Fakeouts in Trading:

How to Spot and Avoid Costly False Signals

Trading can be rewarding, but it’s also filled with traps that catch even experienced traders off guard. One of the most common and costly traps is the fakeout. Understanding fakeouts in trading is essential for protecting your capital and improving your overall trading performance.

Fake Out Meaning in Trading: What Is a Fakeout?

A fakeout (false breakout) in trading occurs when the price of a security appears to break through a significant support or resistance level, only to reverse direction shortly after. These false breakouts trick traders into entering positions based on what seems like a genuine price movement, but the move quickly reverses, often resulting in losses.

Markets occasionally produce signals that look legitimate but prove to be false moves. These movements can happen in any timeframe, from minute charts to monthly charts, making them a concern for day traders and long-term investors alike.

Fakeouts often manifest during periods of market volatility. Traders need to be on the lookout for sudden changes that might not align with broader trends. Recognising fakeouts involves a keen observation of market behaviour.

To better understand, consider these characteristics:

- Sudden reversals after an initial breakout

- Lack of volume confirmation

- Occurrence near psychological levels

Fakeouts can be a part of larger strategies, sometimes manipulated by significant market players. These strategic moves can trap unwary traders. Recognising a fakeout is a mix of art and science in the trading world.

Common Types of Fakeouts

Support and Resistance Fakeouts

The most frequent type of fakeout happens at support and resistance levels. Price appears to break below support or above resistance, triggering trades from eager market participants. However, the breakout lacks genuine momentum, and price quickly returns to its previous range.

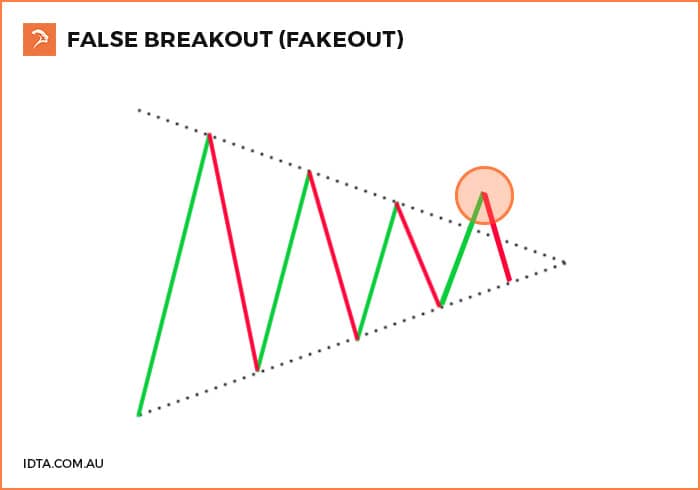

Triangle Pattern Fakeouts

Chart patterns like triangles often experience fakeouts. Traders anticipate breakouts from these consolidation patterns, but sometimes the initial break is false. The price may penetrate the triangle boundary only to snap back inside the pattern before eventually breaking out in the opposite direction.

Trend Line Fakeouts

Trend lines are popular tools for identifying market direction, but they’re also prone to fakeouts. A stock might appear to break through a long-standing trend line, suggesting a trend reversal, only to quickly move back within the original trend.

Why Do Fakeouts Happen?

Lack of Volume

Many fakeouts occur due to insufficient trading volume. When a breakout happens without substantial volume backing it, the move often fails. Genuine breakouts typically require increased participation from traders and investors.

Market Manipulation

Large institutional traders sometimes create fakeouts deliberately. They may push prices beyond key levels to trigger stop losses or force retail traders into poor positions before reversing the move to their advantage.

Algorithmic Trading

High-frequency trading algorithms can create short-term price spikes that resemble breakouts but lack staying power. These automated systems may execute large orders quickly, causing temporary price movements that don’t reflect genuine market sentiment.

News Events

Economic announcements or company news can cause initial price reactions that appear to signal trend changes but prove temporary. Markets often overreact to news before settling into more sustainable price levels.

How to Identify Potential Fakeouts

Identifying fakeouts requires a keen eye and the right tools. Technical analysis plays a key role in spotting these misleading signals. Traders use various indicators and price action clues to distinguish between real and fake movements.

One common method involves observing key technical indicators. Moving averages, RSI, and MACD can signal potential fakeouts. When these indicators diverge from the price action, a fakeout might be occurring. It’s essential to look for patterns that suggest reversal instead of a true breakout.

Technical indicators to watch include:

- Moving Averages: Reveal trends and potential reversals.

- RSI: Highlights overbought or oversold conditions.

- MACD: Indicates trend changes and momentum shifts.

Price action clues provide additional insights. Watch for candlestick patterns that hint at fakeouts, such as Doji and Spinning tops. These often indicate indecision in the market, signalling that a breakout may not hold.

Price action clues include:

- Sudden reversals after a breakout

- Candlestick patterns like Doji

- Lack of volume support for breakouts

By using a combination of indicators and price action, traders improve their chances of identifying fakeouts. This approach allows for more informed and confident trading decisions. Stay vigilant and use these tools to safeguard your trading strategy.

Watch Trading Volume

Volume analysis is crucial for distinguishing real breakouts from fakeouts. Legitimate breakouts typically show increased trading volume as more participants join the move. If a breakout occurs on low volume, it’s more likely to be a fakeout.

Wait for Confirmation

Rather than trading immediately on a breakout, wait for confirmation. This might mean waiting for the price to close beyond the breakout level or for additional candles to confirm the direction. Patience can save you from falling victim to false signals.

Check Multiple Timeframes

Examining different timeframes helps provide context for potential breakouts. A breakout that looks convincing on a five-minute chart might appear less significant when viewed on hourly or daily charts. Multi-timeframe analysis reduces the likelihood of being fooled by short-term noise.

Look for Retests

Genuine breakouts often involve a retest of the broken level. After breaking through resistance, price commonly pulls back to test that level as new support. If the level holds, it adds credibility to the breakout. Fakeouts rarely show this behaviour.

Strategies to Avoid Fakeout Losses

Use Stop Losses Wisely

While stop losses are essential for risk management, placing them too close to breakout levels makes you vulnerable to fakeouts. Consider using wider stops that account for normal market volatility and potential false moves.

Scale Into Positions

Instead of entering your full position size immediately on a breakout, consider scaling in gradually. This approach reduces your risk if the breakout proves to be a fakeout while still allowing you to profit from genuine moves.

Trade Established Trends

Fakeouts are more common during sideways or consolidating markets. Trading in the direction of established trends reduces fakeout risk, as genuine breakouts are more likely to occur with the prevailing trend.

Avoid Low-Liquidity Periods

Markets with thin trading volumes are more susceptible to fakeouts. Avoid trading breakouts during holiday periods, after-hours sessions, or in markets with naturally low liquidity.

Technical Indicators to Help Identify Fakeouts

Relative Strength Index (RSI)

The RSI can help identify potential fakeouts by showing momentum divergences. If price makes a new high but RSI fails to confirm with its own new high, the breakout might lack strength and could be a fakeout.

Moving Average Convergence Divergence (MACD)

MACD crossovers and divergences can provide additional confirmation for breakouts. A genuine breakout often coincides with MACD momentum in the same direction.

Bollinger Bands

When price breaks out of Bollinger Bands but immediately retreats, it often signals a fakeout. Sustained moves beyond the bands with expanding bandwidth suggest more legitimate breakouts.

Risk Management When Dealing with Fakeouts

Position Sizing

Never risk more than you can afford to lose on any single trade. Fakeouts can happen to even the most careful traders, so proper position sizing protects your overall account from significant damage.

Diversification

Spreading your trades across different markets, timeframes, and strategies reduces the impact of individual fakeouts. If one trade falls victim to a false signal, other positions might offset the loss.

Emotional Control

Fakeouts can be frustrating and emotionally challenging. Maintaining discipline and sticking to your trading plan, even after experiencing false signals, is crucial for long-term success.

The Psychology Behind Fakeouts

Understanding the psychological aspects of fakeouts helps explain why they’re so effective at trapping traders. Fear of missing out (FOMO) drives many traders to act quickly on apparent breakouts without proper analysis. Greed can also cause traders to ignore warning signs that suggest a potential fakeout.

Professional traders often exploit these psychological tendencies by creating fakeouts deliberately. They understand that retail traders tend to place stop losses just beyond obvious support and resistance levels, making these areas prime targets for false breakouts.

Advanced Techniques for Fakeout Avoidance

Market Structure Analysis

Understanding market structure when learning how to trade helps identify high-probability trading setups and avoid potential fakeouts. Markets that respect key levels consistently are less likely to produce false breakouts compared to choppy, directionless markets.

Seasonal Patterns

Some markets show seasonal tendencies that affect the likelihood of fakeouts. Understanding these patterns can help you adjust your trading approach during different times of the year.

Economic Calendar Awareness

Major economic announcements can create volatile conditions ripe for fakeouts. Being aware of scheduled releases helps you either avoid trading during these periods or adjust your strategy accordingly.

Fakeouts vs. Real Breakouts: Key Differences

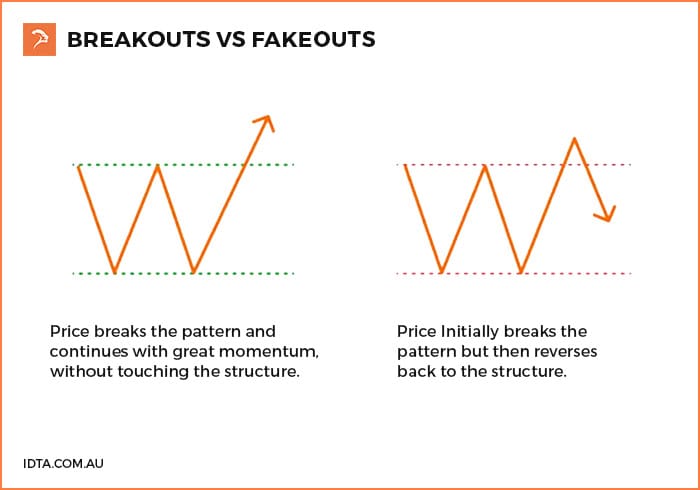

Distinguishing between fakeouts and real breakouts is essential for successful trading. Fakeouts are misleading and can lead to losses, while real breakouts offer genuine trading opportunities. Understanding the differences between them can significantly impact trading performance.

Fakeouts often occur with low volume, indicating a lack of commitment by traders. In contrast, real breakouts usually have high volume, supporting the price move. This key difference helps traders confirm the validity of breakouts.

Consider these factors when differentiating:

- Volume levels: High or low volume during breakout.

- Follow-through: Sustained price movement or quick reversal.

- Market sentiment: Confirms or contradicts the breakout.

Real breakouts tend to sustain their movement, whereas fakeouts quickly reverse direction. By recognising these differences, traders can avoid traps and capitalise on genuine breakout opportunities.

How to Trade Fakeouts: Turning Traps into Opportunities

Trading fakeouts can be profitable if approached with a strategic mindset. Recognising a fakeout early can allow traders to capitalise on the market’s short-term confusion. This involves understanding the market’s psychology and adapting quickly.

One way to leverage a fakeout is through contrarian trading strategies. By entering a position opposite to the expected movement post-fakeout, traders can take advantage of the rapid market adjustment. Key to this is observing the quick reversal patterns that signify a fakeout.

Key actions to consider:

- Identify rapid reversals after breakouts.

- Use contrarian strategies to benefit from market retracements.

Timing is crucial in executing these trades. Traders need to act decisively once a fakeout is confirmed, often requiring strict watchfulness and speed. Tools like automated trading algorithms can help execute trades swiftly when human response might lag.

Conclusion

Fakeouts in trading represent one of the most common challenges facing traders at all experience levels. These false signals can be costly, but understanding their nature and implementing proper risk management techniques significantly reduces their impact on your trading results.

The key to dealing with fakeouts lies in patience, proper analysis, and disciplined execution. By waiting for confirmation, analysing volume patterns, and using appropriate risk management, you can minimise losses from false breakouts while positioning yourself to profit from genuine market moves.

Remember, fakeouts are part of market dynamics and can be turned into opportunities with the right strategy and mindset. Stay informed, practice risk management, and constantly refine your trading skills for better results.

If you’d like to learn more, consider taking a stock trading course for beginners.

Cameron has over 10 years experience in teaching people how to day trade the futures markets. He has feature alongside the CME Group, and NinjaTrader, and has been published in multiple magazines, including leading trading magazine Your Trading Edge magazine.