What is leverage trading and how does it work? In this post, we’ll cover the good, the bad, and the ugly of leveraged trading and trading leveraged products.

What is Leverage Trading?

Leveraged trading, also known as trading on margin is offered by most major brokers. This type of trading allows a trader to multiply the value of their trades. This means that a trader can open a position with a value more than the funds used to open that position.

Day traders who choose to trade leveraged products do so to seek accelerated returns. The more leverage, the more potential for higher returns, this is popular with traders with a smaller account. The opposite is also true, trading with leverage can lead to large losses. It’s important to have a trading strategy, and excellent day trading risk management techniques when trading leveraged products in volatile markets.

How Does Leverage Trading Work?

To use trading leverage you use borrowed money from your broker allowing you to increase your position size. As the trader you are only required to have the margin available. The margin is a fractional amount of the position size.

Once the trader closes out their position, they must return the borrowed funds to the broker. The trader will then either receive or pay the difference. If the trade is profitable, the trader gets the difference in price, otherwise the trader pays the difference.

This gives traders the ability to open positions of a size not possible using a smaller account. Trading leverage is described as a ratio which indicates the funds utililised against funds borrowed. For example, a ratio of 1:10 would mean that you can leverage each dollar up to 10 times.

Leverage Trading Example

Let’s say that, for this example, your trading leverage is 1:10 and are placing $100 on a trade. You have 10 x the buying power, the value of your trade is now $1,000 (10 x $100).

This trade multiplies potential profits based on the amount of leverage. This trade also multiplies potential losses. In this example, profits are multiplied by 10, as are losses.

For this example, let’s say that the movement in price was $5. If the trader predicted the correct direction for the trade, the profit is 10 x $5 = $50. If the trader picks the wrong direction, then the loss is $50.

On this trade the initial margin (funds needed to place the trade) is $100. Depending on volatility and movement against the trader, this can change. If a trade moves against the trader enough the margin required grows. If the margin required nears the total funds in the account, the trader may receive a margin call.

Trading Leveraged Products

A common product used for trading with leverage is a derivatives contract (e.g. Futures). A derivative is a financial instrument that derives its value from an underlying asset or security. Derivatives allow traders to speculate on the movement of an underlying asset. The trader does this without actually owning the asset.

A trader might buy a derivative contract that allows them to bet against the movement of a stock. The trader is able to see a profit or loss without actually owning the stock/asset.

Types of Products For Trading With Leverage

Trading leverage is available on most popular markets. Leverage products include:

| Product | Leverage |

|---|---|

| Options | Up to 40:1 |

| Futures | 90-95% (10% margin) |

| Forex | Up to 30:1 (some brokers offer 100:1) |

| CFDs | 2:1 to 30:1 |

| Cryptocurrencies | 2:1 – 3:1 |

| Some ETFs | 2:1 – 3:1 |

Note the with Futures that the margin required is only 10-15% of the contract’s actual value.

The trading leverage allowed on these markets depends on regulatory limitations and volatility. Brokerages also control the amount of leverage that they offer.

Leverage Trading: The Good

Let’s take a look at some of the benefits of leveraged trading. While there are risks (which we’ll get to shortly) there are also many benefits to leverage trading.

1. More Accessible, Smaller Entry Price:

Trading on margin allows a trader to access products without paying the full price of the asset. This means traders with smaller accounts can still access and trade these products.

2. Increased Profits:

When trading with leverage, you can make much larger profits than you would with a standard trade. The same is true for losses, more on that later.

Leverage trading is particularly popular among traders looking to capitalize on small price moves—think stocks, forex, commodities, and cryptocurrencies. The appeal is obvious: with even a modest amount of capital, you can control a much larger position and amplify your gains if the market moves in your favor.

3. Increased Liquidity:

Leveraged products are typically very liquid, which means you can enter and exit quickly. This is true with the major Futures markets where the volume is large.

4. Increased Flexibility:

With leverage trading, you have more flexibility to trade in a wider range of markets. This is particularly true for trading Futures in Australia as there are many asset classes to choose from

Leverage Trading: The Bad, and Ugly

1. Increased Risk:

Trading leveraged products carries a larger risk than not trading with leverage. The increased size of potential losses means it’s important to track and manage trades.

2. Losses can exceed funds available:

Depending on the broker, you may be liable to pay back your broker should you lose more than your full account. If you are using a 2:1 leverage, your losses would be doubled. That means that if an asset loses more than 50% of its value, you’ll lose more than 100% of the cash you had available to invest.

What is Overleveraging and Why Is It Risky?

Overleveraging Explained:

Overleveraging happens when a trader takes on positions that are too large in relation to their account size. This means committing a significant amount of borrowed funds, often in hope of magnified gains, but at the expense of safety.

The main danger with overleveraging is that even a small movement against your position can have an outsized impact. A modest drop in price can trigger substantial losses—sometimes wiping out your account or resulting in negative balances. This tends to happen when traders chase quick profits or act out of fear of missing out (also known as “FOMO Trading”), stepping well outside their usual risk tolerance.

Why is it risky?

- Losses can compound rapidly due to high exposure

- Margin calls are more likely, forcing you to deposit more funds or close positions at a loss

- Emotional decision-making—like increasing position size after a winning streak—can accelerate losses

Avoiding overleveraging starts with careful position sizing, strict discipline, and respecting your own risk limits. In the world of leveraged trading, sometimes less really is more.

Common Misconceptions: “Get Rich Quick” with Leverage

A stubborn myth about leveraged trading is the promise of rapid wealth—the classic “get rich quick” scheme. It’s tempting to think that a dash of leverage and a lucky trade (or two) is all it takes to turn a small account into a fortune overnight. But here’s the reality: while leverage can boost gains, it comes hand-in-hand with the potential for swift and catastrophic losses.

Many new traders are drawn in by stories of overnight millionaires and wild success on social media or forums like Reddit. Yet, for every viral tale of doubling an account, there are countless quieter stories of accounts blown up in a single bad day.

Some specific misconceptions include:

- Leverage is a shortcut to wealth. In fact, without proper knowledge, leverage often amplifies mistakes.

- It’s easy to beat the market with high risk. The truth: markets—whether in Forex, stocks, or crypto—favor those who have a solid plan and patience, not just big bets.

- Education isn’t necessary. Many skip learning risk management, position sizing, or even how margin works, leading to avoidable pitfalls.

The takeaway? There’s no magic formula, no lucky product, and no shortcut. Instead, building skills, understanding the tools (like those provided by reputable firms such as CME Group for futures or CBOE for options), and being prepared for all market conditions makes all the difference. Getting educated and becoming a disciplined risk manager is the true path to long-term trading success.

What are the Risks of Trading Leveraged Products?

Because of the increased risk involved in trading leverage, you need to be a good risk manager. You should always use a stop loss and risk management techniques to avoid massive losses.

A large loss may lead you to receive a ‘margin call’ from your broker. A margin call will be a demand to deposit further funds. This can happen because your broker worries about your ability to repay your debt if your investments continue to lose value.

Some brokerages will provide negative balance protection. This means that you will be exited from a trade rather than go into the minus.

If the broker doesn’t offer this, risk is technically unlimited. If ill managed, you could end up owing your broker money.

Reduce the Risk of Trading Leveraged Products

To reduce the risk of trading leveraged products, first limit the size of the leverage you use. While trading leverage adds more bang for your buck, so to speak, the greater the leverage the greater the risk.

Why Limit Your Exposure to Leveraged Trading?

The simple reason most experienced traders recommend capping your leveraged positions is risk control. If you allocate too much of your portfolio to highly leveraged trades, a single misstep (or rapid market move) could wipe out not just your invested capital, but potentially leave you owing more than your account holds—thanks to the double-edged sword of margin.

A common approach among prudent traders is to keep leveraged trades to around 10% of your total portfolio. This way:

- The bulk of your investments remain in lower-risk, long-term assets, like diversified share portfolios or index funds.

- You limit the portion of your capital exposed to rapid swings or sudden losses characteristic of leveraged products.

- If a leveraged trade goes south, the impact on your finances is contained, and you’re far less likely to face a margin call from your broker.

This “10% rule” isn’t just a thumb-in-the-air estimate. It’s a well-tested risk management practice, championed by industry veterans and regulators alike (think: FINRA and the SEC) to prevent catastrophic losses.

By keeping the majority of your funds in less volatile investments, you’re in a far better position to weather storms in the leveraged portion, without derailing your financial security. Ultimately, controlled allocation helps you navigate the excitement of leverage while minimizing the chance of turning a bad trade into a painful financial lesson.

Use a Stop loss:

You should also trade using a stop loss for every trade you place. This will ensure that you control the maximum amount of money at risk each time you trade. Because there is limitless risk with leverage trading, it’s important to manually add that limit.

Have a maximum risk allowance:

Have an initial risk in mind before placing the trade, this forms the stop loss. I choose to use the rule of no more than 2% of my account size per trade. If my technical analysis on a trade says my stop needs to be more than 2%, I don’t take the trade as it is too risky for me.

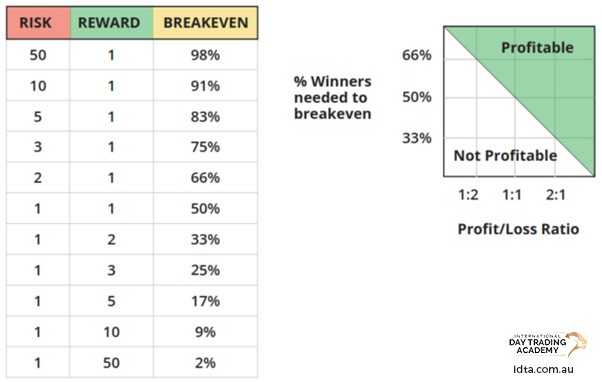

Make your reward to risk in your favour:

You should always have a risk reward ratio of 1:1 or better. 1:1 means that your reward is equal to your risk. I usually look to have my reward to risk at 2:1 as it is a good balance between achievable and maintainable.

If I have my reward to risk at 1:1, I need to have a win rate above 50%. If all my trades are 2:1 then I can be profitable around the 40% mark. It might sound like making the reward much, much bigger than the risk means you rarely need to be right. While you can be correct less often, it is much harder to be correct.

Make your position sizes appropriate:

You should only open a position if it is allowed within your risk limitations. Leveraged trading can be risky and a larger position can compound out of control. Trading is about accumulation, not about getting rich quick.

Consider Diversification When Trading with Leverage

Diversification is a valuable tool when approaching leveraged trading—think of it as spreading your eggs across multiple baskets rather than risking them all in one. If you already have a balanced portfolio of investments, introducing leveraged trades as a smaller add-on can boost your growth potential without putting your entire net worth on the line.

However, be careful not to let leveraged positions dominate your portfolio. Leveraged trading comes with amplified risks, so your ability to stomach losses is crucial. As a general rule, I never allocate more than 10% of my total available capital to leveraged products. This way, even if things go south, the bulk of your portfolio is protected. In short: diversify smartly, keep your leveraged exposure limited, and you’ll be trading with both eyes open.

Can You Consistently Make Money with Leveraged Trading?

The short answer: yes, but only if you’re disciplined and methodical about your approach.

Consistency in leveraged trading comes down to managing both risk and your own expectations. First, never put all your eggs in the leveraged basket. Most experienced traders recommend allocating the majority of your capital—around 80–90%—to a diversified, medium- to long-term portfolio. The remaining 10–20% can be earmarked for more aggressive, short-term leveraged strategies.

The key is making that smaller portion work smart, not just hard. With the right skills, planning, and a solid risk management framework, it’s possible for those leveraged trades to generate results that rival or even outperform your core investments over time. However, this is only achievable if you’ve put in the time to properly learn how leveraged products work and have established a consistent, tested strategy.

Here’s how successful traders stack the odds in their favor:

Commit to education: Take trading courses, more specifically, study under seasoned professionals that are licensed and actively trade.

Stick to a plan: Every trade should fit within your risk parameters and be supported by clear technical or fundamental analysis.

Risk only what you can afford to lose: Leveraged trades carry higher risk; treat them as such and resist the urge to chase losses.

Track your performance: Regularly review and adjust your strategy. Journal your trades to spot patterns and mistakes.

While not everyone will reach the point of consistency, those who are patient, diligent, and proactive about managing risk give themselves a genuine shot at joining the minority that profits from leveraged trading.

How to Start Trading Leveraged Products

You should follow these steps before you take up leveraged trading. Because of the risks involved you need to have the knowledge, skills, and experience to be consistent.

Learn a Trading Strategy

The best way to learn a trading strategy is to learn to trade from an academy or a professional trader. It’s possible to learn from sources on the internet, but beware of conflicting information. Learning from various sources doesn’t provide context. Without context you may use that information in the wrong way.

A trading strategy helps find high-probability trades, but also provides risk management tools. A robust strategy will not only tell you when to enter a trade, but also when to exit, which is important.

Find a Broker or Trading Platform

To be able to trade you will need access to a trading platform, and a means of executing orders. You can do this via a broker, they often provide the platform. You can also access the Futures markets directly through a platform like NinjaTrader.

Practise on a Simulated Account

Before you dive straight in, you need to practise your trading on an account that doesn’t hold real money. Even after learning a strategy inside out, it’s important to gain real life experience.

Practicing on a simulation account will allow you to gain live market experience without risking your own money and is the best way to learn day trading. Once you have proven to yourself that you can be consistently profitable you can trade live.

Start Trading

Once you start live trading you need to ensure that you aren’t trading with too much leverage. You need to be mindful of risk management. Because leverage trading is risky you should start out slow and build your way up as your confidence grows.

Leverage Trading Australia

Leverage trading is a risky proposition that can lead to large losses if not done correctly. Be mindful of risk management

When it comes to leveraged trading, there are definitely good and bad aspects to consider. Make sure you weigh the pros and cons before deciding if leveraged trading is right for you.

If you’re interested in learning more about leverage trading, check out our next free trading class.

![What is Leverage Trading? [The Good, Bad, and Ugly] 2 leverage trading - pros and cons of trading leveraged products](https://idta.com.au/wp-content/uploads/2022/03/leverage-trading-pros-and-cons-of-trading-leveraged-products.jpg)

![What is Leverage Trading? [The Good, Bad, and Ugly] 6 Free day trading web class](https://idta.com.au/wp-content/uploads/2020/08/free-day-trading-web-class.png)