks, futures, forex, and commodities all apply these concepts. Learning about support and resistance can enhance trading strategies. It is a fundamental part of technical analysis.

What is Support and Resistance in Trading?

Support and resistance are critical in technical analysis. They represent key levels where price movements pause or reverse.

Support is a lower limit on a price chart. Here, a downtrend might stop due to buying interest. Resistance is the opposite. It’s an upper level where an uptrend might stall because of selling pressure.

These levels are essential for traders. They provide clues about market behavior. Recognizing them can help in predicting future price movements.

Traders use several methods to identify support and resistance. Historical price data is a common tool. There is no formula, but patterns are often present.

Key traits of support and resistance include:

- They act as barriers to price movement.

- They can change roles after a breakout.

- They are often close, but not exact numbers.

Understanding these concepts is vital. It assists traders in managing risks and identifying opportunities.

Recognizing support and resistance is a foundational skill. It is applicable in various trading strategies. As traders gain experience, their ability to identify these levels improves.

The Psychology Behind Support and Resistance

The psychology behind support and resistance revolves around market sentiment. These levels form due to collective trader behavior.

Support emerges when traders expect a drop to halt. They start buying, believing prices are undervalued. Resistance forms similarly, with sellers stepping in when prices rise.

Market psychology is critical here. Traders often react based on past price movements. When chart patterns repeat, support and resistance levels solidify.

The human element in trading is significant. Emotions like fear and greed influence decision-making. Recognizing these levels allows traders to anticipate reactions.

Key psychological factors in support and resistance include:

- Fear of loss leading to selling at resistance.

- Hope for gains prompting buying at support.

- Herd behavior reinforcing these levels.

Understanding psychology is crucial for successful trading. It aids in making informed decisions and predicting market movements. Insight into trader psychology enhances strategic positioning.

Key Characteristics of Support and Resistance Levels

Support and resistance levels have distinct characteristics. They are not precise figures but rather zones. These zones fluctuate within a range, presenting opportunities and risks alike.

The strength of these levels grows with testing. When a level is frequently tested without breaking, it gains significance. This repetition adds credibility to the level’s influence.

Breakouts through these levels can signal trend changes. However, false breakouts are common and require caution. A breakout with high volume is typically seen as more reliable.

Support and resistance are dynamic and adaptive. They shift based on market volatility and participant behavior.

Important characteristics include:

- Strength correlates with the number of tests

- Volume confirms the significance of levels

- Levels are often zones, not exact numbers

Understanding these traits aids traders in making informed decisions. Recognizing these characteristics can provide a strategic edge in the market.

Types of Support and Resistance

Support and resistance come in several forms. Each type serves a different purpose in trading strategies. Understanding these variations can help traders navigate the markets effectively.

Horizontal support and resistance are the most recognized type. These levels are drawn as straight lines on charts. They represent clear zones where price tends to reverse or pause.

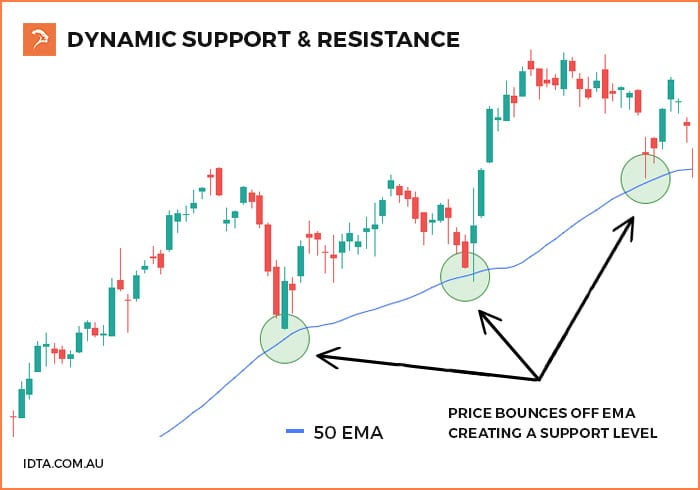

Dynamic support and resistance move with the price, this can be seen in trend trading. They aren’t fixed, adjusting with market activity. Tools like moving averages help identify these levels.

Psychological levels are another form. Often found at round numbers, traders view them as significant. This perception leads to price reactions at these points.

Distinct types include:

- Horizontal support and resistance

- Dynamic support and resistance

- Psychological levels

Each type plays a unique role. Recognizing them enhances a trader’s ability to anticipate market moves. By grasping these concepts, traders can refine their strategies and reduce potential risks.

Horizontal Support and Resistance

Horizontal support and resistance are crucial concepts. They appear when price forms peaks or troughs at similar levels. Traders see these straight lines as clear zones on their charts.

These levels derive from previous market highs and lows. They create a visual map, guiding entry and exit points. When price approaches these levels, traders watch closely for potential reversals.

Dynamic Support and Resistance

Dynamic support and resistance change with the market. Unlike static levels, they follow price fluctuations. Moving averages often highlight these adaptable points.

These levels help in trending markets. Traders use them to find potential support or resistance. Since they shift with price, they require ongoing analysis and adjustment.

Psychological Levels

Psychological levels stem from human behavior. Commonly found around round numbers, they hold psychological significance. These numbers, like 100 or 1000, draw trader attention naturally.

Prices tend to react around psychological levels. Traders often expect reversals or pauses at these points. Understanding this behavior can provide a strategic advantage in trading.

How to Identify Support and Resistance Levels

Identifying support and resistance levels is essential in trading. These levels are not just lines on a chart but key zones. Mastering them can enhance a trader’s decision-making process.

To begin, traders often use historical price data. Past price points reveal where the market has reversed or stalled before.

Chart patterns and price action offer another method. Observing patterns like double tops or bottoms provides insights.

Indicators also play a role. Common tools include moving averages and Fibonacci retracements. These indicators help highlight support and resistance zones.

Use these tools to gain deeper market insights:

- Historical price data

- Chart patterns

- Trading indicators

Combining these methods often yields the best results. Identifying these levels requires practice, but it’s worth the effort. Traders who master this skill can potentially increase their accuracy.

Using Historical Price Data

Historical price data is a solid foundation. It gives a glimpse into past market behavior. Traders look for previous highs and lows to identify key levels.

These past price points offer clues. They show where price has previously paused or reversed. By marking these levels, traders prepare for future price movements.

Chart Patterns and Price Action

Chart patterns are visual guides for traders. Patterns like double tops or flags point to likely levels of support or resistance.

Price action complements these patterns. By watching price movements, traders learn to recognize emerging levels. This combined approach adds depth to market analysis.

Support and Resistance Indicators

Indicators enhance the identification process. They automate the detection of potential levels. Moving averages are popular for this purpose.

Traders look for:

- Moving averages

- Fibonacci retracements

- Bollinger Bands

These tools highlight dynamic levels. They adapt to market movements, showing traders where support or resistance might form. Using them can clarify complex market trends.

The Role of Volume in Support and Resistance

Volume plays a pivotal role in identifying support and resistance. It provides an extra layer of insight into market movements. High volume often confirms the strength of a support or resistance level.

When price approaches a support level with high volume, it suggests strong buying interest. Conversely, high volume at a resistance level indicates robust selling pressure. These dynamics help traders gauge the credibility of a price move.

Key points to note regarding volume:

- High volume validates the strength of levels.

- Low volume may indicate potential false breakouts.

- Volume spikes can signal impending changes in trend.

Monitoring volume helps traders understand the market’s conviction. It aids in distinguishing between true and false breakouts. Hence, integrating volume analysis into strategies is beneficial.

Support and Resistance in Different Markets

Support and resistance are versatile concepts applied across various markets. Each market, however, presents unique characteristics influencing these levels. Stocks, forex, and commodities are common domains for applying these techniques.

In stock markets, support and resistance levels often align with historical highs and lows. Traders watch these levels for possible reversals. In the forex market, currency pairs exhibit support and resistance based on macroeconomic events and geopolitical factors.

Commodities behave differently, influenced by supply and demand dynamics. Here, support and resistance levels can shift rapidly due to seasonal trends or market disruptions. Traders need to adapt their strategies accordingly.

Key considerations include:

- Understand the specific market dynamics.

- Stay updated on news affecting market conditions.

- Adapt strategies to fit different market requirements.

Trading Using Support and Resistance

Support and resistance are key to effective trading practices. They help traders determine potential entry and exit points. When a price approaches a support level, traders often consider buying opportunities. Conversely, nearing a resistance level might signal a selling opportunity.

Successful trading involves recognizing these levels on price charts. Identifying potential reversals or trend continuations is crucial. Establishing these zones with precision can improve decision-making. Both individual stocks and broader markets demonstrate these levels.

By understanding support and resistance, traders can better navigate volatile market conditions. Applying these concepts increases the likelihood of executing profitable trades. Patience and observation are vital in identifying these patterns reliably.

Key actions for traders include:

- Recognizing support and resistance zones.

- Implementing entry and exit strategies based on these zones.

Support and Resistance Trading Strategies

Several strategies leverage support and resistance for trading. Each strategy depends on market conditions and trader preferences. Popular methods include range, breakout, and pullback trading.

By selecting a suitable strategy, traders can enhance their market approach. Understanding the nuances of each strategy is essential in learning how to trade support and resistance. Such insights can lead to more disciplined and systematic trading.

Key strategies focus on:

- Identifying suitable market conditions for each strategy.

- Aligning strategy with personal risk tolerance and goals.

Range Trading

Range trading exploits price fluctuations within support and resistance zones. Traders buy near support and sell near resistance. This strategy works well in sideways markets.

Key elements of range trading include:

- Identifying non-trending markets.

- Recognizing clear support and resistance zones.

Breakout Trading

Breakout trading captures price movements beyond established levels. When a price breaks through support or resistance, it often signals a new trend. Traders typically enter trades in the breakout’s direction.

Key considerations for breakout trading:

- Monitoring volume to confirm breakouts.

- Setting stop-loss orders to manage risk.

Pullback Trading

Pullback trading leverages temporary price reversals. After breaking a support or resistance level, prices often pull back. Traders enter trades once the price tests and holds the new level.

Important factors in pullback trading:

- Confirming the trend is intact after the pullback.

- Evaluating the strength of the initial breakout.

Common Mistakes When Trading Support and Resistance

Traders often misinterpret support and resistance levels by treating them as precise price points instead of zones. This misunderstanding can lead to premature trade executions. Recognizing that these levels are more like areas where price action may reverse is crucial.

Another common error is neglecting the context of the broader market trends. We always consider market context in our live trading rooms, and stress to our members the importance.

Believing that a support or resistance level will always work can be risky. This is especially true during times of market changes or big economic events.

It’s essential to avoid over-reliance on support and resistance without considering other indicators and market signals. Combining multiple sources of data leads to better trading decisions.

Key mistakes to avoid include:

- Treating support and resistance as exact numbers.

- Ignoring the influence of market trends and news.

- Over-relying on these levels without additional analysis.

Advanced Concepts: Role Reversal and Multiple Timeframes

Role reversal is a fascinating concept in support and resistance trading. When a support level is breached, it often becomes a new resistance level. Similarly, if resistance is broken, it can turn into support. This reversal occurs due to traders adjusting their positions based on market expectations.

Analyzing multiple timeframes is critical for effective trading. Larger timeframe support and resistance levels usually hold more weight. They offer a broader view, enhancing overall strategy efficacy. Viewing different timeframes can reveal hidden opportunities or risks unseen on smaller charts.

Using these advanced concepts can improve trading outcomes. It helps traders align strategies with market dynamics. Mastering these tactics involves practice and experience.

Key points to remember:

- Role reversals provide new trading opportunities.

- Large timeframe levels carry more significance.

- Multi-timeframe analysis offers comprehensive market insight.

Combining Support and Resistance with Other Indicators

Support and resistance levels gain strength when combined with trading indicators. Technical tools like moving averages and RSI complement these levels. They provide additional context and confirmation for trade decisions.

Indicators enhance the reliability of support and resistance strategies. Traders should incorporate these tools to gain different perspectives. This multifaceted approach can lead to more informed trades.

Consider these common combinations:

- Moving Averages: Offers a dynamic view of support and resistance.

- Relative Strength Index (RSI): Indicates overbought or oversold conditions.

- Fibonacci Retracements: Identifies potential reversal zones within trends.

Employing multiple indicators helps traders validate assumptions. It provides a holistic trading strategy for better market analysis.

Frequently Asked Questions about Support and Resistance

Support and resistance are essential concepts in trading, yet beginners often have questions. Here are answers to some common queries:

- What are support and resistance in trading?

- Support is a level where a price drop might stop. Resistance is a level where a price rise might pause.

- How do I identify support and resistance levels?

- They can be identified using historical prices, trends, and key round numbers.

- Are support and resistance reliable in all markets?

- They work across various markets but effectiveness can vary with market conditions.

- Can support become resistance?

- Yes, when prices break through, roles can switch, known as role reversal.

Key Takeaways and Best Practices

Mastering support and resistance can significantly improve trading outcomes. It requires understanding market dynamics and participant psychology.

Key Takeaways:

- Support and resistance are pivotal for setting entry and exit points.

- They are not precise but zones where price changes are likely.

- Use indicators and patterns to identify these crucial levels.

Integrating support and resistance with other analysis tools can enhance strategies. Always consider the broader market context to avoid false signals.

Regularly updating and adjusting your levels as the market evolves is critical. Combining them with sound risk management practices will optimize your trading approach.

Conclusion

Support and resistance are fundamental concepts in trading. Grasping their nuances can significantly enhance your trading prowess. Implementing these strategies offers clarity in a volatile market landscape.

While they simplify identifying potential reversal points, caution is necessary. Always pair support and resistance with other analyses to ensure robust decisions. With practice and diligence, these principles can become invaluable tools in any trader’s arsenal.

If you want to learn more about how to trade support and resistance check out our stock trading courses for beginners. Learn from a team of traders dedicated to trading better together.