Understanding risk reward ratio for day trading is a necessity for all beginner day traders.

Today, we’re going to look at risk reward ratio for day trading and how to calculate risk reward ratio when trading.

What is a risk reward ratio for Day Trading?

A risk to reward ratio is the ratio of funds risked to return, or return being sought.

Day traders use a risk management technique called a stop loss. This means that they are trading with limited risk. A trader not using a stop loss has unlimited risk in the market.

A Day Trader will also set a profit target which is the reward they are aiming to receive.

The risk is the price difference between entry and stop. The reward is the difference between entry and target.

You then compare the size of the two to get the risk to reward ratio.

What is a good risk to reward ratio?

The best risk reward ratio for day trading depends a little on your strategy and the market you are trading in.

You need your risk to reward to fit what you’re trying to achieve otherwise you won’t reach your goals. Your risk reward ratio should complement your objectives, rather than acting as a solo tool that isn’t personalised to your exact needs.

Risk too small and you might get stopped out (exited from the trade). Risk too large and you’re exposed to losing more than you are comfortable with.

If your profit target is too high, you’re not likely to reach it. Target too low and you won’t have much room to have balanced risk.

So what is the best risk to reward ratio for day trading?

The larger your reward vs risk the lower your profit loss percentage can be whilst remaining profitable. But you do need to make your target something that is achievable and give your stop some breathing room.

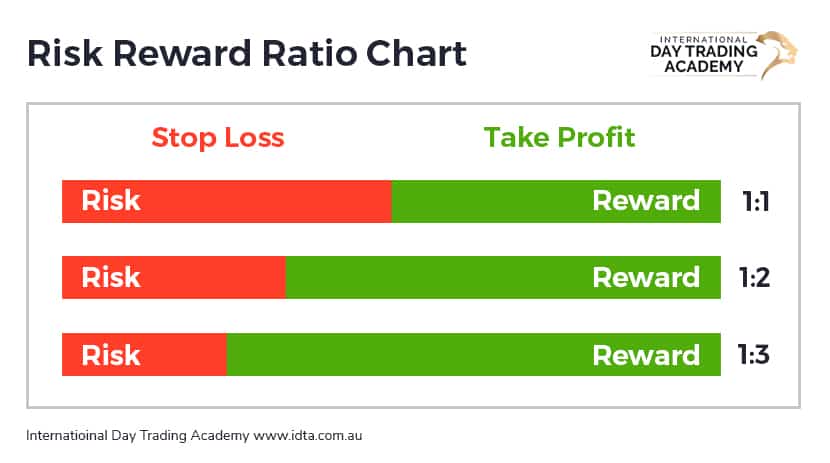

The general consensus on risk to reward is between 1:1 and 1:2. 1:1 is risking the same amount as the reward you are seeking. 1:2 is aiming for a reward that is twice the size of your risk. This is Positive Risk Reward Ratio.

You don’t need to have the same risk to reward for every trade, but try to keep it at better than 1:1. The 1:1 to 1:2 range is the sweet spot for many traders.

If you choose to risk more than you seek to make, you need to win more often than you lose. The larger the risk compared to the reward means that you will need to win more often. This is called a negative Risk Reward Ratio.

How to calculate risk reward ratio

Now that we’ve addressed what is a ‘good’ risk to reward ratio, we arrive at the ultimate question: what details or tools do you need in order to know how to calculate risk reward ratio?

Calculating the risk to reward ratio is pretty easy, but let’s look at an example to explain it.

Let’s say that a trader enters a trade when the price is at $100. They’re expecting the price to go to $120. They set a profit target for $120. They want to have a risk to reward of 1:2 so they set their stop loss at $90.

This trade has a risk of $10 with a reward target of $20. You can simplify that fraction to be 1:2, $20 is double the size of $10.

High risk high reward

If you are trading a high-risk strategy, you must seek a high reward. A high-risk strategy that only bears small rewards requires a very high win loss percentage.

The more unbalanced the risk compared to the reward, the more often you need to have a winning trade.

This is a lot of pressure to put on yourself as a trader, and isn’t typically recommended for beginners, or even professionals.

Low risk low reward

In a similar way to high risk needing high reward, low risk should seek lower rewards. If your rewards are larger than risk, then the reward takes more movement to reach.

If your reward is too far to reach you will eventually stop out without ever reaching it.

Win loss ratio

At a 1:2 ratio you maintain a long-term win loss percentage just over 33% and breakeven. The calculation is 33% but you do need to account for trading costs.

One thing to consider; the larger the reward compared to risk the less likely to reach your profit target. The distance to your stop becomes closer and closer to entry compared to the target.

So there is room to have more losses but statistically you will have more by default.

At a 1:1 ratio you have an equal distance from entry to stop and entry to profit target. This means price has an equal distance to move so things are more balanced in that respect.

At a 1:1 risk to reward ratio your breakeven needs to be a win loss percentage just above 50% (to account for fees).

If you have a proven trading strategy your goal should be to achieve a much higher win/loss than 50%. If you’re competent in trading, a win loss ratio of at least 60% is very achievable.

Risk to reward profile

A good day trader will have a written risk profile that dictates the amount of risk they allow in their trading. This profile will include their allowed risk to reward for their trades.

Committing this to paper provides a guide to keep the trader on track with their risk to reward. It’s tempting to chase a high reward and risk more than you should, that’s why we have the risk to reward profile. It’s to keep ourselves in check.

Having a set risk to reward ratio, or range of ratios can also assist in disqualifying trades. If your trading strategy suggests you place your stop and profit outside your ratio, don’t take the trade.

Risk reward ratio for Day Trading – the bottom line

It’s recommended that new day traders use a fixed risk/reward profile when they start trading. This will help build structure and get you thinking about risk vs reward.

For those who have been trading a while you might already have a rough risk to reward that you follow. It’s fine to have a mental guide as long as you don’t stray too far from it.

Consider your own goals and risk tolerances before deciding on your risk to reward ratio. Only risk what you can afford to lose and use risk management techniques when trading.

Inspired to further develop your risk to reward ratio? Our courses are designed for both beginner and advanced day traders looking to improve their day trading strategies. Register now for our free trading class to learn the most effective day trading strategies from trading experts.