In a falling market, short trading allows a trader to still find opportunities to make money, if they are astute and nimble. In this article, we’ll explore some short trading strategies that can help you capitalize on opportunities.

What is Short Trading?

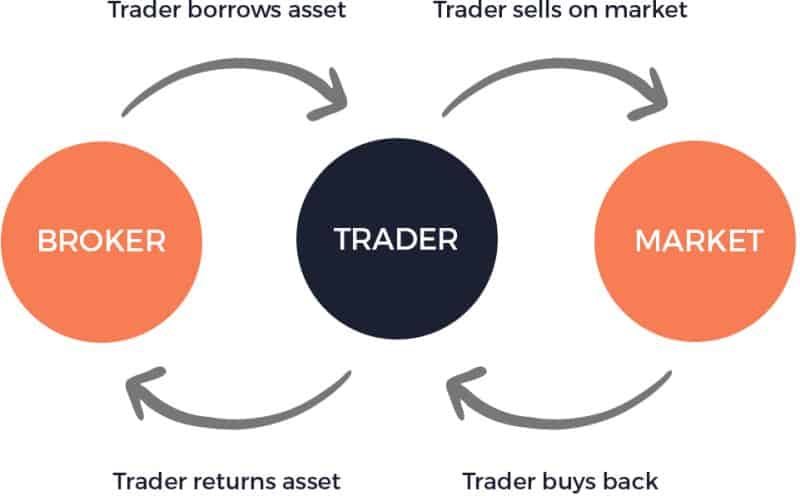

Short trading is when a trader borrows shares or other assets from a broker and sells them. This is done with the expectation of being able to buy them back at a lower price later. The trader then has to deliver the asset back to the broker once bought back.

In Futures trading, short trading is simply the purchase of a “sell contract”. The contract is an agreement to pay the difference between entry price and exit price. If price goes up, the trader receives a loss, if the price goes down, they make a profit.

Short selling is one of a few bear market trading strategies, it allows investors to profit from falls in price.

How Short Selling Supports Market Efficiency

Short selling isn’t just about taking a pessimistic view of the market—it also plays an important role in keeping markets balanced and efficient. By allowing traders to act on negative outlooks, short selling helps expose companies or assets that may be overvalued.

Here’s how this dynamic actually benefits the marketplace:

- Improves Price Discovery: When traders can freely go short, prices more accurately reflect both positive and negative information. This means markets are less likely to become inflated by unchecked optimism.

- Adds Liquidity: Short sellers add additional buyers (when covering their positions) and sellers to the marketplace, making it easier for everyone to enter and exit trades.

- Acts as a Check on Excess: If a stock price has run too far ahead of underlying fundamentals, short selling can temper exuberance before bubbles form.

While short selling has its critics, it ultimately helps markets adjust more quickly to new information and can even contribute to stability by highlighting weaknesses early—sometimes prompting companies to address underlying issues before they become critical.

Gauging Sentiment with Short Selling Metrics

Short selling metrics offer valuable insight into what traders collectively think about a stock’s future. Two common metrics in this area are the short interest ratio (SIR) and the days-to-cover ratio.

- Short Interest Ratio (SIR): This metric shows the proportion of shares currently sold short versus the total shares available to trade (“the float”). If a company is seeing a high SIR, it’s a red flag that many traders believe its share price is likely to drop. It can indicate widespread bearish sentiment, especially if other market signals back up the caution.

- Days-to-Cover Ratio: Also called the short interest-to-volume ratio, this tells you how many days it would take, on average, for everyone with a short position to buy back and cover if they all tried at once. A high days-to-cover number means there are a lot of shorts relative to how actively the stock trades each day, often another sign that the market feels uneasy about the company’s prospects.

By monitoring these short selling metrics, traders can get a feel for whether investors as a group are optimistic (bullish) or pessimistic (bearish) about a particular stock’s direction. If both metrics are high, it usually points to caution in the air and the potential for price declines. This kind of information helps traders decide when to jump in, or step aside, when considering a short trade.

Long vs Short Trading

As well as short trading, traders are able to take long trades. Long and short trading are at the opposite ends of the spectrum. Where short selling profits from a decline in price, long trades profit from a rise in price.

When it comes to long vs short trading, there is no one better than the other. The best strategy is actually to trade both long and short to maximise opportunities. Being able to trade the market in both directions allows a trader to find more opportunities, and to trade more market types.

Using a long and short trading strategy means you have opportunity when the market goes down as well as up.

What is a Bear Market?

A bear market is one in which sentiment is negative and price is falling. Alternatively, a market in which price is rising is called a bull market.

Strictly speaking, a bear market is when price falls by 20% or more from the 52-week high, or from recent highs. A bear market is generally marked by investor pessimism. This can cause prices to continue falling, adding to further negative sentiment.

Note that the price drop is a sustained one, typically 2 months or more. Bearish markets tend to mirror overall economic downturns or negativity. A downtrend lasting for fewer than 2 months can be considered a correction.

Bearish markets are associated with stock indices such as S&P 500, NASDAQ, etc., but commodity and currency markets can also be bearish.

Day Traders aren’t concerned whether it’s a bear or bull market. We can go short or go long in both environments. We’re more focused on picking the turns in the market and finding the micro trend up or down.

Bear Market Trading Strategies

Besides short selling, there are bear market strategies where you can seek to profit from a falling market.

A bear market trader might view the market as an opportunity to build a portfolio of “value stocks” at a good price.

This strategy is “buying the dip”, it’s used to enter at value prices, or to dollar-cost average existing positions.

Trading dividend stocks is another bear market strategy. A dividend stock is one that pays a certain percentage to investors at scheduled dates. The dividend paid by the company may assist in hedging the drop in the price of the stock.

With day trading Futures, things are a little simpler.

Rather than worrying about open positions, hedging, or buying dips, a short seller purchases sell contracts. If correct, and price falls, they profit.

Alternative Bear Market Strategies

Short selling isn’t the only way to benefit from falling prices. Investors can also consider:

- Futures Contracts: The Futures markets offer a broad range of market classes that can be short traded. The process of shorting the futures markets is as simple as buying a “sell” contract. Futures allow you to hold a short position without borrowing any underlying asset.

- Put Options: Rather than selling stocks short, put options allow you to profit from a decline in a stock’s price—without needing to borrow shares or open a margin account. This can help manage risk, as your potential loss is limited to the premium paid for the option.

- Inverse or Bear ETFs: Exchange-traded funds designed to move inversely to a particular index or sector can offer exposure to a falling market. These are often used for short-term hedging or speculation, with the advantage of not requiring margin or direct short sales. They also tend to have a lower risk of a short squeeze compared to individual stocks.

Practical Example: Profit and Loss on a Short Trade

To see how a short trade works in practice, let’s look at a simple example:

Suppose you believe a particular stock, currently trading at $50, will fall in value. You borrow 100 shares from your broker and immediately sell them on the market. You are now “short” 100 shares.

- If you’re right: A week later, the company announces poor results and the stock falls to $40. You buy back the 100 shares at $40 each and return them to your broker.

- Your profit: ($50 – $40) x 100 shares = $1,000 (excluding commissions and fees).

- If you’re wrong: Instead of dropping, the stock is suddenly the target of a takeover, and its price jumps to $65. You decide to close out your position to avoid further losses and buy back the 100 shares at $65 each.

- Your loss: ($50 – $65) x 100 shares = -$1,500.

This example highlights both the profit potential and the risk involved in short trading; The price can drop, but it can also rise much higher than you expect, increasing your losses.

Hedging with Short Selling

Short selling isn’t always about speculation. Sometimes, traders use short trades as a hedge to protect gains or reduce losses in their existing portfolios.

If you’re holding stocks that are starting to fall, opening a short position can help balance out potential losses. However, keep in mind that hedging comes with its own costs: fees, margin interest, and even the opportunity cost of limiting your potential upside if the market rebounds.

How to Execute a Short Trade

The very first thing you need to do is consider both fundamental and technical analysis on the asset you want to trade. It’s important to identify a good trade and to have a solid thesis as to why it’s a good trade.

In performing technical analysis you will first need to know how to read candlestick charts. Candlestick charts are used to display price movement of a given market or asset. These charts begin to produce patterns over time, based on historical data. These chart patterns help predict where price will move.

Now that you have identified the short trading opportunity, these are the steps in executing.

When to Consider Short Selling

Timing is crucial when it comes to short selling. Markets tend to fall faster than they rise, meaning that opportunities can appear and disappear quickly. A strong thesis is essential, but so is patience—jumping in too early can be costly, as holding an unprofitable short position comes with risks and expenses if the price moves against you.

Short sellers often look for opportunities in the following scenarios:

- Entrenched Bear Markets: Shorting is best suited for clear downtrends, where negative sentiment is widespread and prices are falling swiftly.

- Deteriorating Fundamentals: Watch for signs like slowing revenue, shrinking profit margins, or rising costs—these can signal potential downside ahead.

- Bearish Technical Indicators: Technical signals such as a breakdown below a major support level, or moving average crossovers (like a 50-day average dipping below the 200-day average, known as the “death cross”), can confirm a bearish setup.

- Overvalued Assets: Sometimes, a stock or sector becomes “priced for perfection,” with high valuations and lofty investor expectations. The smart short seller waits for cracks to appear—such as a failed earnings report or the start of a downtrend—before making a move.

Now that you have identified the short trading opportunity, these are the steps in executing.

For Stocks, Commodities, Forex etc:

- Borrow the stock/asset from your broker

- Immediately “sell” the asset on the market

- Monitor and manage risk for your open trade

- If price drops you can buy it back cheaper than you borrowed it for

This results in profiting from the difference between the price you borrowed at, and the price you bought the asset back at. If you were wrong, you would eventually have to return the asset to the broker by buying back at a higher price.

For Futures:

- Buy 1 or more sell contracts on your chosen market/asset

- Monitor and manage risk for your open trade

- If price drops you can exit and receive funds to the value of the contract at its current price

If you’re wrong in your prediction, you will exit the trade and will be receiving funds to the reduced value of the contract.

Short selling is all about finding the right setup, acting decisively, and managing your risk. With the right mix of fundamental and technical analysis, and watching for key signals, you can stack the odds in your favour when the market turns south.

Closing a Short Position (Covering)

To close a short position, the trader must buy back the borrowed shares and return them to the lender—this is known as “covering the short.” Ideally, the shares are repurchased at a lower price than what the trader sold them for, allowing the trader to keep the difference as profit (minus any interest charges and commissions).

This is done by entering a buy order for the same number of shares (or contracts) that were sold short. Once the buy order is filled, the position is closed and the borrowed assets are returned, completing the short trade cycle.

With this foundation, you’re equipped to understand the mechanics of short trading and how to take advantage of falling markets. Let’s look at the potential rewards of short trading…

What are the Rewards of Short Trading?

In a bearish market, short selling is one of the only ways of profiting from the market. Where there is a downward trend across markets it is difficult to find long trades.

In a bearish market the trend is strong, so when price falls, it does so quickly. This means that if the bear market trader chooses the right direction, they could see a larger return on a smaller investment.

Another way to use short selling is to hedge against long positions. For example, you may be holding stocks that are falling in price, shorting provides the opportunity to balance the losses. If you think that price will continue down, you could seek to make money on the short. You do this to balance the loss on your long position.

Keep in mind, however, that hedging often means you’ll give up some upside if the market recovers, and the cost of maintaining a hedge (such as margin interest or trading fees) can add up over time. Nonetheless, when used carefully, short trading can be a valuable tool in both bearish and volatile markets.

What are the Risks of Short Trading?

So far I’ve made being a short trader sound pretty good, but there are downsides. Short trading is an excellent way to increase the opportunities available in the markets, but it’s not without it’s risk.

Short selling technically has “unlimited risk” because there is no gauge to how high price can go. Contrasted with long trading where risk is limited to the asset reaching 0 value. This is why it’s important to use a stop loss in your trading to limit your risk.

With derivatives such as Futures and Options, there’s risk of losing more than 100% of your account. Your broker might exit you from the trade when you don’t have enough margin to remain in a trade.

In the context of short selling individual stocks, the risks can apply to the companies themselves. If there is enough short selling of a stock it can send a company into bankruptcy.

Example: Losses in Short Selling

Let’s continue with the previous scenario. Suppose the trader didn’t close out the short position at $40, hoping for further decline. Suddenly, a competitor swoops in and acquires the company with a takeover offer of $65 per share, sending the stock soaring.

If the trader then decides to close the short position at $65, the loss on the short sale would be $1,500, calculated as: $50 – $65 = negative $15, and negative $15 x 100 shares = $1,500 loss. In this case, the trader had to buy back the shares at a significantly higher price to cover their position.

This is the essence of “unlimited risk”. While a stock can only fall to zero, there’s no ceiling to how high it can rise. Always manage your risk accordingly.

What is a Short Squeeze and How Does It Happen?

A short squeeze is what happens when a large number of traders who are holding short positions suddenly try to buy back the asset at the same time. This usually occurs when the price of the asset starts rising, instead of falling as they had hoped.

When shorts rush to close their trades and cut their losses, this wave of buying puts even more upward pressure on the price. The result? Prices escalate even faster, forcing more short sellers to cover their positions, which pushes prices even higher in a kind of feedback loop.

The legendary GameStop rally in 2021 is a real-world example that got a lot of attention, but short squeezes aren’t limited to any one stock or market. They can occur in major indices, commodities, forex, and futures.

This is a key risk to be aware of when trading short, especially in assets where a large percentage of the available shares are already being shorted. If the tide turns, the scramble to exit can be quick, costly, and chaotic.

How Can a Short Squeeze Cause Significant Losses for Short Sellers?

A short squeeze can turn what seems like a manageable trade into a financial disaster for short sellers. Here’s how it works: if the price of a heavily shorted stock starts climbing—often due to unexpected news, investor momentum, or coordinated buying activity—short sellers may rush to buy back shares to cover their positions and prevent further losses.

This rush to exit drives the price even higher, creating a kind of domino effect. As more and more shorts scramble to buy, the buying frenzy can push prices up rapidly, multiplying losses for anyone still holding a short position. Because there’s technically no upper limit to how high a stock can go, the losses in a short squeeze can far exceed your initial investment. This is why managing risk is so important if you’re short selling—being caught in a short squeeze is every short trader’s nightmare.

Managing Risk in Short Trading

As mentioned earlier in this article, short selling has unlimited risk. It’s therefore important to make sure that you manually control your risk in any short trade.

The way in which you control your risk is to use a stop loss. A stop loss is a pre-defined price that you set in your trading platform that exits if reached. You set the limit to how much you can lose, once the price is reached, your platform exits you from the trade.

You should also set a reasonable take profit. This is similar to a stop loss, but is your profit target for the trade. As with a stop loss, when this price is reached, you exit the trade.

You should be using a risk management system in trading, whether long or short.

Is Short Selling Legal in Australia

Yes, short selling is legal in Australia. Both institutional traders and retail traders (individuals) have access to short short selling.

Naked short selling is not legal. This is where the short trader places a trade without a lending agreement with a 3rd party. In order for short selling to be legal in Australia, the stock must be borrow before entering the order.

This again doesn’t apply for derivatives like Futures because the underlying asset is never held. Futures traders purely buy and sell contracts that derive value from an underlying asset.

Activist short selling is also not legal in Australia. This is the process of shorting a financial product, then releasing disseminating information publicly.

As long as your short trade is aboveboard, it’s absolutely legal to short sell in Australia.

Bottom Line

Being a short trader can be a profitable way to trade in a declining market, but it is not without risk. You can’t short sell because prices everywhere look like they’re falling. You need to know what you’re doing.

All the principles and required skills apply to short trading. You will need to know how to go about finding high-probability trades. You’ll also need to have strong risk management skills and a grasp of trading psychology.

If you’re interested in learning more about short trading, check out our day trading for beginners course.