Today, we’re going to look at what indices are, the different types of indices, and how to access and trade them.

What Are Indices? – Short Answer

Indices, or an Index (singular) is a way of measuring the average price performance of a group of assets, typically stocks, commodities, currencies, and some others.

An index derives its value from the average price of that given group of assets.

There are major indices including an entire market, as well as more specialised indices that track a sub-set of assets of that market.

What Are Indices? – In-depth

What are indices in trading? An Index seeks to track the broader performance of a market. An index will compare a diversified group of assets. The performance of an Index will therefore indicate the overall strength or weakness of a given market.

An Index can be as broad as to measure every stock on a given market, or an Index may be used to benchmark a specific sector, or a given country.

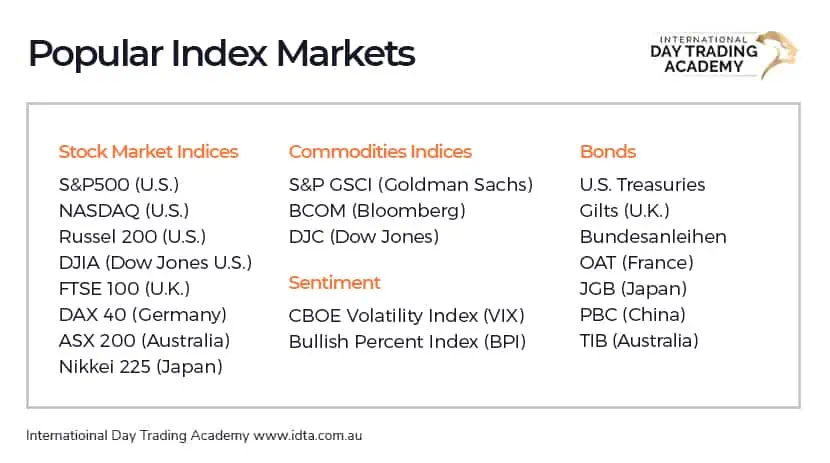

The performance of these Indices are often used by economists to benchmark growth or stability in various sectors such as stocks, commodities, bonds, as well as countries or continents.

Every major market has at least one index representing its average value; From here in Australia where the ASX200 has its index S&P/ASX 200 (XJO) to some of the much larger Indexes like NASDAQ in the U.S. which tracks over 3,000 stocks.

Other major indices include the UK’s FTSE 100 (UK100), Germany’s DAX 40 (DE40), Hong Kong’s Hang Seng (HK50) and Japan’s Nikkei 225 (J225).

It’s common for these stock index funds to be used by investment managers to measure the performance of their investments. The most commonly used being the S&P500 U.S. stock index.

Types of Indices

Indices can be split across sector, country/region, and thematically. There are 5 main types of Indices, they are:

Stocks

Each Stock Index has a set of criteria for a stock for it to be included. Some of the largest include the NASDAQ and S&P500. Stock Indices track the performance of the entire basket of stocks on the Index.

Stock Indices can be either weighted, or unweighted. A weighted Index ranks its constituent stocks by their market cap. Larger companies (companies with larger market cap) will have more effect on the market than smaller ones. In an unweighted Index each constituent has an equal effect to the next.

Commodities

Commodities Indices are mainly accessible via the Futures markets and can track the performance of a broad range of physical commodities. Such commodities include Gold, Silver, Crude Oil, Coffee, Wool, and various others.

Currencies

Currency Indices track the performance of a given currency as its underlying asset. Major currency Indices include the Dollar Index (US), the European Currency Index, and the British Pound Index.

Bonds

Bonds are a form of debt in the form of a security. Bonds have an issuer and an investor who purchases the bonds. When purchasing a bond, the investor ‘lends’ money to the issuer and is repaid with interest.

There are a handful of Bond Indices which include: Corporate Bonds, Government Bonds, and Municipal Bonds. These track the performance of each sector of the Bond market.

Sentiment

Sentiment Indices are thematic, they’re based on the overall sentiment of the markets. An example of a sentiment based index is the Volatility Index (VIX).

When there is perceived to be more volatility in the markets, the Volatility Index will rise. This typically happens when the market is bearish and there is negative sentiment. The opposite is true for bullish markets where sentiment is positive, the VIX will drop in price.

What Are Indices – Characteristics of Indices

- Bi-directional trading. Because Indices are traded via derivatives such as CFDs, Options, and Futures, they can be traded up (long) and down (short)

- Leveraged. Derivative products are leveraged and to trade Indices you need to do so via a derivatives market

- Cover a specialised group of assets such as stocks with similar characteristics, country the Index resides in, market sentiment and others

- Have requirements that must be met for an asset to be listed on the Index

- Provide the ability to hedge either other holdings, or the price of physical assets that are intended on being delivered

- Can be either weighted or un-weighted with regard to the assets within the Index

- Have high volume which provides trading opportunities (for the major Indices)

What Are The Most Traded Indices?

- S&P 500 – The Standard & Poor’s 500 Index tracks 500 large cap companies (largest Market Cap) listed on the New York Stock Exchange (NYSE)

- NASDAQ 100 – This Index tracks the performance of 100 large cap companies (excludes companies in the financial sector such as banks)

- FTSE 100 – The Financial Times Stock Exchange 100 Index (FTSE 100) comprises of 100 companies listed on the UK London Stock Exchange. These are the 100 largest by market cap

- DAX 40 – Previously the DAX 30, 10 companies were added to the DAX index in 2021. The DAX 40 tracks the performance of 40 of Germany’s largest companies

- DJIA – The Dow Jones Industrial Average aims to be an indicator of the American economy and consist of 30 of America’s largest companies. Various sectors are included in order to achieve a broad view of the economy across sectors

How To Trade Indices

There are a handful of ways that you can get involved with Indices trading. The 3 main products that provide index trading are CFD Indices, Index Options, and Index Futures.

Both Index Options and Index Futures are derivative products where contracts are traded over a period of time. Each are speculative markets where a trader will seek to predict where the price of an Index will be at a later date.

CFDs (Contracts for Difference) are also a similar contract based derivative that are aimed at market speculation but do not have an expiry date.

Futures, Options, and CFDs are leveraged products that allow traders to ‘trade on margin’. This allows a trader to open a position with a much smaller capital investment while trading products with a large ‘notional value’. Effectively the buying power is magnified, this means that both profit and loss can be amplified greatly depending on the size of the leverage. Because of this, strict day trading risk management is required.

Each of the above Index Trading products have the ability to trade the markets both up and down. This means that money making opportunities can be found in both rising and falling markets. This is uniquely beneficial compared to “buy only” investments like buying and selling stocks.

It’s also possible to trade ETF (Exchange Traded Funds) stocks such as SPY for the S&P500, and QQQ for NASDAQ, however these are managed funds that attempt to track these Indices. ETFs are attractive to retail investors who are looking for exposure to Indices without having to closely manage their investment.

Why Index Trading

Index Trading allows a trader to focus on a single market, rather than hundreds of stocks or multiple asset classes. Given the popularity of Indices Trading the major Indices typically have a high volume of trading. High volume means that the markets move further and more quickly, and can offer more opportunities to trade.

A major benefit of Indices Trading is the diversity provided by trading a large basket of stocks or assets rather than individual stocks or sectors. This means that the failure of an individual stock or asset has little affect over your index trading.

Unlike stocks, the size of Indices protect themselves from price manipulation from market makers and large hedge funds. This makes a more level playing field for retail traders.

Because Indices Trading is often done via derivatives such as Futures, Options, and CFDs, Index Trading allows bi-directional trading. This means that traders can seek profit when the markets rise as well as fall. A comparable amount of opportunities exist in bear markets compared to bull markets.

Trade Index Futures

Trading Index Futures is the buying and selling of Futures contracts that derive their value from the Index being traded. Futures Index traders speculate on the price action of their chosen Index by buying or selling contracts and exiting those contracts at a later date.

A Futures contract is a derivative which is an agreement between two parties to buy or sell an underlying asset at a predetermined price by a set date. An Index Futures contract is an agreement to buy or sell a contract that derives its value from the index itself as its underlying asset.

Traders may also choose to trade Index Futures as a way of hedging against other equity positions that they hold. For example, a hedge fund may have a large position in one sector, and choose to short trading the index relating to that sector to limit any potential losses.

Why Trade Index Futures

Index Futures are attractive to both Day Traders and Swing Traders as they allow speculation in both directions. This means that a trader can seek trading opportunities in both directions.

It is also simpler to trade an Index rather than scan through hundreds of individual stocks. Indices also have a certain level of diversity built into them by nature.

Pros of Trading Index Futures

- Allow speculation on price movement is both directions

- Trade on margin, traders can enter at a fraction of the contract’s value

- Leveraged, traders can amplify profits (and losses)

- Allow hedging against any decline in value of similar holdings

- Price can be locked in should a company require physical commodities and think price will rise

Cons of Trading Index Futures

- Trading Index Futures is risky due to the leverage involved

- Traders are required to maintain margin and losses can exceed the size of a traders account

- Hedging against other positions reduces any profits as one position will be profitable where the other is a loss

- Swing trading Index Futures requires an overnight margin which has an even greater risk attached

What Are Indices – Bottom Line

Because Indices trading can be done across a number of products such as Futures, CFDs etc, there are a lot of options for the type of product you trade. Each product provides leverage, which can be a positive or negative depending on how you look at things. However if you are a retail trader, leverage does provide the opportunity to trade the same markets that wholesale traders like banks, and hedge funds do.

When considering whether Index Trading is right for you, you will need to weigh up whether the diversity and hedging capabilities out-weigh the risks.

Before you consider trading Indices or any other product, you should learn trading with an ASIC regulated educator, and practise on a simulated account. Only trade money you can afford to lose, and focus on limiting risk in order to maximise your profits and minimise your losses.

To learn more about trading Index Futures, register for our next free trading web class.

![What Are Indices [A Guide To Index Trading] 2 What are indices? - a-guide to trading indices](https://idta.com.au/wp-content/uploads/2023/04/what-are-indices-a-guide-to-trading-indices.webp)

![What Are Indices [A Guide To Index Trading] 4 Free day trading web class](https://idta.com.au/wp-content/uploads/2020/08/free-day-trading-web-class.png.webp)